Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has

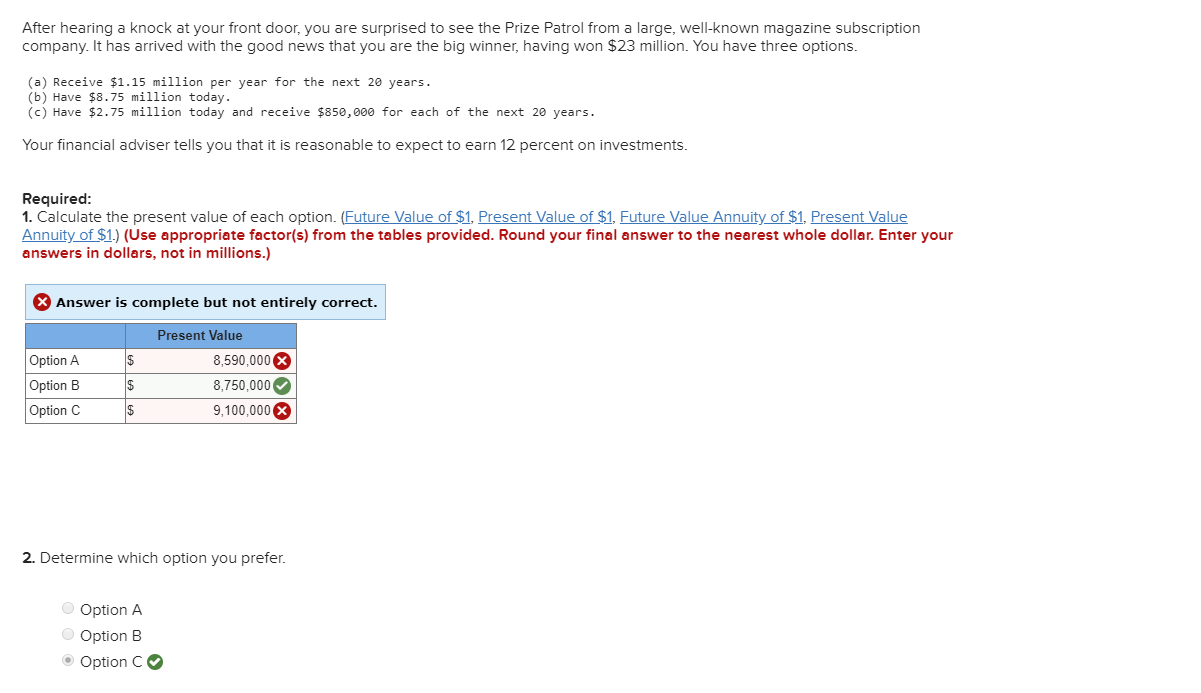

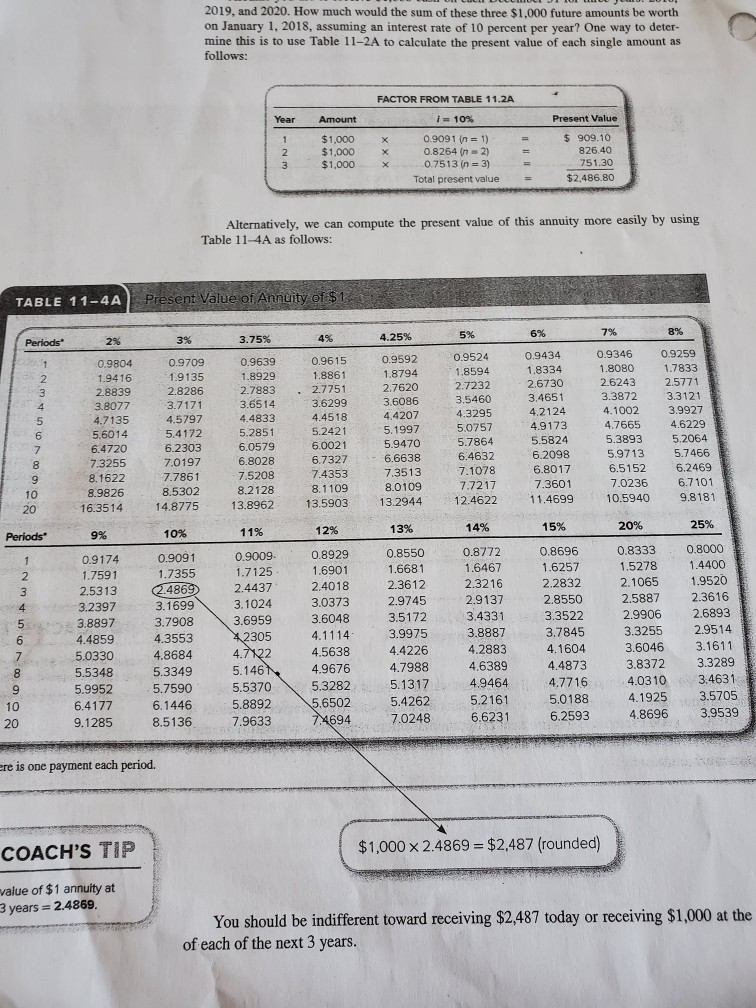

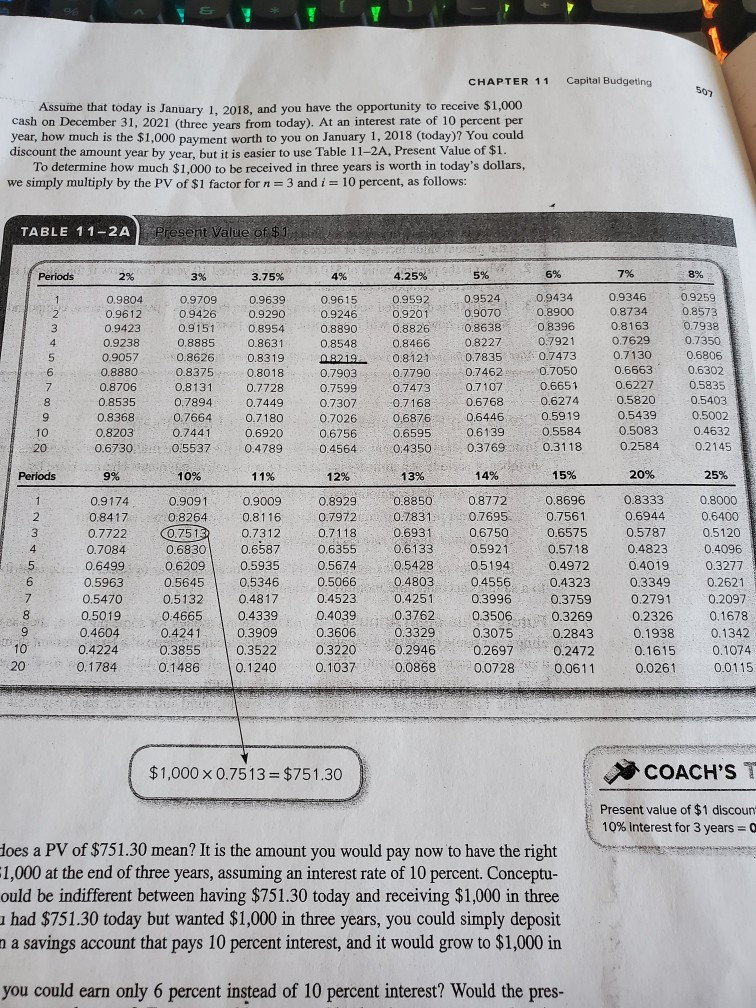

After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has arrived with the good news that you are the big winner, having won $23 million. You have three options. (a) Receive $1.15 million per year for the next 20 years. (b) Have $8.75 million today. (c) Have $2.75 million today and receive $850,000 for each of the next 20 years. Your financial adviser tells you that it is reasonable to expect to earn 12 percent on investments. Required: 1. Calculate the present value of each option. (Future Value of $1, Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar. Enter your answers in dollars, not in millions.) Answer is complete but not entirely correct. Option A Option B Option C $ $ $ Present Value 8,590,000 8,750,000 9,100,000 X 2. Determine which option you prefer. Option A Option B Option C 2019, and 2020. How much would the sum of these three $1,000 future amounts be worth on January 1, 2018, assuming an interest rate of 10 percent per year? One way to deter- mine this is to use Table 11-2A to calculate the present value of each single amount as follows: Year Present Value Amount $1,000 $1,000 $1,000 FACTOR FROM TABLE 11.2A i = 10% 0.9091 in = 1) X 0.8264 (n=2) 0.7513 in = 3) Total present value $ 909.10 826.40 751.30 $2,486.80 Alternatively, we can compute the present value of this annuity more easily by using Table 11-4A as follows: TABLE 11-4A Present Value of Annuity of $1 Periods 2% 3.75% 4.25% 5% 6% 7% 8% 88 OWN 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 6.4720 7.3255 8.1622 8.9826 16.3514 3% 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 14.8775 0.9639 1.8929 2.7883 