Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After studying Iris Hamson's credit analysis, George Davies is considering whether he can increase the holding period return on Yucatan Resort's excess cash holdings (which

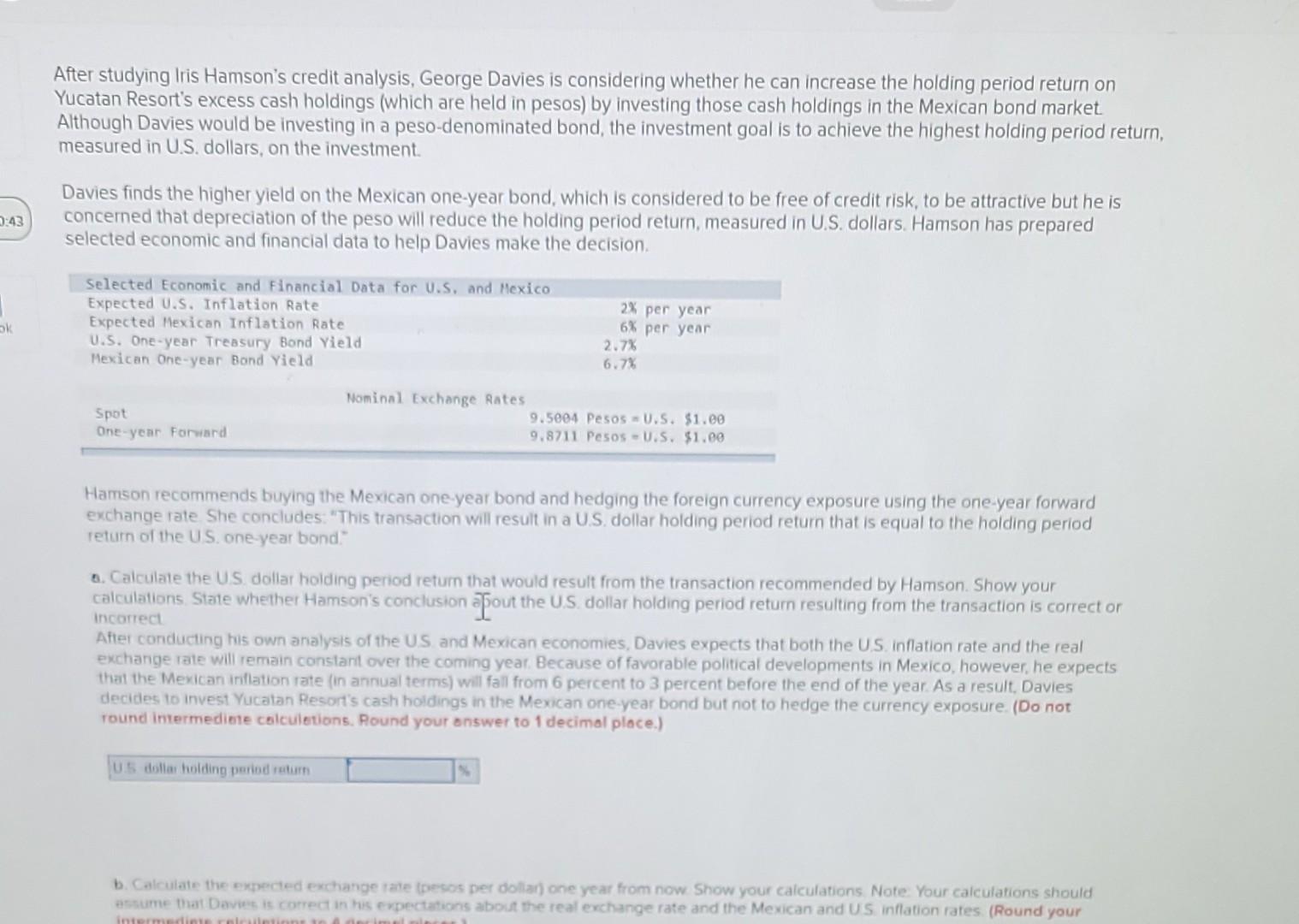

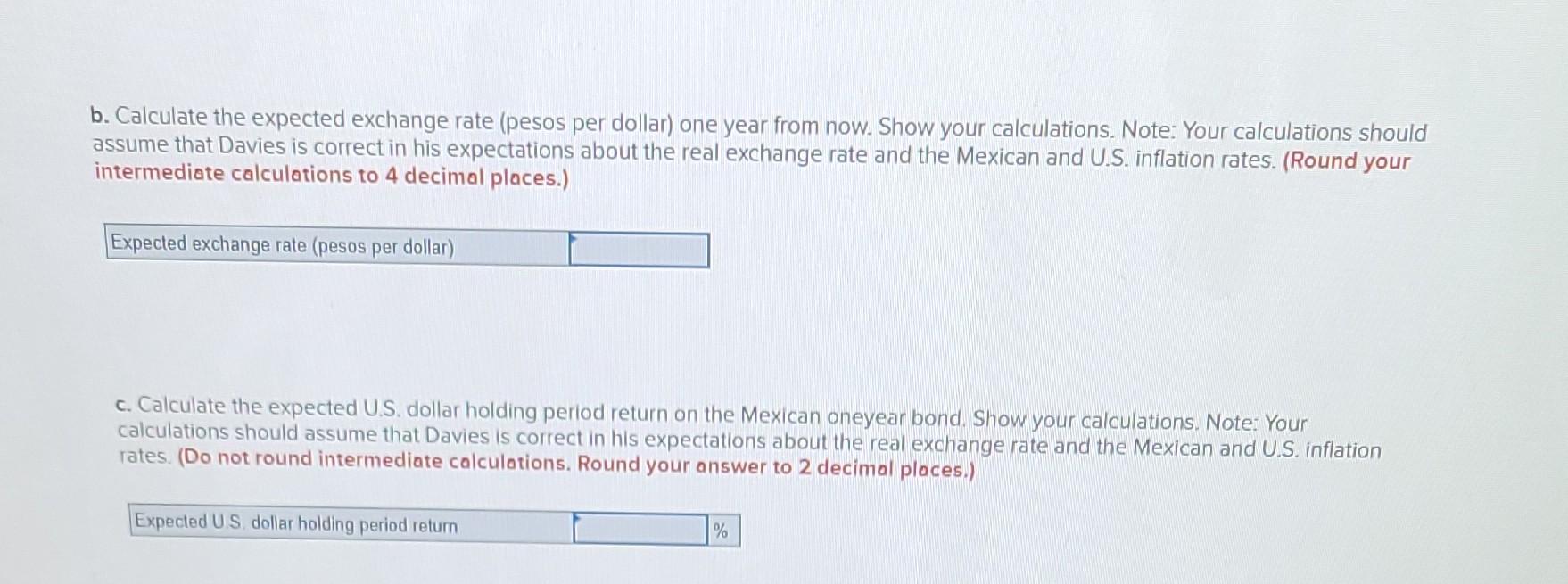

After studying Iris Hamson's credit analysis, George Davies is considering whether he can increase the holding period return on Yucatan Resort's excess cash holdings (which are held in pesos) by investing those cash holdings in the Mexican bond market Although Davies would be investing in a peso-denominated bond, the investment goal is to achieve the highest holding period return, measured in U.S. dollars, on the investment. Davies finds the higher yield on the Mexican one-year bond, which is considered to be free of credit risk, to be attractive but he is concerned that depreciation of the peso will reduce the holding period return, measured in U.S. dollars. Hamson has prepared selected economic and financial data to help Davies make the decision. Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the US. one-year bond: 0. Calculate the US. dollar hoiding period retum that would result from the transaction recommended by Hamson. Show your calculations. State whether Hamson's conclusion Jpout the U.S. dollar holding period return resulting from the transaction is correct or incorrect After conducting his own analysis of the US and Mexican economies, Davies expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Because of favorable political developments in Mexico, however, he expects that the Mexican irillation rate (in annual terms) will fall from 6 percent to 3 percent before the end of the year. As a result, Davies decides to invest Yucatan Resort's cash holdings in the Mexican one-year bond but not to hedge the currency exposure. (Do not round imermediete colculetions. Round your answer to 1 decimal place.) b. Calculate the expected exchange tate (pesos per dollar) one year from now Show your calculations Note Your calculations should astume that Devies is correct in his expectations about the real exchange rate and the Mexican and US inflation rates. (Round your b. Calculate the expected exchange rate (pesos per dollar) one year from now. