Question

After the initial rounds of research, you set up a meet with the current owners of the company to understand their sentiment towards this buy-out.

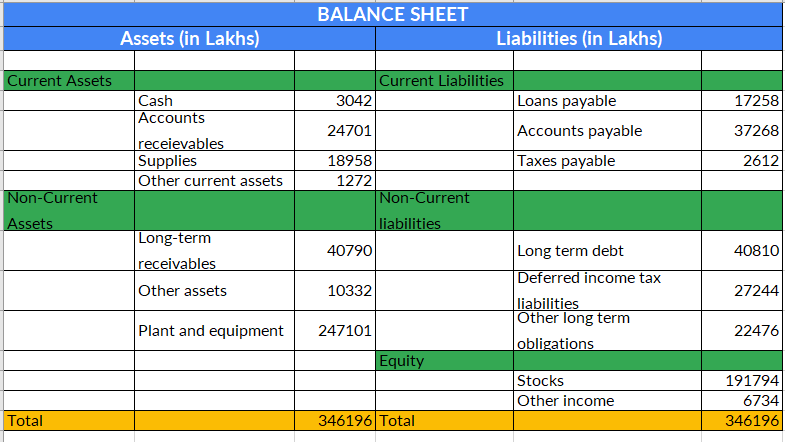

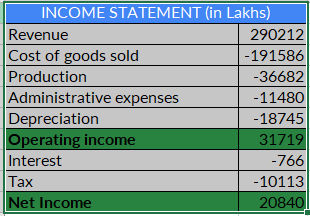

After the initial rounds of research, you set up a meet with the current owners of the company to understand their sentiment towards this buy-out. In the discussion, the owners mentioned the selling price of the company as Rs 5,00,000 Lakhs. Use the discounted cash flow method to calculate the value of equity and arrive at a decision of buyo-buy. If it's a no-buy, quote the maximum possible amount that you would be willing to pay to acquire the company. (5 marks) What would be the share price if there are 1 Crore shares of the Green Energy Company in the market? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started