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 8.1109 13.5903 0.9592 1.8794 2.7620 3.6086 4,4207 5.1997 5.9470 6.6638 7.3513 8.0109 13.2944 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 12.4622 0.9434 1.8334 2.6730 3.4651 4.2124 4.9173 5.5824 6.2098 6.8017 7.3601 11.4699 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 9.8181 Periods 9% 10% 11% 12% 13% 14% 15% 20% 25% 80 con un 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 5.9952 6.4177 9.1285 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.9009 1.7125 2.4437 3.1024 3.6959 42305 4.7122 5.146 5.5370 5.8892 7.9633 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 7.4694 0.8550 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 7.0248 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 6.6231 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 6.2593 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.8696 0.8000 1.4400 1.9520 2.3616 2.6893 2.9514 3.1611 3.3289 3.4631 3.5705 3.9539 re is one payment each period. COACH'S TIP $1,000 x 2.4869 = $2,487 (rounded) alue of $1 annuity at years = 2.4869 You should be indifferent toward receiving $2,487 today or receiving $1,000 at the of each of the next 3 years. CHAPTER 11 Capital Budgeting Assume that today is January 1. 2018, and you have the opportunity to receive $1,000 cash on December 31, 2021 (three years from today). At an interest rate of 10 percent per year, how much is the $1.000 payment worth to you on January 1, 2018 (today)? You could discount the amount year by year, but it is casier to use Table 11-2A, Present Value of $1. To determine how much $1,000 to be received in three years is worth in today's dollars, we simply multiply by the PV of $1 factor for n= 3 and i = 10 percent, as follows: TABLE 11-2A Present Value of $1 Periods 2% 3% 3.75% 