After completing the vertical analysis, please provide a summary of your key findings for this method of analysis. For example, if total assets had a large percentage change between the two years or you find that liquidity is not strong in running your analysis, these would be key findings.

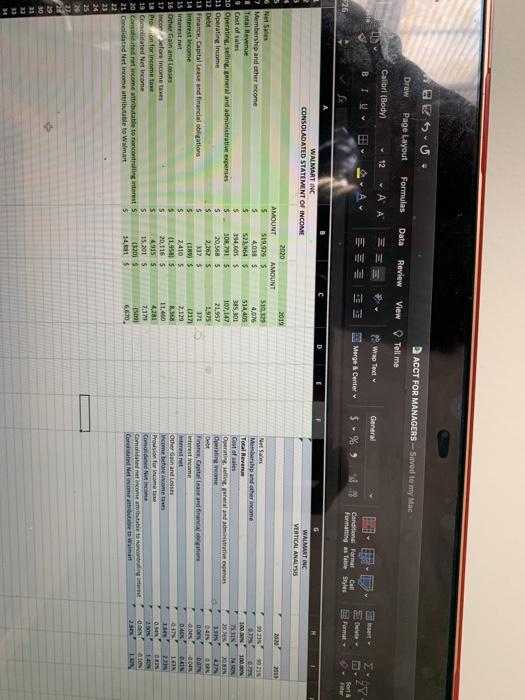

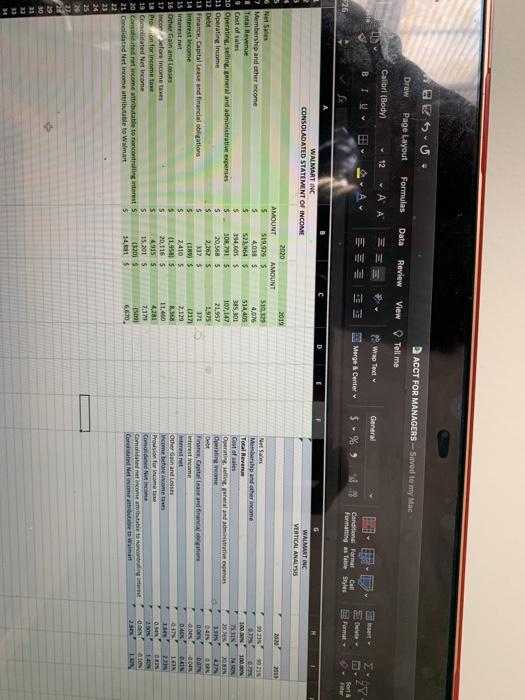

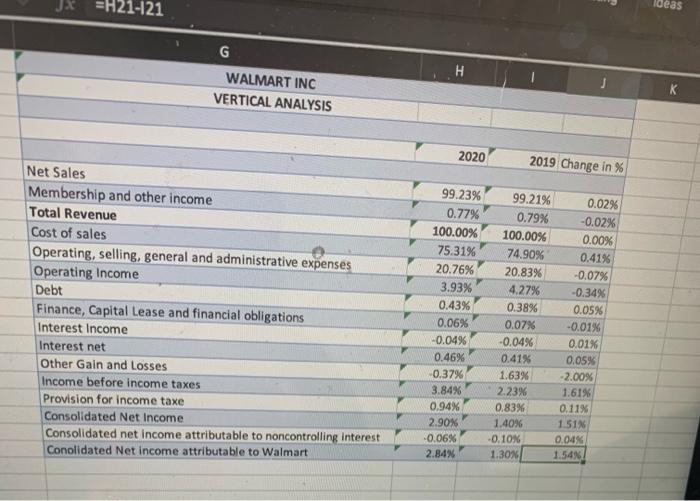

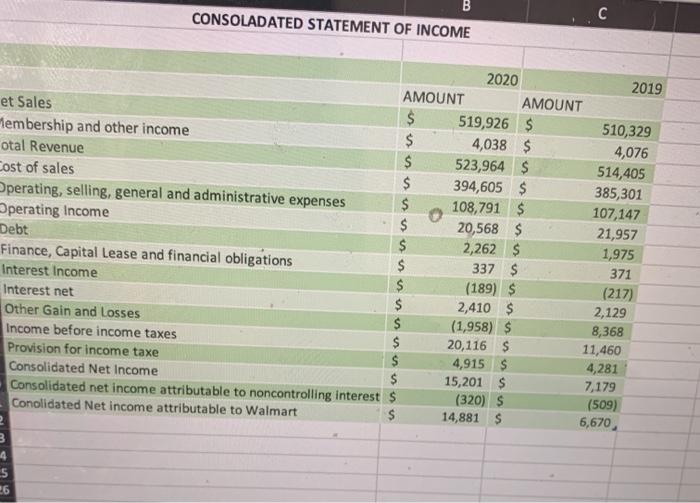

@ESU. Draw Page Layout Formulas ACCT FOR MANAGERS - Saved to my Mac View Tell me Data Review Calibrl (Body 12 - AA 2 Wrap Test General B TV Merge & Center $% 28- Conditions Format Call Formatting as Table Styles Delete Form OEM 26 Sort C D WALMART INC CONSOLADATED STATEMENT OF INCOME G WALMARTIN VERTICAL ANALYSIS 2019 2020 2011 100 100 NY 20 23 3:51 241 2020 AMOUNT Net Sales AMOUNT 5 7 Membership and other income 51996 5 # Total Revenue 4,0385 $ 521,9645 9 Cost of sales $ 394.605 $ 20 Operating sing general and administrative expenses $ SOR 791 $ 11 Operating income s 20,568 5 12 De $ 2,2625 13 Finance, Capitales and financial obligations 5 375 14 Interest income 5 (1895 15 Interest net s 24105 16 Other Gain and LHS $ (1.95$ 17 incorrere income taxes 5 20.1165 18 Preion for income to S 49155 19 Comaled Net Income $ 15,2015 20 Conscient income attributable to controlling interests 120$ 21 Calidated Net income attributable to Walmart $ 14 15 22 23 24 5102 4.01 514.405 385 10 107,147 21,957 1,975 371 0217 2,139 38 11.40 4,281 7.17 15. 6670 Net Sales Membership and other income Total Revenue Cost of sales Operating in real and adminative expenses Opera Finance Coptalandi Interest income Interest Other Gain and Loss Income before come to Provision for income taxe Comedy Come one table to CareNet income table to walmart GN DAN 004 LON 2 L-121 Ideas G WALMART INC VERTICAL ANALYSIS H 2020 2019 Change in % Net Sales Membership and other income Total Revenue Cost of sales Operating, selling, general and administrative expenses Operating Income Debt Finance, Capital Lease and financial obligations Interest Income Interest net Other