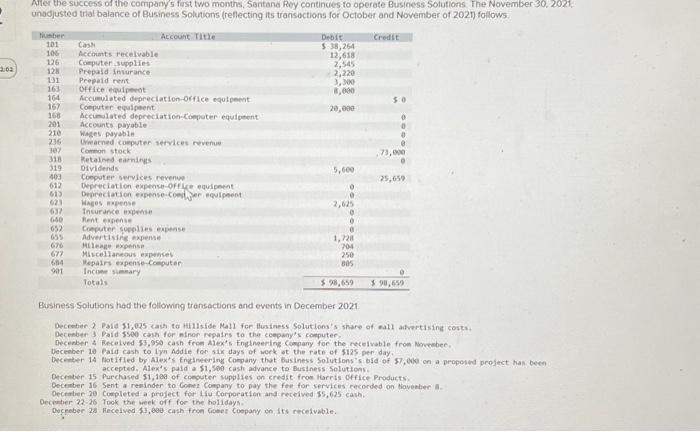

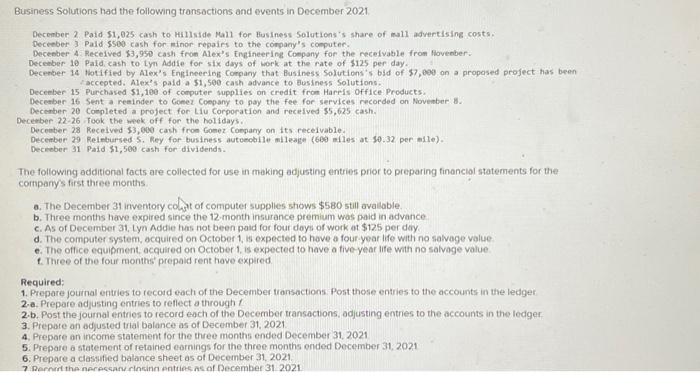

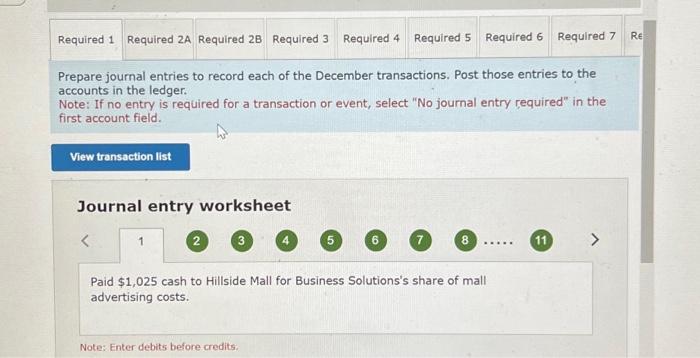

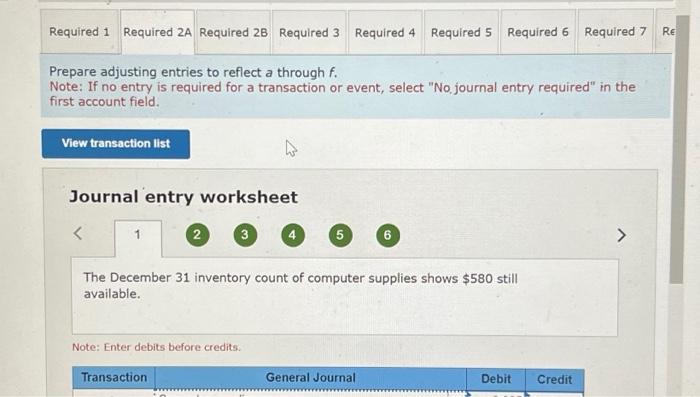

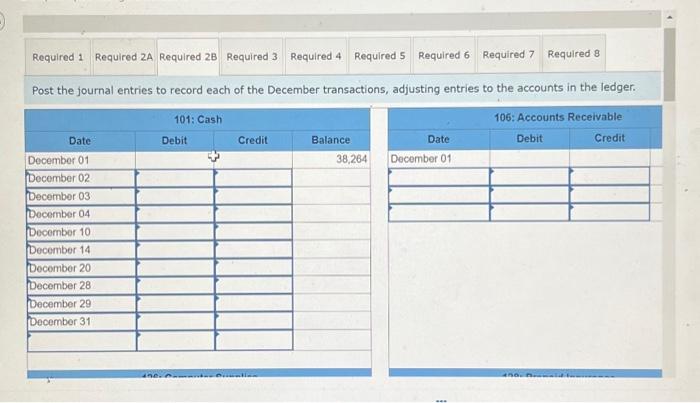

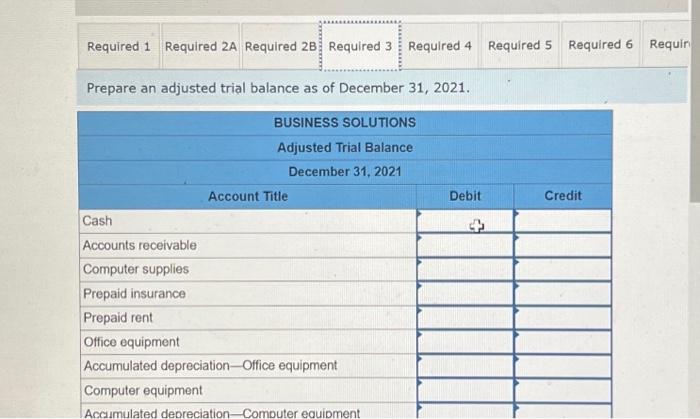

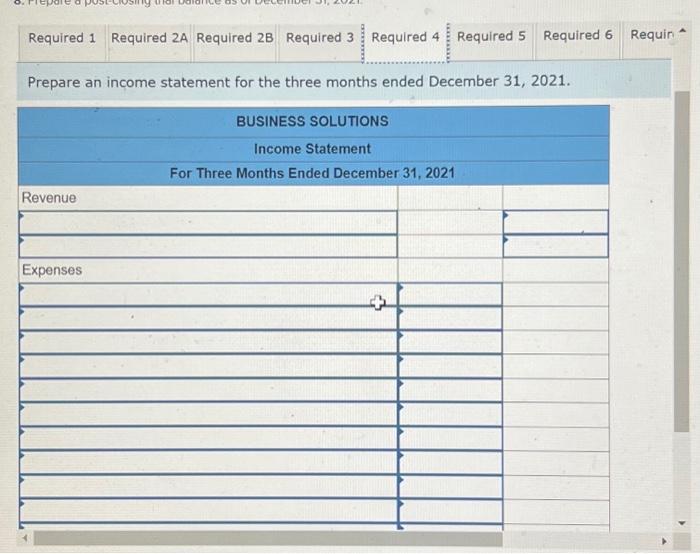

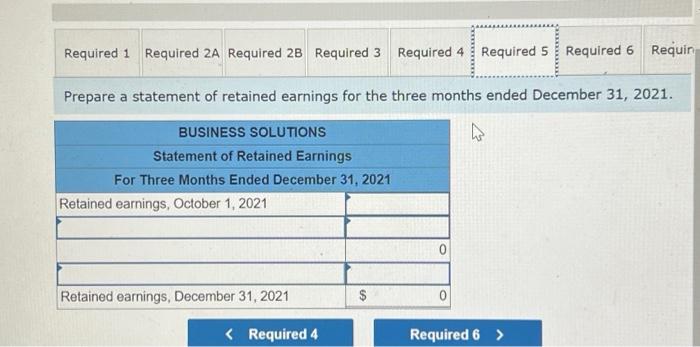

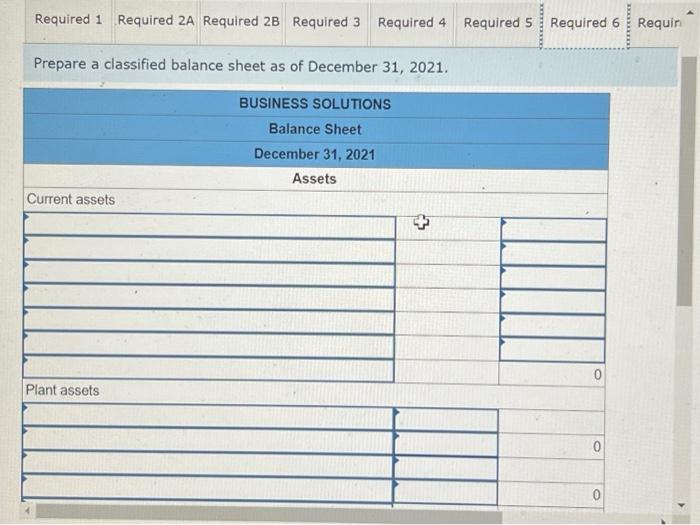

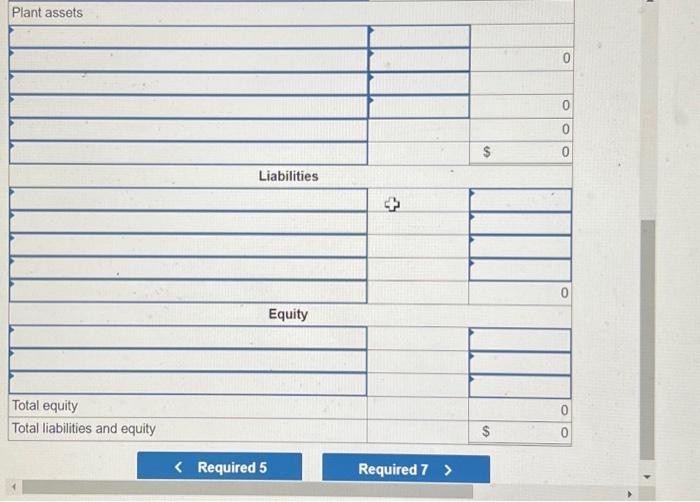

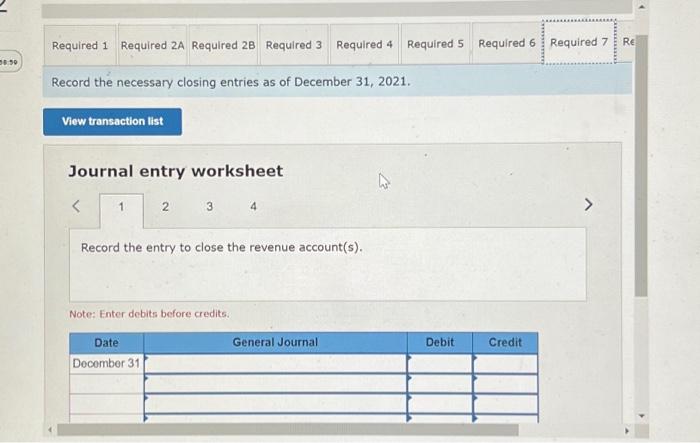

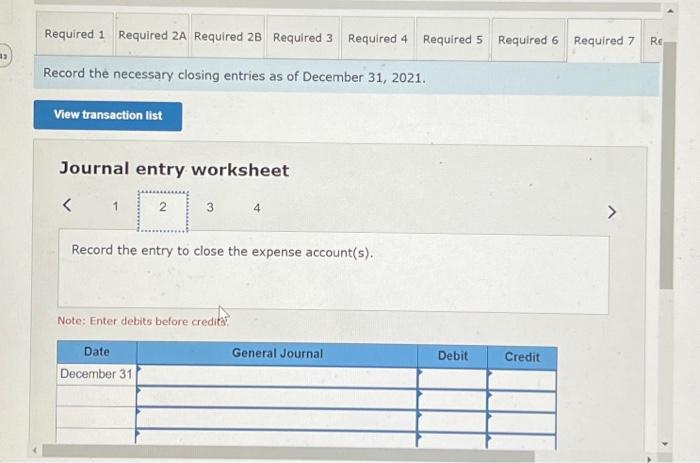

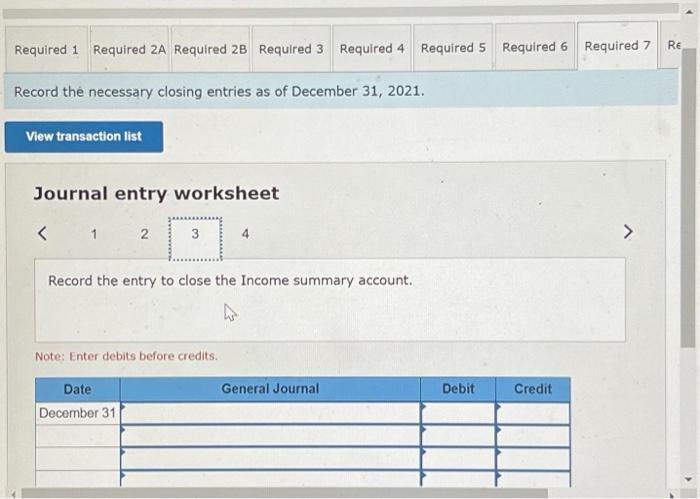

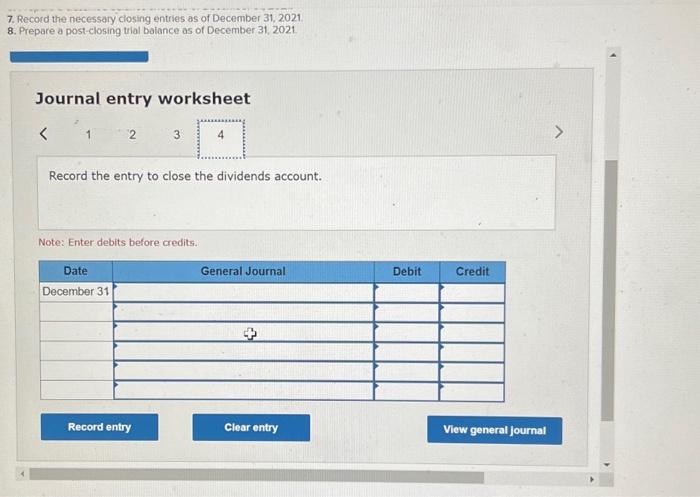

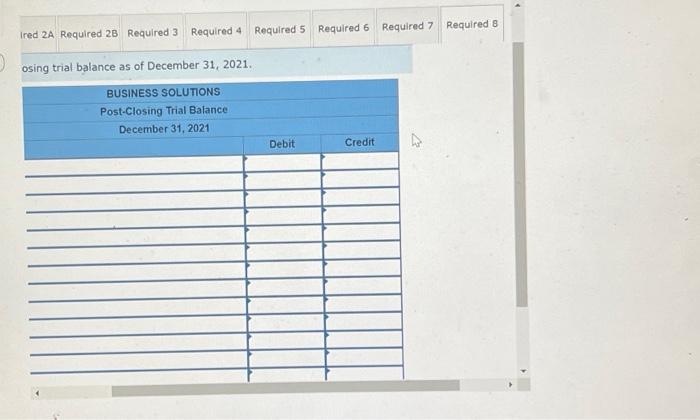

Afler the success of the company/5 fast two months, Santand Rey continues to operate Business Solutions. The November 30.2021 . unsdyusted trial balance of Business Solutions freffecting its transactions for October and November of 202n fortows. Business Solutions had the following transactions and events in December 2021 Deceenber 3 Daid $500 cash for ninor repales to the coepany's coeputer. Wecienber 10 Faid cash to tyn Addie for sir days of werk ot the rate of sizs