4.25% 5% 69 7% 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.6730 0.9709 0.9639 0.9426 0.9290 0.91510.8954 0.8885 0.8631 0.8626 0.8319 0.8375 0.8018 0.8131 0.7728 0.7894 0.7449 0.7664 0.7180 0.7441 0.6920 0.5537 0.4789 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.4564 0.9592 0.9524 0.9201 0.9070 0.8826 0.8638 0.8466 08227 0.8121 0.7835 0.7790 0.7462 0.7473 0.7107 0.7168 0.6768 0.6876 0.6446 0.6595 0.6139 0.43500.3769 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.3118 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.2584 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.2145 20 Periods 9% 10% 12% 14% 15% 20% 25% 8 COWN 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.1784 0.9091 0.8264 0.75132 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.1486 11% 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.1240 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.1037 13% 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 0.0868 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.0611 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.0261 0.8000 0.6400 0.5120 0.4096 0.3277 0.2621 0.2097 0.1678 0.1342 0.1074 0.0115 $1,000 x 0.7513 = $751.30 COACH'S T Present value of $1 discoun 10% Interest for 3 years = 0 Hoes a PV of $751.30 mean? It is the amount you would pay now to have the right 1,000 at the end of three years, assuming an interest rate of 10 percent. Conceptu- could be indifferent between having $751.30 today and receiving $1,000 in three had $751.30 today but wanted $1,000 in three years, you could simply deposit a savings account that pays 10 percent interest, and it would grow to $1,000 in you could earn only 6 percent instead of 10 percent interest? Would the pres

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started