Answered step by step

Verified Expert Solution

Question

1 Approved Answer

African Sunset Capital Limited (ASC) was founded in 1998 as a micro finance business. Following its listing on the Altx (alternative public equity exchange for

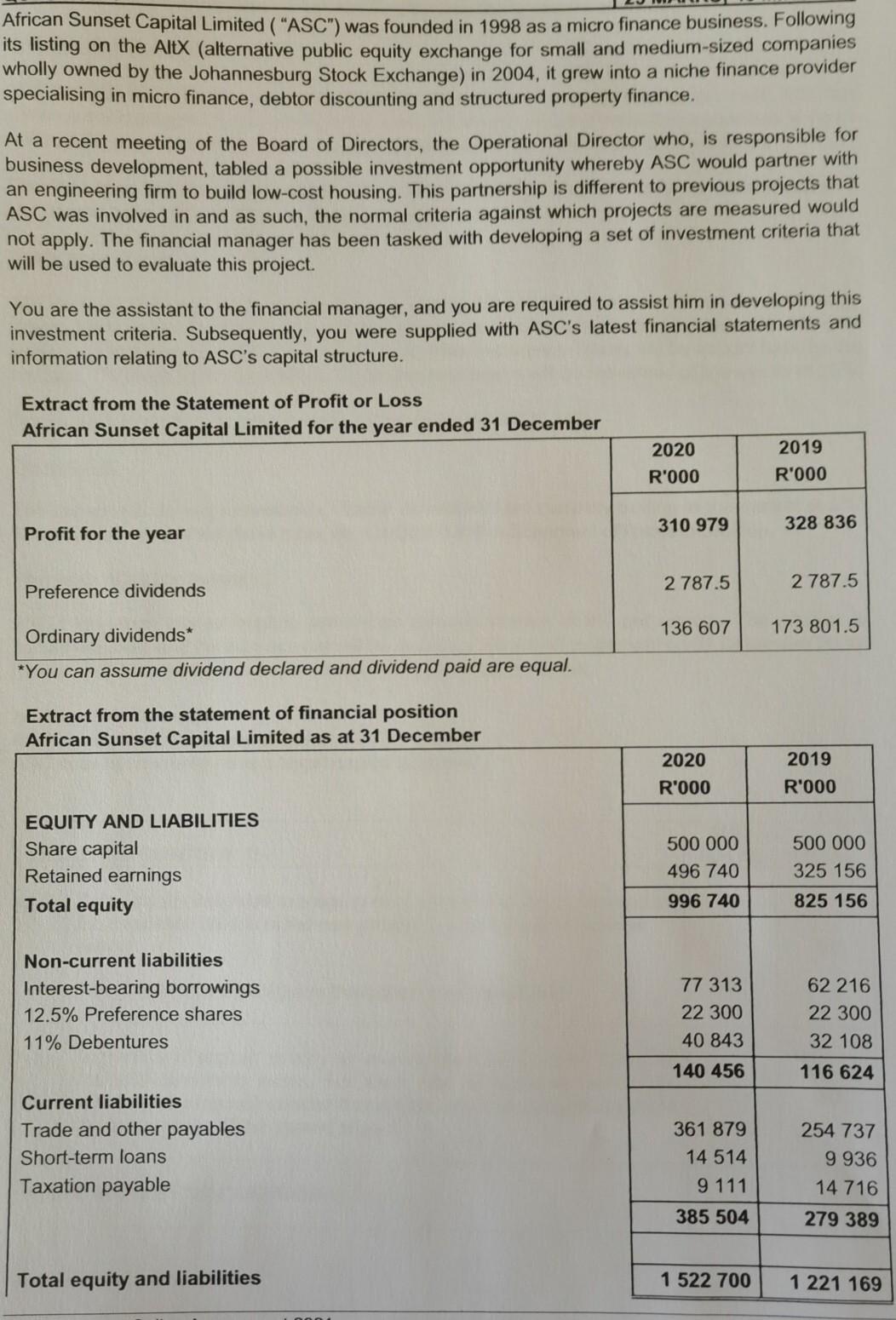

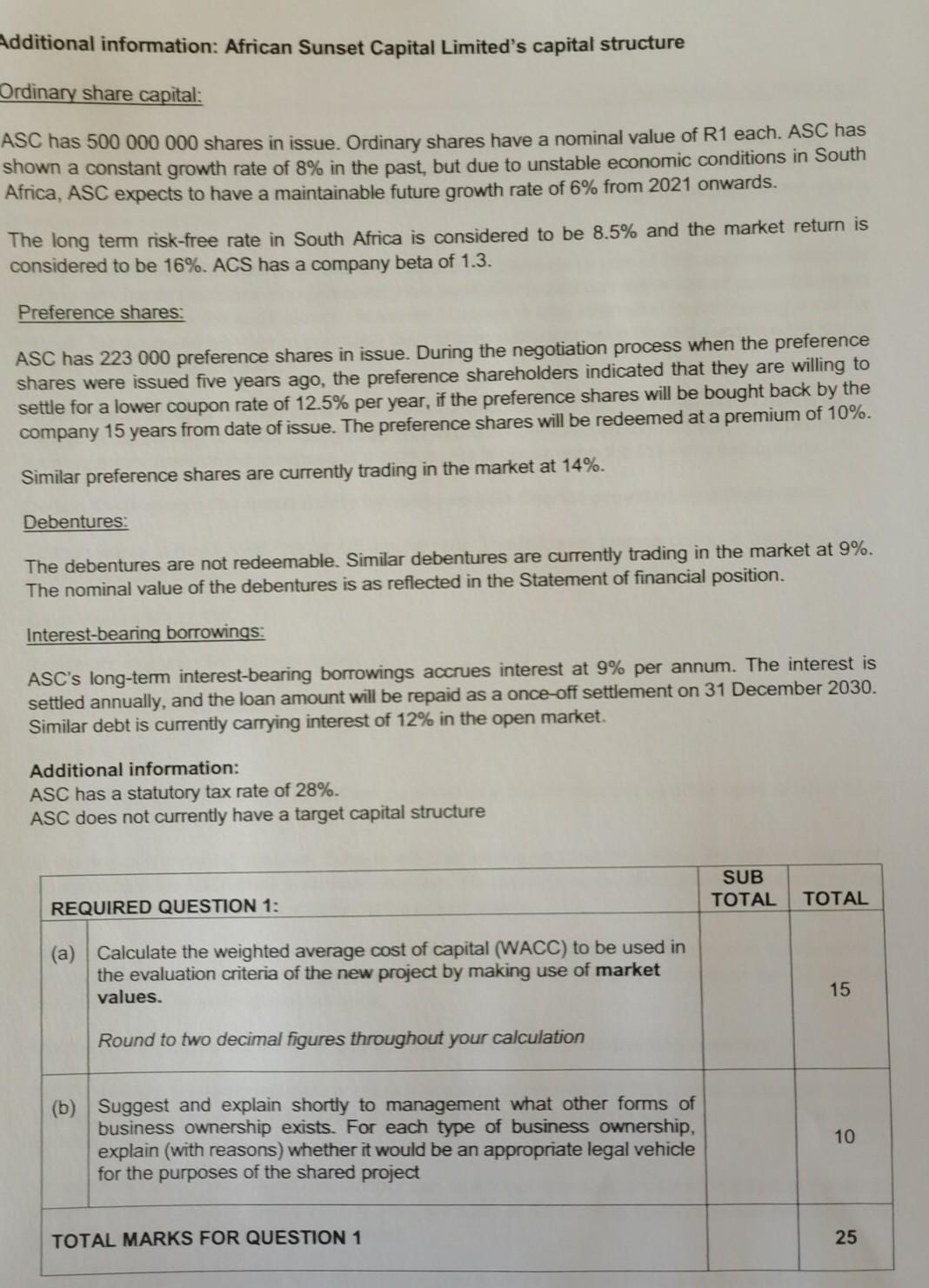

African Sunset Capital Limited ("ASC") was founded in 1998 as a micro finance business. Following its listing on the Altx (alternative public equity exchange for small and medium-sized companies wholly owned by the Johannesburg Stock Exchange) in 2004, it grew into a niche finance provider specialising in micro finance, debtor discounting and structured property finance. At a recent meeting of the Board of Directors, the Operational Director who is responsible for business development, tabled a possible investment opportunity whereby ASC would partner with an engineering firm to build low-cost housing. This partnership is different to previous projects that ASC was involved in and as such, the normal criteria against which projects are measured would not apply. The financial manager has been tasked with developing a set of investment criteria that will be used to evaluate this project. You are the assistant to the financial manager, and you are required to assist him in developing this investment criteria. Subsequently, you were supplied with ASC's latest financial statements and information relating to ASC's capital structure. Extract from the Statement of Profit or Loss African Sunset Capital Limited for the year ended 31 December 2020 R'000 2019 R'000 310 979 328 836 Profit for the year 2 787.5 2 787.5 Preference dividends 136 607 173 801.5 Ordinary dividends* *You can assume dividend declared and dividend paid are equal. Extract from the statement of financial position African Sunset Capital Limited as at 31 December 2020 R'000 2019 R'000 EQUITY AND LIABILITIES Share capital Retained earnings Total equity 500 000 496 740 996 740 500 000 325 156 825 156 Non-current liabilities Interest-bearing borrowings 12.5% Preference shares 11% Debentures 77 313 22 300 40 843 140 456 62 216 22 300 32 108 116 624 Current liabilities Trade and other payables Short-term loans Taxation payable 361 879 14 514 9111 254 737 9 