Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 1, 2020, Ballister Dorth organized a computer service company called Ballister Systems. Ballister is organized as a sole proprietorship and will provide

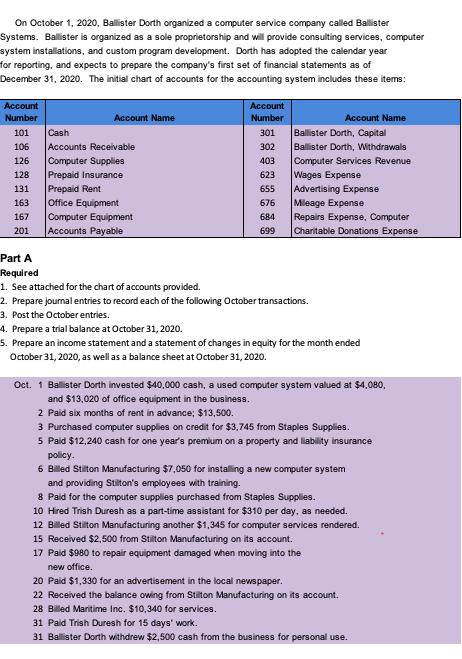

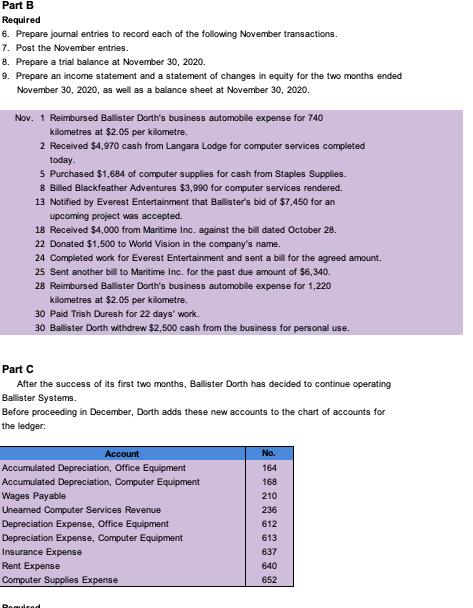

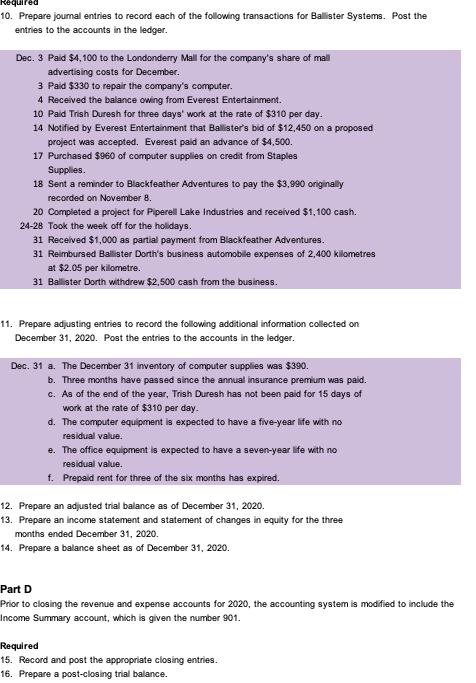

On October 1, 2020, Ballister Dorth organized a computer service company called Ballister Systems. Ballister is organized as a sole proprietorship and will provide consulting services, computer system installations, and custom program development. Dorth has adopted the calendar year for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2020. The initial chart of accounts for the accounting system includes these items: Account Number 101 106 126 128 131 163 167 201 Account Name Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accoun Payable Part A Required 1. See attached for the chart of accounts provided. Account Number 301 302 403 623 655 676 684 699 Account Name Ballister Dorth, Capital Ballister Dorth, Withdrawals Computer Services Revenue Wages Expense Advertising Expense Mileage Expense Repairs Expense, Computer Ch ritable Donations Expense 2. Prepare journal entries to record each of the following October transactions. 3. Post the October entries. 4. Prepare a trial balance at October 31, 2020. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2020, as well as a balance sheet at October 31, 2020. Oct. 1 Ballister Dorth invested $40,000 cash, a used computer system valued at $4,080, and $13,020 of office equipment in the business. 2 Paid six months of rent in advance; $13,500. 3 Purchased computer supplies on credit for $3,745 from Staples Supplies. 5 Paid $12,240 cash for one year's premium on a property and liability insurance policy. 6 Billed Stilton Manufacturing $7,050 for installing a new computer system and providing Stilton's employees with training. 8 Paid for the computer supplies purchased from Staples Supplies. 10 Hired Trish Duresh as a part-time assistant for $310 per day, as needed. 12 Billed Stilton Manufacturing another $1,345 for computer services rendered. 15 Received $2,500 from Stilton Manufacturing on its account. 17 Paid $980 to repair equipment damaged when moving into the new office. 20 Paid $1,330 for an advertisement in the local newspaper. 22 Received the balance owing from Stilton Manufacturing on its account. 28 Billed Maritime Inc. $10,340 for services. 31 Paid Trish Duresh for 15 days' work. 31 Ballister Dorth withdrew $2,500 cash from the business for personal use. Part B Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at November 30, 2020. Nov. 1 Reimbursed Ballister Dorth's business automobile expense for 740 kilometres at $2.05 per kilometre. 2 Received $4,970 cash from Langara Lodge for computer services completed today. 5 Purchased $1,684 of computer supplies for cash from Staples Supplies. 8 Billed Blackfeather Adventures $3,990 for computer services rendered. 13 Notified by Everest Entertainment that Ballister's bid of $7,450 for an upcoming project was accepted. 18 Received $4,000 from Maritime Inc. against the bill dated October 28. 22 Donated $1,500 to World Vision in the company's name. 24 Completed work for Everest Entertainment and sent a bill for the agreed amount. 25 Sent another bill to Maritime Inc. for the past due amount of $6,340. 28 Reimbursed Ballister Dorth's business automobile expense for 1,220 kilometres at $2.05 per kilometre. 30 Paid Trish Duresh for 22 days' work. 30 Ballister Dorth withdrew $2,500 cash from the business for personal use. Part C After the success of its first two months, Ballister Dorth has decided to continue operating Ballister Systems. Before proceeding in December, Dorth adds these new accounts to the chart of accounts for the ledger: Account Accumulated Depreciation, Office Equipment Accumulated Depreciation, Computer Equipment Wages Payable Unearned Computer Services Revenue Depreciation Expense, Office Equipment Depreciation Expense, Computer Equipment Insurance Expense Rent Expense Computer Supplies Expense Required No. 164 168 210 236 612 613 637 640 652 quired 10. Prepare journal entries to record each of the following transactions for Ballister Systems. Post the entries to the accounts in the ledger. Dec. 3 Paid $4,100 to the Londonderry Mall for the company's share of mall advertising costs for December. 3 Paid $330 to repair the company's computer. 4 Received the balance owing from Everest Entertainment. 10 Paid Trish Duresh for three days' work at the rate of $310 per day. 14 Notified by Everest Entertainment that Ballister's bid of $12,450 on a proposed project was accepted. Everest paid an advance of $4,500. 17 Purchased $960 of computer supplies on credit from Staples Supplies. 18 Sent a reminder to Blackfeather Adventures to pay the $3,990 originally recorded on November 8. 20 Completed a project for Piperell Lake Industries and received $1,100 cash. 24-28 Took the week off for the holidays. 31 Received $1,000 as partial payment from Blackfeather Adventures. 31 Reimbursed Ballister Dorth's business automobille expenses of 2,400 kilometres at $2.05 per kilometre. 31 Ballister Dorth withdrew $2,500 cash from the business. 11. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger. Dec. 31 a. The December 31 inventory of computer supplies was $390. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Trish Duresh has not been paid for 15 days of work at the rate of $310 per day. d. The computer equipment is expected to have a five-year life with no residual value. e. The office equipment is expected to have a seven-year life with no residual value. f. Prepaid rent for three of the six months has expired. 12. Prepare an adjusted trial balance as of December 31, 2020. 13. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020. 14. Prepare a balance sheet as of December 31, 2020. Part D Prior to closing the revenue and expense accounts for 2020, the accounting system is modified to include the Income Summary account, which is given the number 901. Required 15. Record and post the appropriate closing entries. 16. Prepare a post-closing trial balance.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The Following are the required as per the above question Date Particulars Oct 1 Cash Computer Equipment Office Equipment Ballister Dorth Capital 2 Prepaid Rent Cash Cash 3 Computer Supplies Accounts P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started