Question

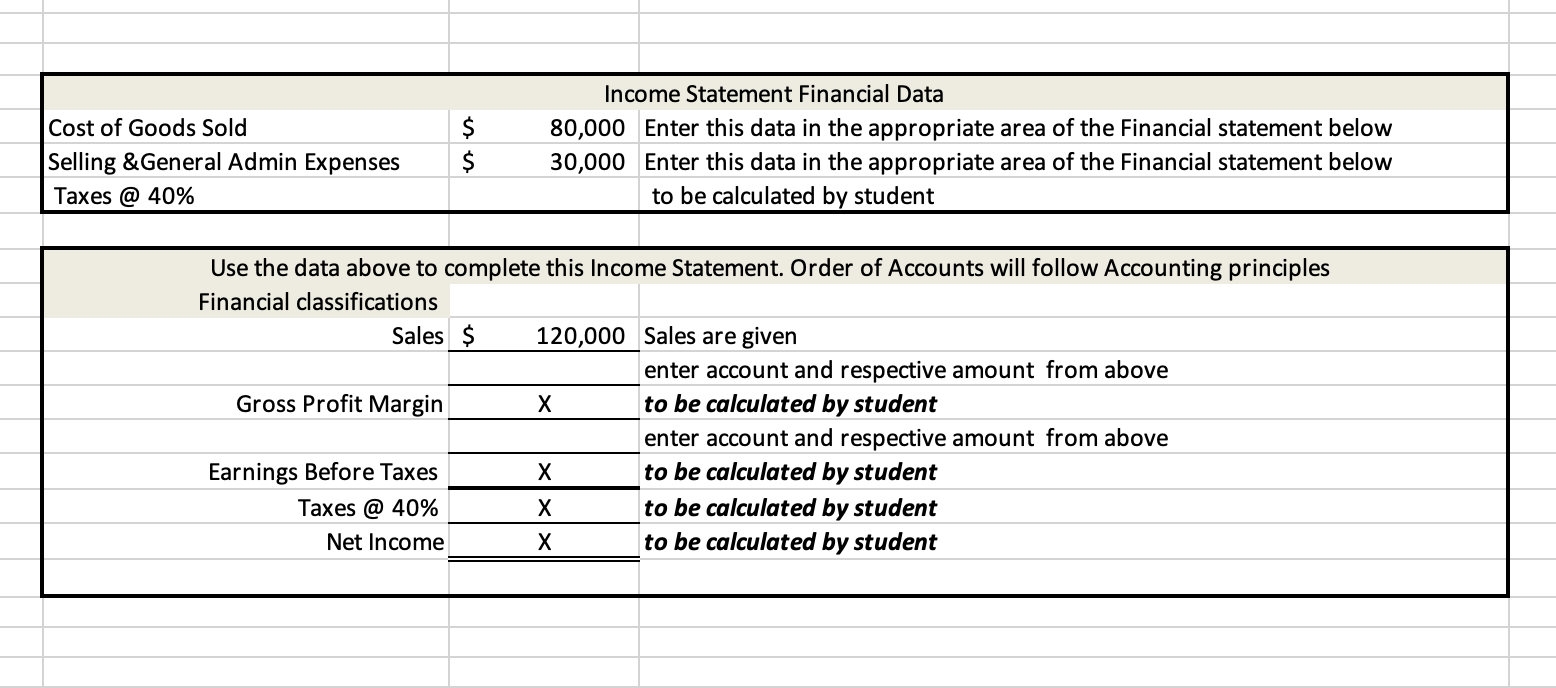

After completing the Income Statement, you should be able to measure a companys COGS and its effect on the Gross Profit Margin (GPM). Based on

After completing the Income Statement, you should be able to measure a companys COGS and its effect on the Gross Profit Margin (GPM). Based on your assessment of the firms Income Statement, you are to report to senior management on these key components:

Question 1: What is the markup on COGS?

Question 2: Compare this companys markup to a COGS industry standard of 70%. What is the result?

Question 3: Explain how the difference in this companys markup and industry markup rates affect profitability, or levels of the GPM?

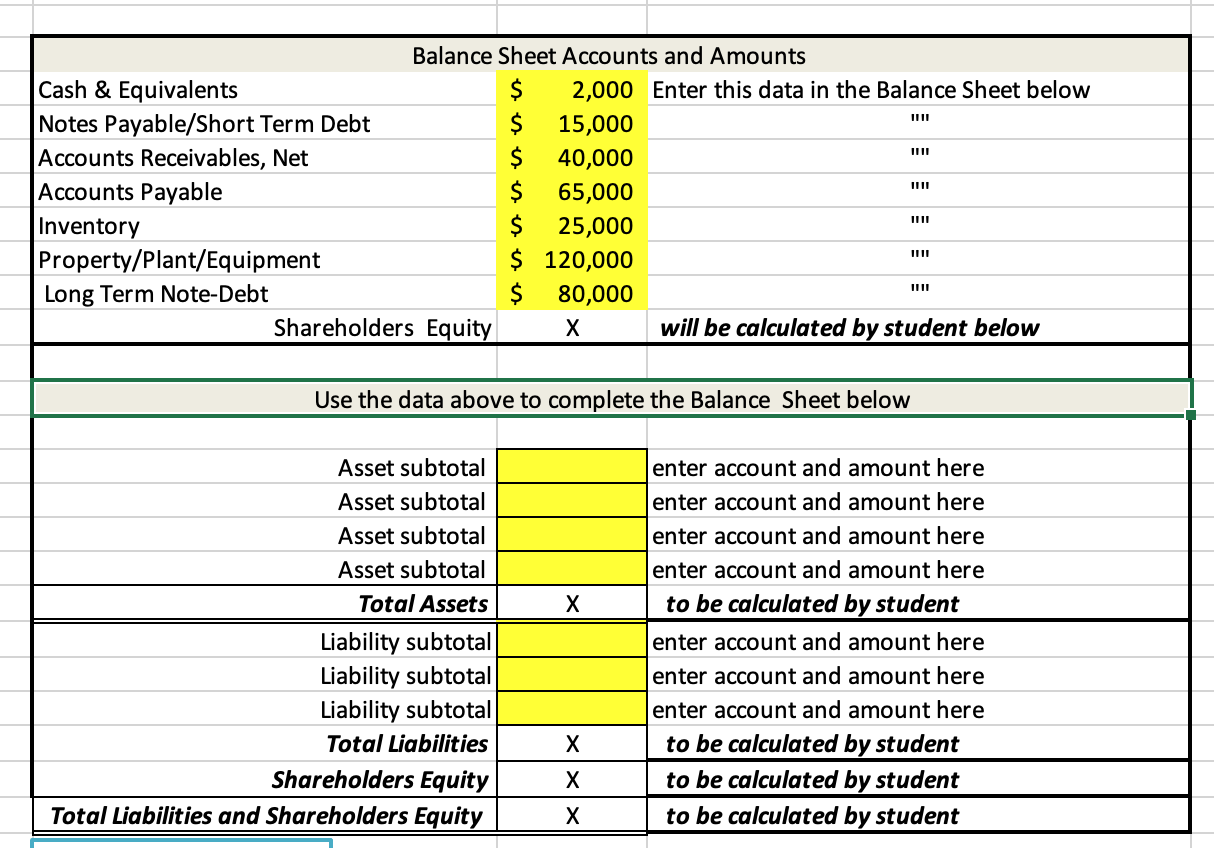

After completing the Balance Sheet in the Excel Spreadsheet hyperlinked above, you should be able to measure a companys capital structure. Based on your assessment of the firm's Balance Sheet, you are to report to senior management on these key components:

Question 4: What is the nature of this company's capital structure? Include percentages in your commentary?

Question 5: Compare this capitalization structure percent to an Industry Standard of 50%. What is the result?

Question 6: To what extent is this company 'leveraged'?

Cost of Goods Sold Selling &General Admin Expenses Taxes @ 40% $ $ Income Statement Financial Data 80,000 Enter this data in the appropriate area of the Financial statement below 30,000 Enter this data in the appropriate area of the Financial statement below to be calculated by student Use the data above to complete this Income Statement. Order of Accounts will follow Accounting principles Financial classifications Sales $ 120,000 Sales are given enter account and respective amount from above Gross Profit Margin to be calculated by student enter account and respective amount from above Earnings Before Taxes X to be calculated by student Taxes @ 40% to be calculated by student Net Income to be calculated by student Balance Sheet Accounts and Amounts Cash & Equivalents 2,000 Enter this data in the Balance Sheet below Notes Payable/Short Term Debt $ 15,000 Accounts Receivables, Net $ 40,000 Accounts Payable $ 65,000 Inventory $ 25,000 Property/Plant/Equipment $ 120,000 Long Term Note-Debt $ 80,000 Shareholders Equity X will be calculated by student below Use the data above to complete the Balance Sheet below X Asset subtotal Asset subtotal Asset subtotal Asset subtotal Total Assets Liability subtotal Liability subtotal Liability subtotal Total Liabilities Shareholders Equity Total Liabilities and Shareholders Equity enter account and amount here enter account and amount here enter account and amount here enter account and amount here to be calculated by student enter account and amount here enter account and amount here enter account and amount here to be calculated by student to be calculated by student to be calculated by studentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started