Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After liquidating noncash assets and paying creditors, account balances in the Pharoah Co. are Cash $18,100; A, Capital (Cr.) $8,500; B, Capital (Cr.) $6,400;

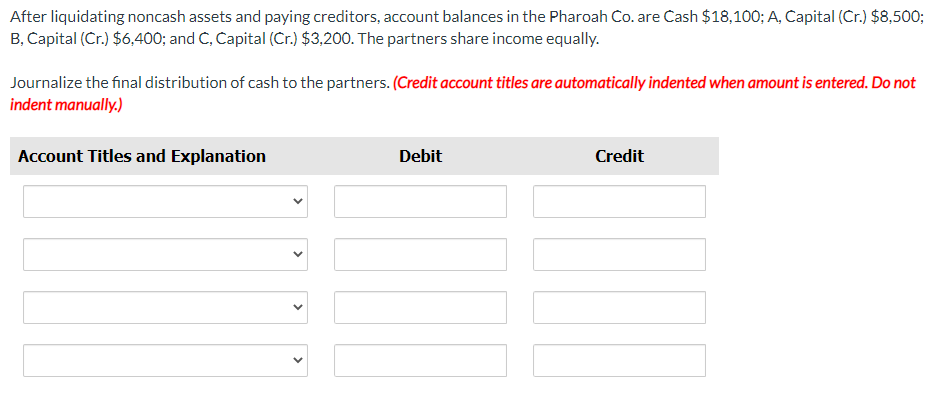

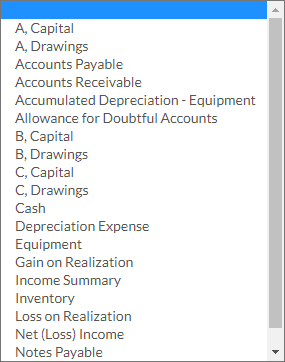

After liquidating noncash assets and paying creditors, account balances in the Pharoah Co. are Cash $18,100; A, Capital (Cr.) $8,500; B, Capital (Cr.) $6,400; and C, Capital (Cr.) $3,200. The partners share income equally. Journalize the final distribution of cash to the partners. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation > Debit Credit A, Capital A, Drawings Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Allowance for Doubtful Accounts B, Capital B, Drawings C, Capital C, Drawings Cash Depreciation Expense Equipment Gain on Realization Income Summary Inventory Loss on Realization Net (Loss) Income Notes Payable A, Capital A, Drawings Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Allowance for Doubtful Accounts B, Capital B, Drawings C, Capital C, Drawings Cash Depreciation Expense Equipment Gain on Realization Income Summary Inventory Loss on Realization Net (Loss) Income Notes Payable Salaries Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entry for Final Distribution of Cash A Drawings 7900 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd3239b417_961860.pdf

180 KBs PDF File

663dd3239b417_961860.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started