After examining and analyzing the information seen in the two (2) tables below, use Excel to perform the following exercise. Use a different tab

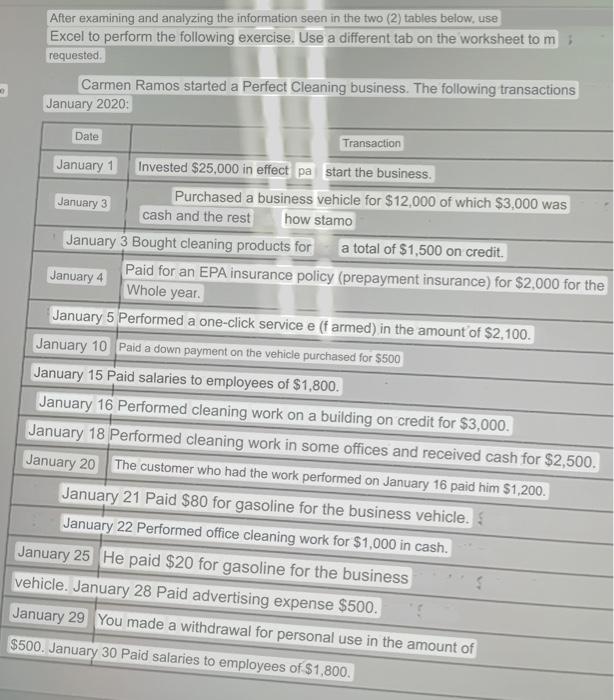

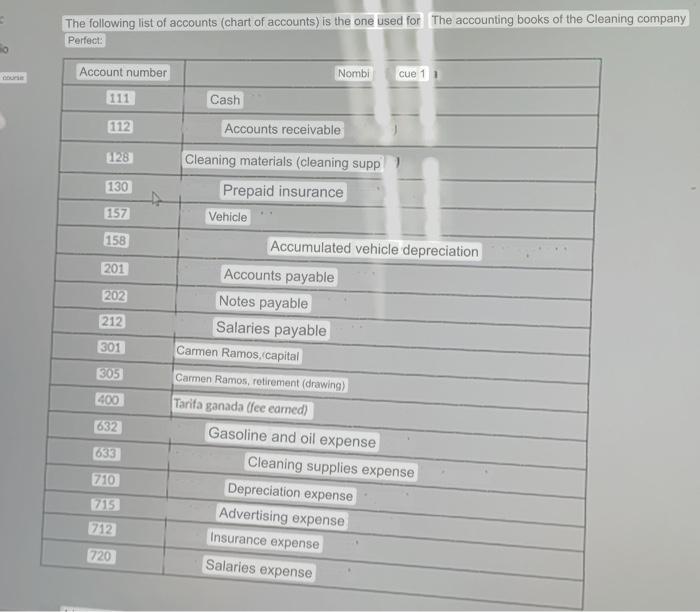

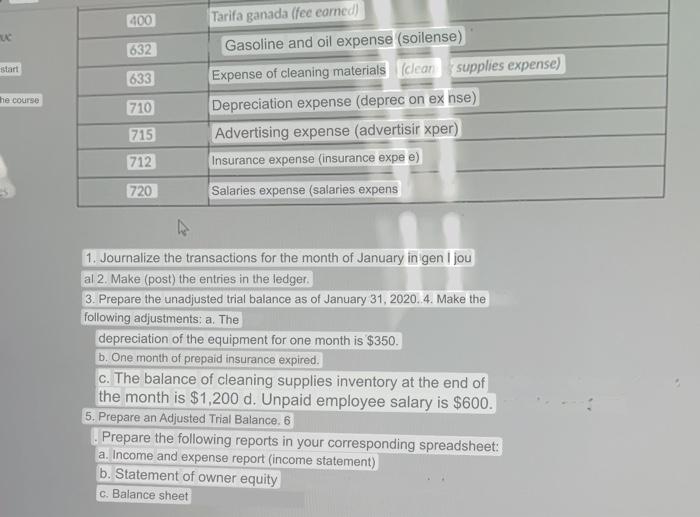

After examining and analyzing the information seen in the two (2) tables below, use Excel to perform the following exercise. Use a different tab on the worksheet to m requested. Carmen Ramos started a Perfect Cleaning business. The following transactions January 2020: Date January 1 January 3 January January 4 Transaction Invested $25,000 in effect pa start the business. Purchased a business vehicle for $12,000 of which $3,000 was cash and the rest how stamo 3 Bought cleaning products for a total of $1,500 on credit. Paid for an EPA insurance policy (prepayment insurance) for $2,000 for the Whole year. January 5 Performed a one-click service e (f armed) in the amount of $2,100. January 10 Paid a down payment on the vehicle purchased for $500 January 15 Paid salaries to employees of $1,800. January 16 Performed cleaning work on a building on credit for $3,000. January 18 Performed cleaning work in some offices and received cash for $2,500. January 20 The customer who had the work performed on January 16 paid him $1,200. January 21 Paid $80 for gasoline for the business vehicle. January 22 Performed office cleaning work for $1,000 in cash. January 25 He paid $20 for gasoline for the business vehicle. January 28 Paid advertising expense $500. January 29 You made a withdrawal for personal use in the amount of $500. January 30 Paid salaries to employees of $1,800. io course The following list of accounts (chart of accounts) is the one used for The accounting books of the Cleaning company Perfect: Account number 111 112 128 130 157 158 201 202 212 301 305 400 632 633 710 715 712 720 Cash Accounts receivable Cleaning materials (cleaning supp Prepaid insurance Vehicle Nombi Accounts payable Notes payable Salaries payable Accumulated vehicle depreciation Carmen Ramos, capital Carmen Ramos, retirement (drawing) Tarifa ganada (fee earned) Gasoline and oil expense cue 1 1 Cleaning supplies expense Depreciation expense Advertising expense Insurance expense Salaries expense muc start The course 400 632 633 710 715 712 720 Tarifa ganada (fee earned) Gasoline and oil expense (soilense) Expense of cleaning materials (clean supplies expense) Depreciation expense (deprec on ex nse) Advertising expense (advertisir xper) Insurance expense (insurance expe e) Salaries expense (salaries expens 1. Journalize the transactions for the month of January in gen I jou al 2. Make (post) the entries in the ledger. 3. Prepare the unadjusted trial balance as of January 31, 2020. 4. Make the following adjustments: a. The depreciation of the equipment for one month is $350. b. One month of prepaid insurance expired. c. The balance of cleaning supplies inventory at the end of the month is $1,200 d. Unpaid employee salary is $600. 5. Prepare an Adjusted Trial Balance, 6 Prepare the following reports in your corresponding spreadsheet: a. Income and expense report (income statement) b. Statement of owner equity c. Balance sheet After examining and analyzing the information seen in the two (2) tables below, use Excel to perform the following exercise. Use a different tab on the worksheet to m requested. Carmen Ramos started a Perfect Cleaning business. The following transactions January 2020: Date January 1 January 3 January January 4 Transaction Invested $25,000 in effect pa start the business. Purchased a business vehicle for $12,000 of which $3,000 was cash and the rest how stamo 3 Bought cleaning products for a total of $1,500 on credit. Paid for an EPA insurance policy (prepayment insurance) for $2,000 for the Whole year. January 5 Performed a one-click service e (f armed) in the amount of $2,100. January 10 Paid a down payment on the vehicle purchased for $500 January 15 Paid salaries to employees of $1,800. January 16 Performed cleaning work on a building on credit for $3,000. January 18 Performed cleaning work in some offices and received cash for $2,500. January 20 The customer who had the work performed on January 16 paid him $1,200. January 21 Paid $80 for gasoline for the business vehicle. January 22 Performed office cleaning work for $1,000 in cash. January 25 He paid $20 for gasoline for the business vehicle. January 28 Paid advertising expense $500. January 29 You made a withdrawal for personal use in the amount of $500. January 30 Paid salaries to employees of $1,800. io course The following list of accounts (chart of accounts) is the one used for The accounting books of the Cleaning company Perfect: Account number 111 112 128 130 157 158 201 202 212 301 305 400 632 633 710 715 712 720 Cash Accounts receivable Cleaning materials (cleaning supp Prepaid insurance Vehicle Nombi Accounts payable Notes payable Salaries payable Accumulated vehicle depreciation Carmen Ramos,(capital Carmen Ramos, retirement (drawing) Tarifa ganada (fee earned) Gasoline and oil expense cue 1 1 Cleaning supplies expense Depreciation expense Advertising expense Insurance expense Salaries expense muc start The course 400 632 633 710 715 712 720 Tarifa ganada (fee earned) Gasoline and oil expense (soilense) Expense of cleaning materials (clean supplies expense) Depreciation expense (deprec on ex nse) Advertising expense (advertisir xper) Insurance expense (insurance expe e) Salaries expense (salaries expens 1. Journalize the transactions for the month of January in gen I jou al 2. Make (post) the entries in the ledger. 3. Prepare the unadjusted trial balance as of January 31, 2020. 4. Make the following adjustments: a. The depreciation of the equipment for one month is $350. b. One month of prepaid insurance expired. c. The balance of cleaning supplies inventory at the end of the month is $1,200 d. Unpaid employee salary is $600. 5. Prepare an Adjusted Trial Balance, 6 Prepare the following reports in your corresponding spreadsheet: a. Income and expense report (income statement) b. Statement of owner equity c. Balance sheet

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed workings for all the steps without leaving anything Journal Entries Tab DateAccountDebitCreditExplanation 1JanCash25000Investmen...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started