Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After Misha finishes her Bachelor of Commerce degree (in Australia) she travels to the UK to work as an accountant for three years. During

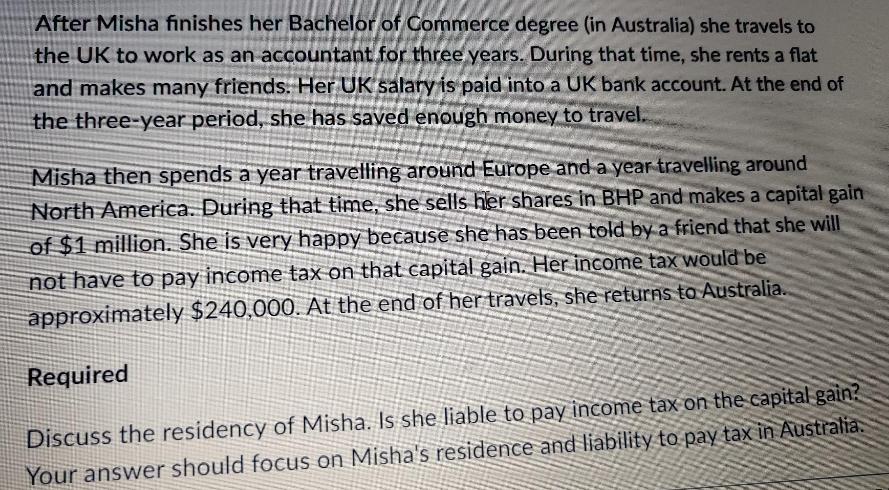

After Misha finishes her Bachelor of Commerce degree (in Australia) she travels to the UK to work as an accountant for three years. During that time, she rents a flat and makes many friends. Her UK salary is paid into a UK bank account. At the end of the three-year period, she has saved enough money to travel. Misha then spends a year travelling around Europe and a year travelling around North America. During that time, she sells her shares in BHP and makes a capital gain of $1 million. She is very happy because she has been told by a friend that she will not have to pay income tax on that capital gain. Her income tax would be approximately $240,000. At the end of her travels, she returns to Australia. Required Discuss the residency of Misha. Is she liable to pay income tax on the capital gain? Your answer should focus on Misha's residence and liability to pay tax in Australia.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation i From the facts it would appear that Misha does no...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started