per day. Decenter 16 Sent a reninder to Coner Company to pay the fou for services cencorded on tiaventer in. Oecentier 20 Conpleted a project for Liv Corporation and recelved $5,625cash. Dectester 2226 Took the week off for the holldays. Oecreber 28 Hecelved $3,000 cash fron Coeve Coopany in its recelvable. Business Solutions had the following transoctions and events in December 2021. December 2. Paid 51,025 cash to Hulside Mall for Business Solutions's share of mull advertising costs. Deceeber 3 Pald $500 cash for minor repairs to the conpany's computer. Decenber 4 . Pectelved $3,950 cash from Alex's Engineering Company for the recelvable from Hovenber. Decenber 10 Pald cash to tym Addie for six days of work at the rate of $125 per day. Decenber 14 thotified by Alex's Englineering Company that Business Solutions's bid of $7,000 on a propased project has been raccepted. Alex?'s paid a $1,500 cash advance to Business Solutions. Deceeber 15 Purchased $1,100 of computer supplies on credit fron Harris office Products. Deceaber 16 Sent a reninder to Gomet Coepany to poy the fee for services recorded on Noventier 8. Decenber 20 Completed a project for Liu Corporation and recelved 55,625cash. Decenber 2226 rook the week off for the holidays. Decenter 28 Recelved $3,000 cash fron Gonez Coepany on its recelvable. December 29 Relelursed 5 . Rey for business autocobile milleage (6ee alles at 30.32 per alle). Decreaber 31 Paid $1,500 cash for dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financiol statements for the companys first three months. a. The December 3t invertory coht of computer supplies shows $580 still avalable. b. Three months have expired since the 12 - month insurance premium was paid in advance c. As of December 31, Lyn Addie has not been paid for four doys of work at $125 per day. d. The computer system, ocquired on October 1, is expected to hove a four yoar life with no salvage value e. The office equipment, acquired on October 1 , is expected to have a five-year ife with no salvage value t. Three of the four months' prepaid rent have expired Required: 1. Prepare journal entries to recotd each of the December transactions. Post these entries to the accounts