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates. (Round your intermediate calculations to 4 decimal places.) c. Calculate the expected U.S. dollar holding period return on the Mexican oneyear bond. Show your calculations, Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates. (Do not round intermediate calculations. Round your answer to 2 decimal places.) After studying Iris Hamson's credit analysis, George Davies is considering whether he can increase the holding period return on Yucatan Resort's excess cash holdings (which are held in pesos) by investing those cash holdings in the Mexican bond market Although Davies would be investing in a peso-denominated bond, the investment goal is to achieve the highest holding period return, measured in U.S. dollars, on the investment. Davies finds the higher yield on the Mexican one-year bond, which is considered to be free of credit risk, to be attractive but he is concerned that depreciation of the peso will reduce the holding period return, measured in U.S. dollars. Hamson has prepared selected economic and financial data to help Davies make the decision. Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the US. one-year bond: 0. Calculate the US. dollar hoiding period retum that would result from the transaction recommended by Hamson. Show your calculations. State whether Hamson's conclusion Jpout the U.S. dollar holding period return resulting from the transaction is correct or incorrect After conducting his own analysis of the US and Mexican economies, Davies expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Because of favorable political developments in Mexico, however, he expects that the Mexican irillation rate (in annual terms) will fall from 6 percent to 3 percent before the end of the year. As a result, Davies decides to invest Yucatan Resort's cash holdings in the Mexican one-year bond but not to hedge the currency exposure. (Do not round imermediete colculetions. Round your answer to 1 decimal place.) b. Calculate the expected exchange tate (pesos per dollar) one year from now Show your calculations Note Your calculations should astume that Devies is correct in his expectations about the real exchange rate and the Mexican and US inflation rates. (Round your b. Calculate the expected exchange rate (pesos per dollar) one year from now. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates. (Round your intermediate calculations to 4 decimal places.) c. Calculate the expected U.S. dollar holding period return on the Mexican oneyear bond. Show your calculations, Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started