Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Untitled M202... USC Files USC Files USC Files M res... GSBA.539.Fin.Spr24.PS1.ValuingBonds.pdf E 28 marshallonline.usc.edu/courses/977/files/folder/FIN%2008/?preview=243325 Ax Cre... Ho... eTo... Pro... Ma... IN Cur... eTo... NR...

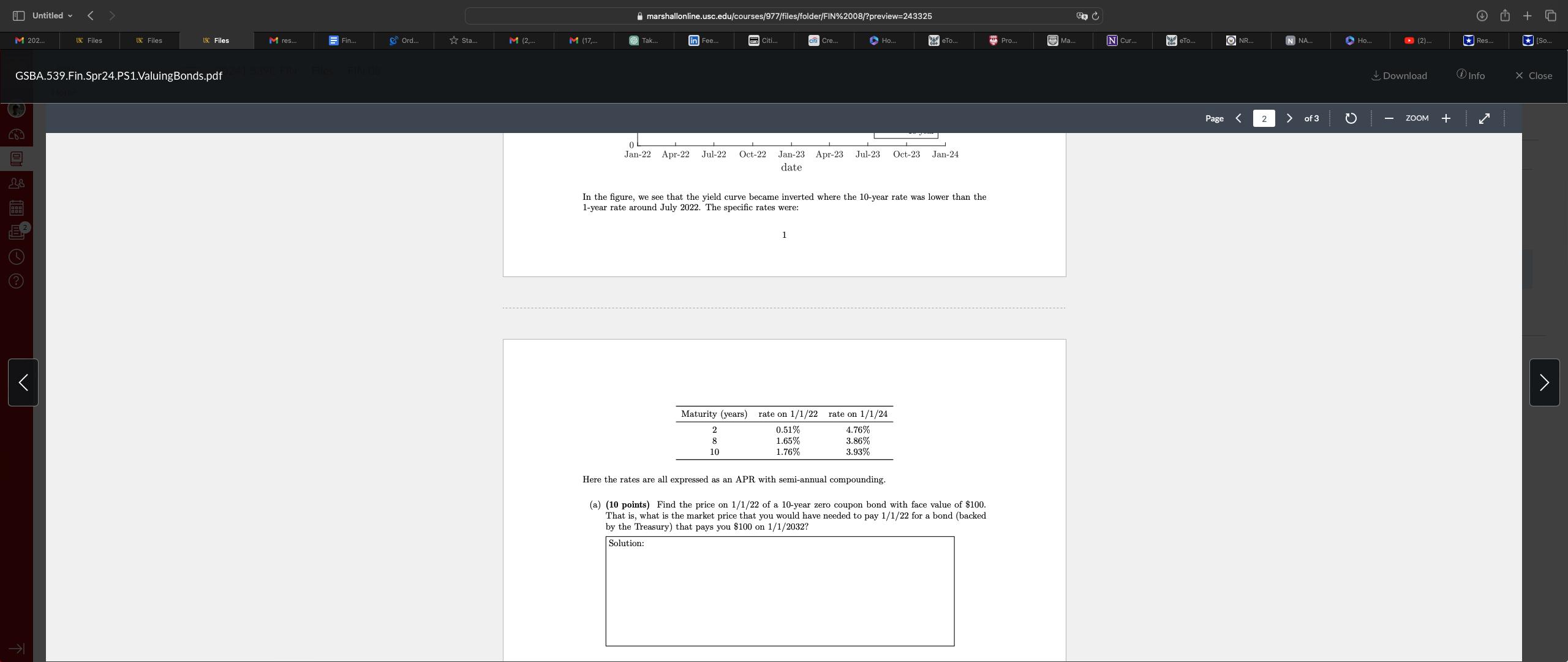

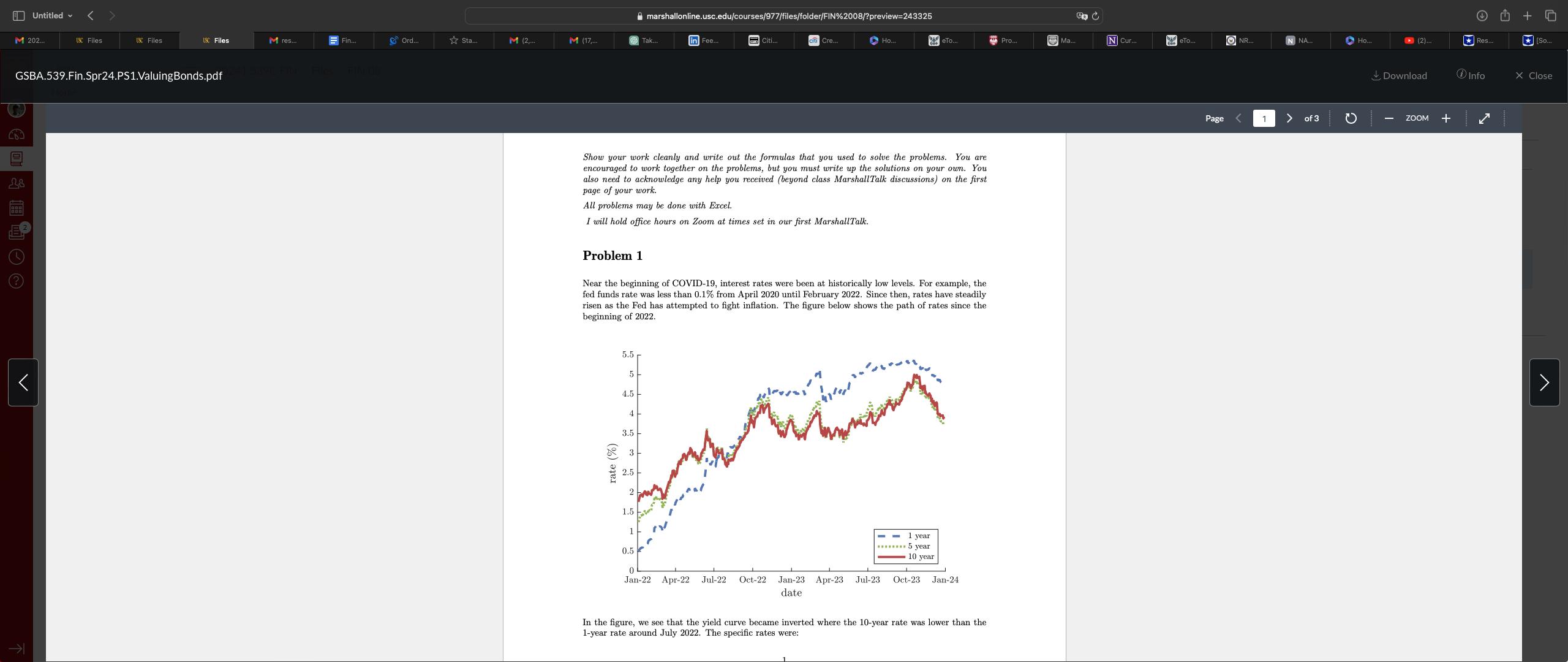

Untitled M202... USC Files USC Files USC Files M res... GSBA.539.Fin.Spr24.PS1.ValuingBonds.pdf E 28 marshallonline.usc.edu/courses/977/files/folder/FIN%2008/?preview=243325 Ax Cre... Ho... eTo... Pro... Ma... IN Cur... eTo... NR... NA... Ho... (2)... Res... Fin... GOrd... Sta... M (2.... M (17,... Tak... linl Fee... Citi... SAVE FIDE Files FIM D Jan-22 Apr-22 Jul-22 Oct-22 Jul-23 Jan-23 Apr-23 date Oct-23 Jan-24 In the figure, we see that the yield curve became inverted where the 10-year rate was lower than the 1-year rate around July 2022. The specific rates were: 1 Maturity (years) rate on 1/1/22 rate on 1/1/24 2 0.51% 4.76% 8 10 1.65% 3.86% 1.76% 3.93% Here the rates are all expressed as an APR with semi-annual compounding. (a) (10 points) Find the price on 1/1/22 of a 10-year zero coupon bond with face value of $100. That is, what is the market price that you would have needed to pay 1/1/22 for a bond (backed by the Treasury) that pays you $100 on 1/1/2032? Solution: Page 2 of 3 C A + Q (So... Download Info Close ZOOM > E Untitled M202... USC Files USC Files USC Files M