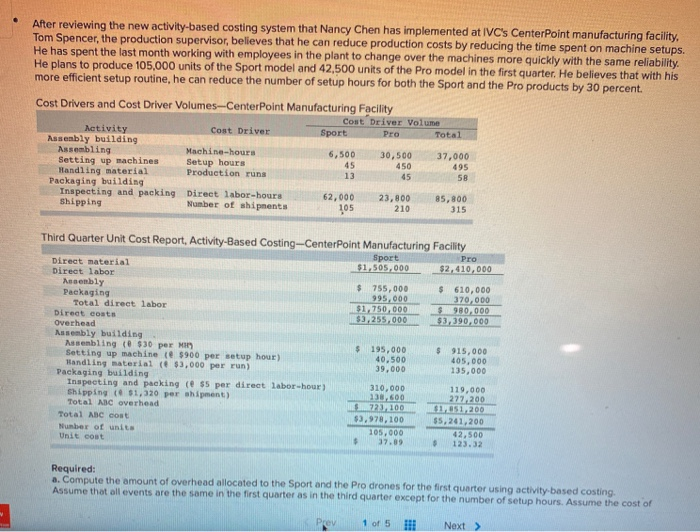

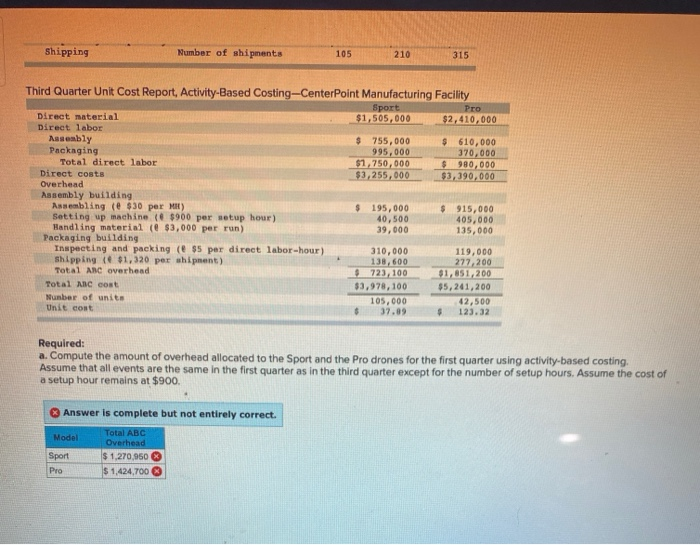

After reviewing the new activity-based costing system that Nancy Chen has implemented at VC's CenterPoint manufacturing facility. Tom Spencer, the production supervisor, believes that he can reduce production costs by reducing the time spent on machine setups. He has spent the last month working with employees in the plant to change over the machines more quickly with the same reliability He plans to produce 105,000 units of the Sport model and 42,500 units of the Pro model in the first quarter. He believes that with his more efficient setup routine, he can reduce the number of setup hours for both the Sport and the Pro products by 30 percent. Cost Drivers and Cost Driver Volumes-CenterPoint Manufacturing Facility Cost Driver Volume Activity Cost Driver Sport Pro Total Assembly building Assembling Machine-hours 6,500 30,500 37,000 Setting up machines Setup hours 45 450 495 Handling material Production runs 13 45 58 Packaging building Inspecting and packing Direct labor-hours 62,000 23,800 85,800 Shipping Number of shipments 105 210 315 Third Quarter Unit Cost Report, Activity-Based Costing-CenterPoint Manufacturing Facility Sport Pro Direct material $1,505,000 $2,410,000 Direct labor Assembly $ 755,000 $ 610,000 Packaging 995,000 370,000 Total direct labor $1,750,000 S 980,000 Direct costs $3,255,000 $3,390,000 Overhead Assembly building Assembling ($30 per MS $ 195,000 $ 915,000 Setting up machine ($900 per setup hour) 40.500 405,000 Handling material ( $3,000 per run) 39,000 135,000 Packaging building Inspecting and packing (e $5 per direct labor-hour) 310,000 119,000 Shipping ($1,320 per shipment) 238,600 272,200 Total ABC overhead S723100 $1.051,200 Total ABC cost $3,978,100 55,241,200 Number of units 105,000 42,500 Unit cost $ 37.09 123.32 Required: a. Compute the amount of overhead allocated to the Sport and the Pro drones for the first quarter using activity based costing. Assume that all events are the same in the first quarter as in the third quarter except for the number of setup hours. Assume the cost of Prev 1 of 5 Next > Shipping Number of shipments 105 210 315 Third Quarter Unit Cost Report, Activity-Based Costing-CenterPoint Manufacturing Facility Sport Pro Direct material $1,505,000 $2,410,000 Direct labor Assembly $ 755,000 $ 610,000 Packaging 995,000 370,000 Total direct labor $1,750,000 $ 980,000 Direct costs $3,255,000 $3,390,000 Overhead Assembly building Assembling (e $30 per MB) $ 195,000 $ 915,000 Setting up machine ( $900 per setup hour) 40,500 405,000 Handling material ( $3,000 per run) 39,000 135,000 Packaging building Inspecting and packing (e $5 per direct labor-hour) 310,000 119,000 Shipping $1,320 per shipnent) 138,600 277,200 Total ABC overhead $ 723, 100 $1,851,200 Total AC cost $3,978,100 $5,241,200 Number of units 105,000 42,500 Unit cost 37.89 123.32 $ Required: a. Compute the amount of overhead allocated to the Sport and the Pro drones for the first quarter using activity-based costing. Assume that all events are the same in the first quarter as in the third quarter except for the number of setup hours. Assume the cost of a setup hour remains at $900. Answer is complete but not entirely correct. Model Sport Pro Total ABC Overhead $1,270,950 $ 1,424,700