Gain and Losses Income before income taxes Provision for income taxe Consolidated Net Income Consolidated net income attributable to noncontrolling interest Conolidated Net income attributable to Walmart 99.23% 0.77% 100.00% 75.31% 20.76% 3.93% 0.43% 0.06% -0.049 0.46% -0.37% 3.84% 0.94% 2.90% -0.06% 2.84% 99.21% 0.79% 100.00% 74.90% 20.83% 4.27% 0.38% 0.07% -0.04% 0.41% 1.63% 2.23% 0.83% 1.40% -0.10% 1.30% 0.02% -0.02% 0.00% 0.41% -0.07% -0.34% 0.05% -0.01% 0.01% 0.05% -2.00% 1.61% 0.11% 1.51% 0,04% 1.54 B CONSOLADATED STATEMENT OF INCOME C Debt 2020 2019 AMOUNT AMOUNT et Sales $ 519,926 $ 510,329 Membership and other income $ 4,038 $ 4,076 otal Revenue $ 523,964 $ 514,405 Cost of sales $ 394,605 $ 385,301 Operating, selling, general and administrative expenses $ 108,791 $ 107,147 Operating Income $ 20,568 $ 21,957 $ 2,262 $ 1,975 Finance, Capital Lease and financial obligations $ 337 $ 371 Interest Income $ (189) S (217) Interest net $ 2,410 $ 2,129 Other Gain and Losses S (1,958) $ 8,368 Income before income taxes $ 20,116 S 11,460 Provision for income taxe $ 4,915 $ 4,281 Consolidated Net Income $ 15,201 $ 7,179 Consolidated net income attributable to noncontrolling interest $ (320) S (509) Conolidated Net income attributable to Walmart $ 14,881 $ 6,670 4 5 26 @ESU. Draw Page Layout Formulas ACCT FOR MANAGERS - Saved to my Mac View Tell me Data Review Calibrl (Body 12 - AA 2 Wrap Test General B TV Merge & Center $% 28- Conditions Format Call Formatting as Table Styles Delete Form OEM 26 Sort C D WALMART INC CONSOLADATED STATEMENT OF INCOME G WALMARTIN VERTICAL ANALYSIS 2019 2020 2011 100 100 NY 20 23 3:51 241 2020 AMOUNT Net Sales AMOUNT 5 7 Membership and other income 51996 5 # Total Revenue 4,0385 $ 521,9645 9 Cost of sales $ 394.605 $ 20 Operating sing general and administrative expenses $ SOR 791 $ 11 Operating income s 20,568 5 12 De $ 2,2625 13 Finance, Capitales and financial obligations 5 375 14 Interest income 5 (1895 15 Interest net s 24105 16 Other Gain and LHS $ (1.95$ 17 incorrere income taxes 5 20.1165 18 Preion for income to S 49155 19 Comaled Net Income $ 15,2015 20 Conscient income attributable to controlling interests 120$ 21 Calidated Net income attributable to Walmart $ 14 15 22 23 24 5102 4.01 514.405 385 10 107,147 21,957 1,975 371 0217 2,139 38 11.40 4,281 7.17 15. 