Answered step by step

Verified Expert Solution

Question

1 Approved Answer

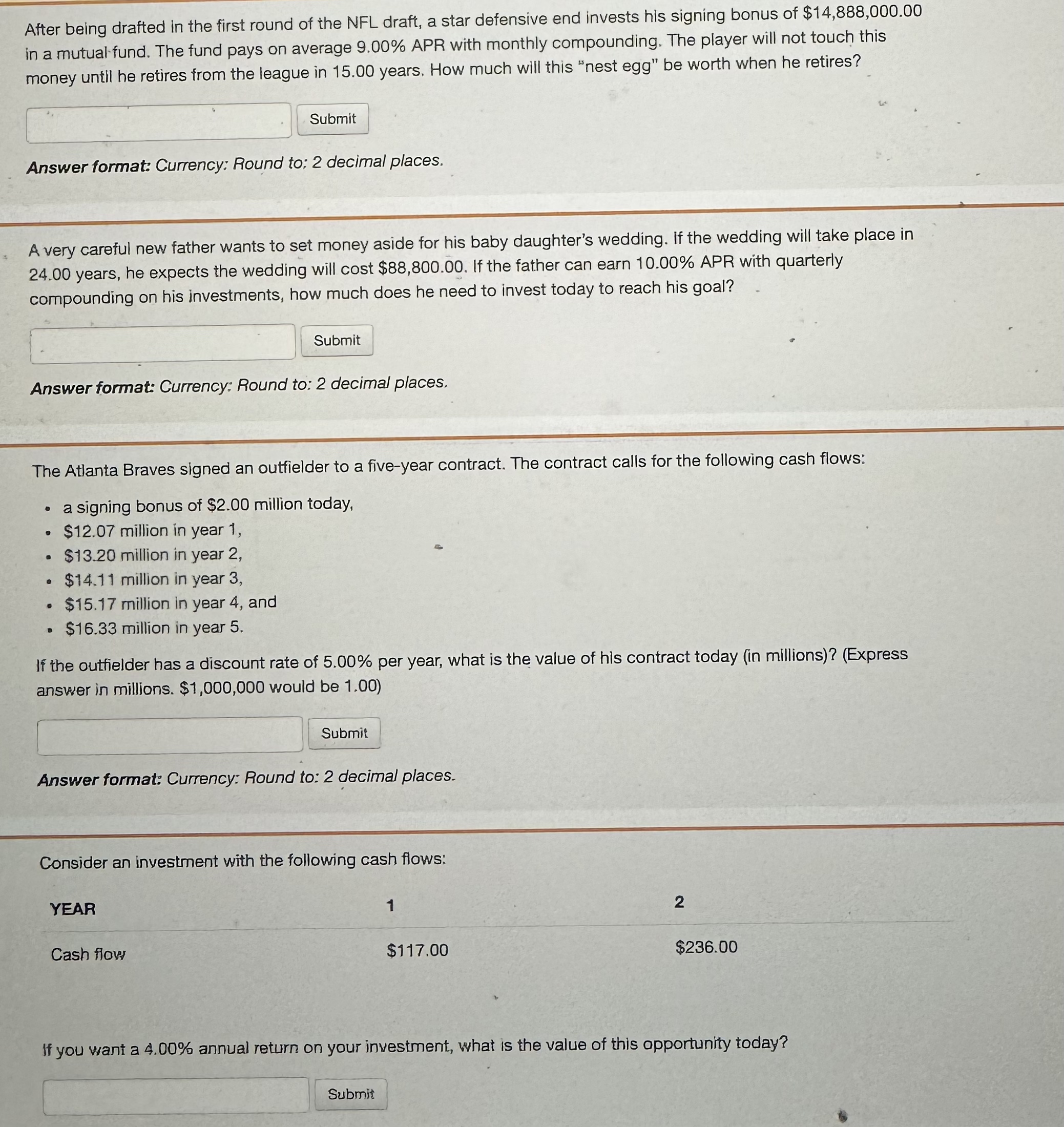

After being drafted in the first round of the NFL draft, a star defensive end invests his signing bonus of $ 1 4 , 8

After being drafted in the first round of the NFL draft, a star defensive end invests his signing bonus of $ in a mutual fund. The fund pays on average APR with monthly compounding. The player will not touch this money untll he retires from the league in years. How much will this "nest egg" be worth when he retires?

Answer format: Currency: Round to: decimal places.

A very careful new father wants to set money aside for his baby daughter's wedding. If the wedding will take place in years, he expects the wedding will cost $ If the father can earn APR with quarterly compounding on his investments, how much does he need to invest today to reach his goal?

Answer format: Currency: Round to: decimal places.

The Atlanta Braves signed an outfielder to a fiveyear contract. The contract calls for the following cash flows:

a signing bonus of $ million today,

$ million in year

$ million in year

$ million in year

$ million in year and

$ million in year

If the outfielder has a discount rate of per year, what is the value of his contract today in millionsExpress answer in millions. $ would be

Answer format: Currency: Round to: decimal places.

Consider an investment with the following cash flows:

YEAR

Cash flows

$

$

If you want a annual return on your investment, what is the value of this opportunity today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started