res... GSBA.539.Fin.Spr24.PS1.ValuingBonds.pdf 28 Fin... GOrd... Sta... M (2.... M (17,... Tak... in Fee... Citi... SAVE FIDE Files FIM D marshallonline.usc.edu/courses/977/files/folder/FIN%2008/?preview=243325 Ax Cre... Ho... eTo... Pro... Ma... IN Cur... eTo... NR... NA... Ho... (2)... Res... Show your work cleanly and write out the formulas that you used to solve the problems. You are encouraged to work together on the problems, but you must write up the solutions on your own. You also need to acknowledge any help you received (beyond class Marshall Talk discussions) on the first page of your work. All problems may be done with Excel. I will hold office hours on Zoom at times set in our first MarshallTalk. Problem 1 Near the beginning of COVID-19, interest rates were been at historically low levels. For example, the fed funds rate was less than 0.1% from April 2020 until February 2022. Since then, rates have steadily risen as the Fed has attempted to fight inflation. The figure below shows the path of rates since the beginning of 2022. rate (%) 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 - - 1 year 5 year 0.5 10 year 0 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 date Jul-23 Oct-23 Jan-24 In the figure, we see that the yield curve became inverted where the 10-year rate was lower than the 1-year rate around July 2022. The specific rates were: Page 1 of 3 C A + Q (So... Download Info Close ZOOM >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started