6670 Net Sales Membership and other income Total Revenue Cost of sales Operating in real and adminative expenses Opera Finance Coptalandi Interest income Interest Other Gain and Loss Income before come to Provision for income taxe Comedy Come one table to CareNet income table to walmart GN DAN 004 LON 2 L-121 Ideas G WALMART INC VERTICAL ANALYSIS H 2020 2019 Change in % Net Sales Membership and other income Total Revenue Cost of sales Operating, selling, general and administrative expenses Operating Income Debt Finance, Capital Lease and financial obligations Interest Income Interest net Other Gain and Losses Income before income taxes Provision for income taxe Consolidated Net Income Consolidated net income attributable to noncontrolling interest Conolidated Net income attributable to Walmart 99.23% 0.77% 100.00% 75.31% 20.76% 3.93% 0.43% 0.06% -0.049 0.46% -0.37% 3.84% 0.94% 2.90% -0.06% 2.84% 99.21% 0.79% 100.00% 74.90% 20.83% 4.27% 0.38% 0.07% -0.04% 0.41% 1.63% 2.23% 0.83% 1.40% -0.10% 1.30% 0.02% -0.02% 0.00% 0.41% -0.07% -0.34% 0.05% -0.01% 0.01% 0.05% -2.00% 1.61% 0.11% 1.51% 0,04% 1.54 B CONSOLADATED STATEMENT OF INCOME C Debt 2020 2019 AMOUNT AMOUNT et Sales $ 519,926 $ 510,329 Membership and other income $ 4,038 $ 4,076 otal Revenue $ 523,964 $ 514,405 Cost of sales $ 394,605 $ 385,301 Operating, selling, general and administrative expenses $ 108,791 $ 107,147 Operating Income $ 20,568 $ 21,957 $ 2,262 $ 1,975 Finance, Capital Lease and financial obligations $ 337 $ 371 Interest Income $ (189) S (217) Interest net $ 2,410 $ 2,129 Other Gain and Losses S (1,958) $ 8,368 Income before income taxes $ 20,116 S 11,460 Provision for income taxe $ 4,915 $ 4,281 Consolidated Net Income $ 15,201 $ 7,179 Consolidated net income attributable to noncontrolling interest $ (320) S (509) Conolidated Net income attributable to Walmart $ 14,881 $ 6,670 4 5 26