Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After reading the PV model under certainty, please complete the second-year B/S and I/S of the firm on the article. After reading the PV model

After reading the "PV model under certainty", please complete the second-year B/S and I/S of the firm on the article.

After reading the "PV model under certainty", please complete the second-year B/S and I/S of the firm on the article.

Please show your calculations, thanks!!

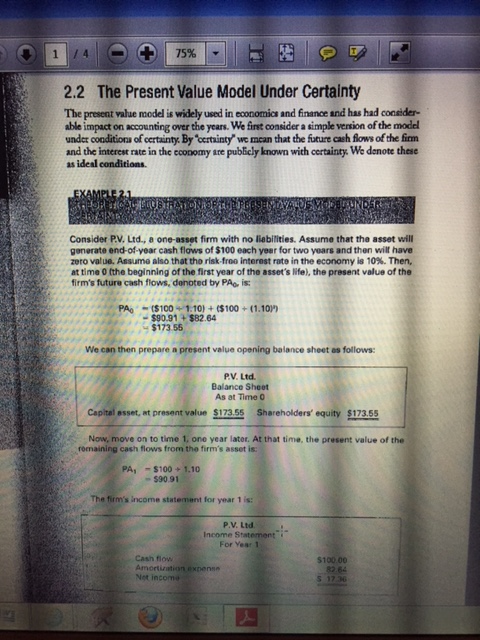

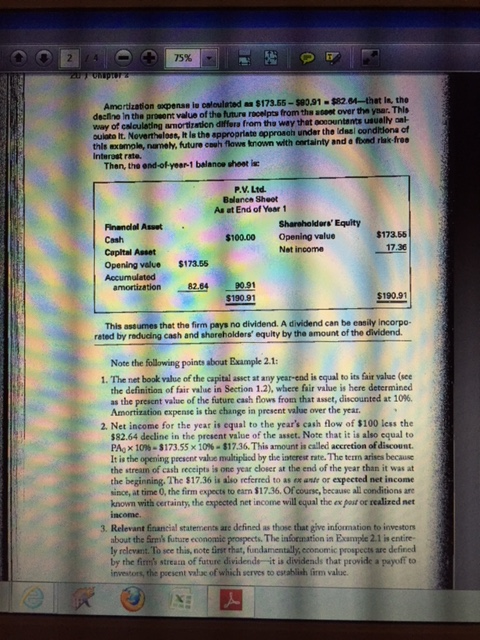

2.2 The Present Value Model Under Certainty The present value model is widely used in economics and finance and has had consider- able impact on accounting over the years. We first consider a simple vension of the model under conditions of certainty. By certainty' we mcan that the future cash flows of the firm and the interest rate in the economy ste pubely known with certainty We denote these as ideal conditions Consider P.V. Ltd., a one-asset firm with no liabilities. Assume that the asset will generate end-of-year cash flows of $100 each yeer for two yoars and then wil have zero value. Assumo also that tho risk-froo interest rate in the economy is 10%. Then, at time 0 the beginning of the first year of the asset's life), the present value of the firm's future cash flows, denoted by PAo is: PAoS100 1.10)+($100+(1.10 $90.91+$82.64 $17355 We can then prepare a present value opening balance sheet as follows: PV. Ltd. Balance Sheet As at Time o Capital esset, at present value $173.55 Shareholders' equity $173.55 Now, move on to time 1, one year lator. At that time, the present value of the romaining cash flows from the firm's asset is: PA $100 1.10 - $90.91 The firm's income statement for year 1 is P.V. Ltd. For Vear 1 Income Statement i Cash flow Amortization expense Net incoma 5100.00 826 2.2 The Present Value Model Under Certainty The present value model is widely used in economics and finance and has had consider- able impact on accounting over the years. We first consider a simple vension of the model under conditions of certainty. By certainty' we mcan that the future cash flows of the firm and the interest rate in the economy ste pubely known with certainty We denote these as ideal conditions Consider P.V. Ltd., a one-asset firm with no liabilities. Assume that the asset will generate end-of-year cash flows of $100 each yeer for two yoars and then wil have zero value. Assumo also that tho risk-froo interest rate in the economy is 10%. Then, at time 0 the beginning of the first year of the asset's life), the present value of the firm's future cash flows, denoted by PAo is: PAoS100 1.10)+($100+(1.10 $90.91+$82.64 $17355 We can then prepare a present value opening balance sheet as follows: PV. Ltd. Balance Sheet As at Time o Capital esset, at present value $173.55 Shareholders' equity $173.55 Now, move on to time 1, one year lator. At that time, the present value of the romaining cash flows from the firm's asset is: PA $100 1.10 - $90.91 The firm's income statement for year 1 is P.V. Ltd. For Vear 1 Income Statement i Cash flow Amortization expense Net incoma 5100.00 826Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started