Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Alpha Investors On July 1, 1985, Jim Roberts felt certain the stock market was in for a correction. The S&P 500 Index had

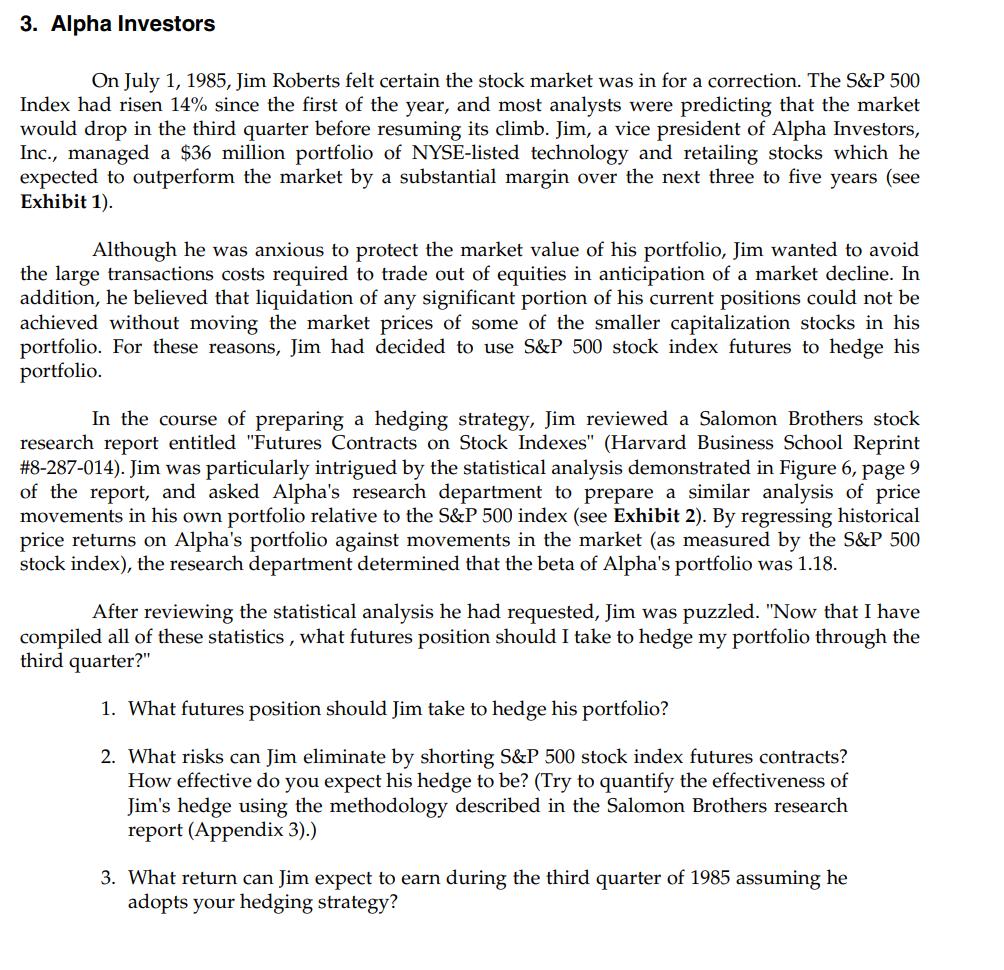

3. Alpha Investors On July 1, 1985, Jim Roberts felt certain the stock market was in for a correction. The S&P 500 Index had risen 14% since the first of the year, and most analysts were predicting that the market would drop in the third quarter before resuming its climb. Jim, a vice president of Alpha Investors, Inc., managed a $36 million portfolio of NYSE-listed technology and retailing stocks which he expected to outperform the market by a substantial margin over the next three to five years (see Exhibit 1). Although he was anxious to protect the market value of his portfolio, Jim wanted to avoid the large transactions costs required to trade out of equities in anticipation of a market decline. In addition, he believed that liquidation of any significant portion of his current positions could not be achieved without moving the market prices of some of the smaller capitalization stocks in his portfolio. For these reasons, Jim had decided to use S&P 500 stock index futures to hedge his portfolio. In the course of preparing a hedging strategy, Jim reviewed a Salomon Brothers stock research report entitled "Futures Contracts on Stock Indexes" (Harvard Business School Reprint #8-287-014). Jim was particularly intrigued by the statistical analysis demonstrated in Figure 6, page 9 of the report, and asked Alpha's research department to prepare a similar analysis of price movements in his own portfolio relative to the S&P 500 index (see Exhibit 2). By regressing historical price returns on Alpha's portfolio against movements in the market (as measured by the S&P 500 stock index), the research department determined that the beta of Alpha's portfolio was 1.18. After reviewing the statistical analysis he had requested, Jim was puzzled. "Now that I have compiled all of these statistics, what futures position should I take to hedge my portfolio through the third quarter?" 1. What futures position should Jim take to hedge his portfolio? 2. What risks can Jim eliminate by shorting S&P 500 stock index futures contracts? How effective do you expect his hedge to be? (Try to quantify the effectiveness of Jim's hedge using the methodology described in the Salomon Brothers research report (Appendix 3).) 3. What return can Jim expect to earn during the third quarter of 1985 assuming he adopts your hedging strategy?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the appropriate futures position for Jim to hedge his portfolio we need to consider the beta of Alphas portfolio and the desired level of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started