Question

After a long period of preparations, Leamington Inc. has finally decided to go public with an IPO. Following the new trend in recent successful

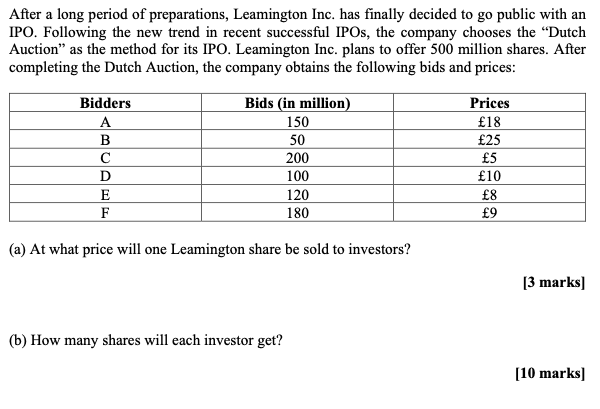

After a long period of preparations, Leamington Inc. has finally decided to go public with an IPO. Following the new trend in recent successful IPOs, the company chooses the "Dutch Auction" as the method for its IPO. Leamington Inc. plans to offer 500 million shares. After completing the Dutch Auction, the company obtains the following bids and prices: Bidders A B D E F Bids (in million) 150 50 200 100 120 180 (a) At what price will one Leamington share be sold to investors? (b) How many shares will each investor get? Prices 18 25 5 10 8 9 [3 marks] [10 marks]

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the price at which one Leamington share will be sold to investors in the Dutch Auction we need to find the price that clears the market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Communication Essentials a skill based approach

Authors: Courtland L. Bovee, John V. Thill

6th edition

978-0132971324

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App