Question

After further understanding the clients financial situation, you believe you need to change your strategy to a long butterfly. Recall: this involves buying 1 put

After further understanding the clients financial situation, you believe you need to change your strategy to a long butterfly. Recall: this involves buying 1 put at a low strike price, selling 2 puts at a higher strike price and buying another put at an even higher (highest available) strike price. Using the June Put Contracts X1, X2 and X3, you have been asked to provide the client the following information (show all workings).

What is the cost of undertaking this strategy

What is the breakeven price(s) of this strategy

What will be the profit if the stock price at expiration is $52.50?

What is one advantages that a long butterfly strategy has over a bull spread?

What type of market conditions would best suit a long butterfly strategy (e.g., what would your view of future market conditions be if you were to implement this strategy). Hint: what happens if market volatility is low? What happens if market volatility is high? What happens if prices increase / decrease?

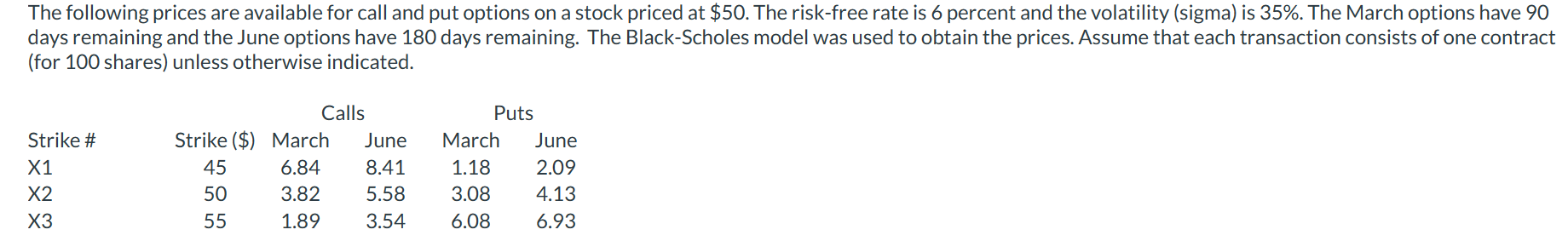

The following prices are available for call and put options on a stock priced at $50. The risk-free rate is 6 percent and the volatility (sigma) is 35%. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices. Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started