936 14 716 385 504 279 389 Total equity and liabilities 1 522 700 1 221 169 Additional information: African Sunset Capital Limited's capital structure Ordinary share capital: ASC has 500 000 000 shares in issue. Ordinary shares have a nominal value of R1 each. ASC has shown a constant growth rate of 8% in the past, but due to unstable economic conditions in South Africa, ASC expects to have a maintainable future growth rate of 6% from 2021 onwards. The long term risk-free rate in South Africa is considered to be 8.5% and the market return is considered to be 16%. ACS has a company beta of 1.3. Preference shares: ASC has 223 000 preference shares in issue. During the negotiation process when the preference shares were issued five years ago, the preference shareholders indicated that they are willing to settle for a lower coupon rate of 12.5% per year, if the preference shares will be bought back by the company 15 years from date of issue. The preference shares will be redeemed at a premium of 10%. Similar preference shares are currently trading in the market at 14%. Debentures: The debentures are not redeemable. Similar debentures are currently trading in the market at 9%. The nominal value of the debentures is as reflected in the Statement of financial position. Interest-bearing borrowings: ASC's long-term interest-bearing borrowings accrues interest at 9% per annum. The interest is settled annually, and the loan amount will be repaid as a once-off settlement on 31 December 2030. Similar debt is currently carrying interest of 12% in the open market. Additional information: ASC has a statutory tax rate of 28%. ASC does not currently have a target capital structure SUB TOTAL TOTAL REQUIRED QUESTION 1: (a) Calculate the weighted average cost of capital (WACC) to be used in the evaluation criteria of the new project by making use of market values. 15 Round to two decimal figures throughout your calculation (b) Suggest and explain shortly to management what other forms of business ownership exists. For each type of business ownership, explain (with reasons) whether it would be an appropriate legal vehicle for the purposes of the shared project 10 TOTAL MARKS FOR QUESTION 1 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started