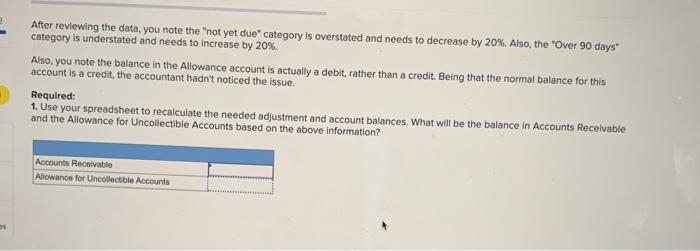

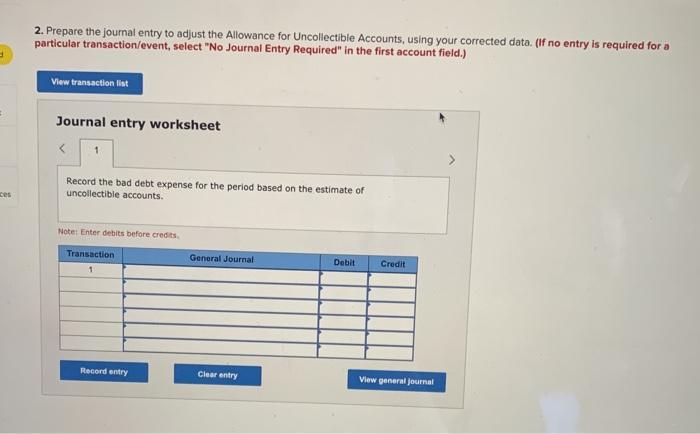

After reviewing the data, you note the "not yet due category is overstated and needs to decrease by 20%. Also, the 'Over 90 days category is understated and needs to increase by 20% Also, you note the balance in the Allowance account is actually a debit, rather than a credit. Being that the normal balance for this account is a credit, the accountant hadn't noticed the issue. Required: 1. Use your spreadsheet to recalculate the needed adjustment and account balances. What will be the balance in Accounts Receivable and the Allowance for Uncollectible Accounts based on the above information? Accounts Receivable Allowance for Uncollectible Accounts 25 2. Prepare the journal entry to adjust the Allowance for Uncollectible Accounts, using your corrected data. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the bad debt expense for the period based on the estimate of uncollectible accounts ces Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal After reviewing the data, you note the "not yet due category is overstated and needs to decrease by 20%. Also, the 'Over 90 days category is understated and needs to increase by 20% Also, you note the balance in the Allowance account is actually a debit, rather than a credit. Being that the normal balance for this account is a credit, the accountant hadn't noticed the issue. Required: 1. Use your spreadsheet to recalculate the needed adjustment and account balances. What will be the balance in Accounts Receivable and the Allowance for Uncollectible Accounts based on the above information? Accounts Receivable Allowance for Uncollectible Accounts 25 2. Prepare the journal entry to adjust the Allowance for Uncollectible Accounts, using your corrected data. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the bad debt expense for the period based on the estimate of uncollectible accounts ces Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal