Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After a period of being unemployed, Henry Murray started a new job as a finance manager on 1 April 2022 earning 76,200 per annum.

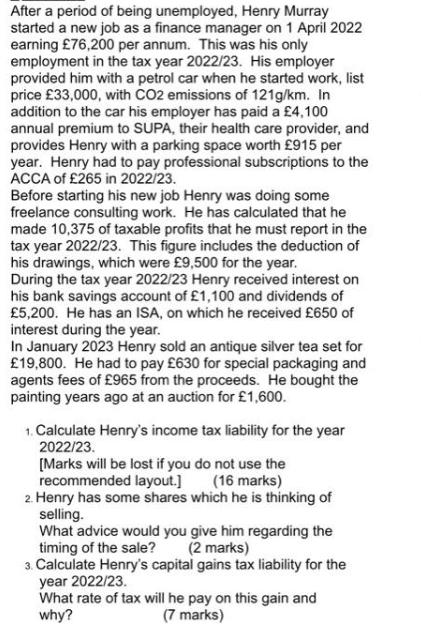

After a period of being unemployed, Henry Murray started a new job as a finance manager on 1 April 2022 earning 76,200 per annum. This was his only employment in the tax year 2022/23. His employer provided him with a petrol car when he started work, list price 33,000, with CO2 emissions of 121g/km. In addition to the car his employer has paid a 4,100 annual premium to SUPA, their health care provider, and provides Henry with a parking space worth 915 per year. Henry had to pay professional subscriptions to the ACCA of 265 in 2022/23. Before starting his new job Henry was doing some freelance consulting work. He has calculated that he made 10,375 of taxable profits that he must report in the tax year 2022/23. This figure includes the deduction of his drawings, which were 9,500 for the year. During the tax year 2022/23 Henry received interest on his bank savings account of 1,100 and dividends of 5,200. He has an ISA, on which he received 650 of interest during the year. In January 2023 Henry sold an antique silver tea set for 19,800. He had to pay 630 for special packaging and agents fees of 965 from the proceeds. He bought the painting years ago at an auction for 1,600. 1. Calculate Henry's income tax liability for the year 2022/23. [Marks will be lost if you do not use the recommended layout.] (16 marks) 2. Henry has some shares which he is thinking of selling. What advice would you give him regarding the timing of the sale? (2 marks) 3. Calculate Henry's capital gains tax liability for the year 2022/23. What rate of tax will he pay on this gain and why? (7 marks)

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate Henrys income tax liability for the year 202223 Taxable Income Earnings from new job 762...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started