in the ledger 2.a. Prepare adjusting entries to reflect a through t 2.b. Post the journal entries to record each of the December transactions, odjusting entries to the accounts in the ledger 3. Prepare an adjusted trial balance as of December 31, 2021. 4. Prepare an incorme statement for the three months ended December 31, 2021 5. Prepare a statement of retained earnings for the three months ended Docember 31, 2021 6. Prepare a classified balance sheet as of December 31, 2021. 7 peroud the neressary closing entries as of December 31.2021 Prepare journal entries to record each of the December transactions. Post those entries to the accounts in the ledger. Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. Prepare adjusting entries to reflect a through f. Note: If no entry is required for a transaction or event, select "No, journal entry required" in the first account field. Journal entry worksheet 2 5 6 The December 31 inventory count of computer supplies shows $580 still available. Note: Enter debits before credits. Post the journal entries to record each of the December transactions, adjusting entries to the accounts in the ledger. Prepare an adjusted trial balance as of December 31, 2021. Prepare an income statement for the three months ended December 31, 2021. Prepare a statement of retained earnings for the three months ended December 31, 2021. Prepare a classified balance sheet as of December 31, 2021. Plant assets Required 5 Required 7 Record the necessary closing entries as of December 31, 2021. Journal entry worksheet Record the entry to close the revenue account(s). Note: Enter debits before credits. Record the necessary closing entries as of December 31, 2021. Journal entry worksheet Record the entry to close the expense account(s). Note: Enter debits before credits? Record the necessary closing entries as of December 31, 2021. Journal entry worksheet Record the entry to close the Income summary account. Note: Enter debits before credits. 7. Record the necessary closing entries as of December 31, 2021 8. Prepare a post-closing trial bolance as of December 31, 2021. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. osing trial balance as of December 31,2021