Question

After working for In the Kitchen remodeling business for several years, Terry and Phyllis decided to go into business for themselves and formed the Kitchens

After working for In the Kitchen remodeling business for several years, Terry and Phyllis decided to go into business for themselves and formed the Kitchens Just for You partnership. Three years ago, they admitted Connie as a partner and recognized goodwill at that time because of her good client list for planned kitchen makeovers. However, they were not able to gain a sufficient market for new customers and on September 1, 20X9, they agreed to dissolve and liquidate the business. They decided on an installment liquidation to complete the projects already initiated. The balance sheet, with profit and losssharing percentages at the beginning of liquidation, is as follows:

| KITCHENS JUST FOR YOU | |||

|---|---|---|---|

| Balance Sheet | |||

| September 1, 20X9 | |||

| Assets | Liabilities and Equities | ||

| Cash | $ 5,000 | Accounts Payable | $ 38,000 |

| Receivables | 69,000 | Connie, Loan | 13,000 |

| Terry, Loan | 8,000 | Terry, Capital (30%) | 10,600 |

| Inventory | 44,000 | Phyllis, Capital (50%) | 38,000 |

| Goodwill | 23,000 | Connie, Capital (20%) | 49,400 |

| Total Assets | $ 149,000 | Total Liabilities and Equities | $ 149,000 |

Connies loan was for working capital; the loan to Terry was for his unexpected personal medical bills.

During September 20X9, the first month of liquidation, the partnership collected $44,000 in receivables and decided to write off $13,000 of the remaining receivables. Sales of one-half of the book value of the inventory realized a loss of $7,000. The partners estimate that the costs of liquidating the business (newspaper ads, signs, etc.), are expected to be $5,000 for the remainder of the liquidation process.

Required:

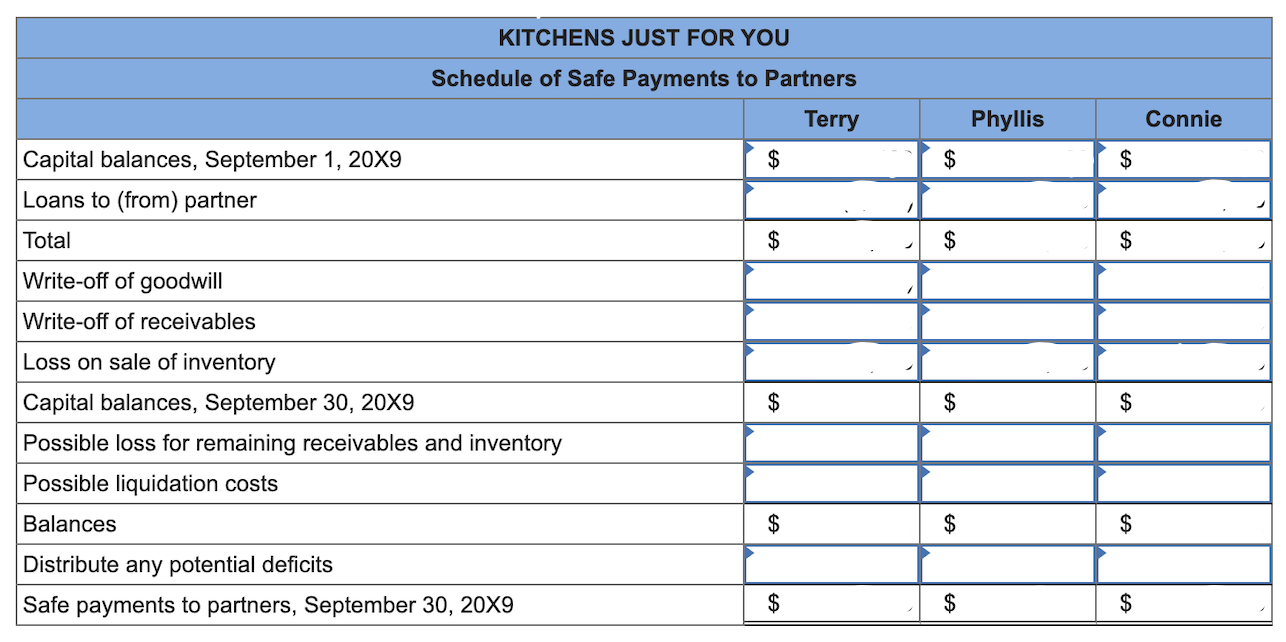

Prepare a schedule of safe payments to partners as of September 30, 20X9, to show how the available cash should be distributed to the partners. Please follow the practical guidelines when completing this worksheet.

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ KITCHENS JUST FOR YOU } \\ \hline \multicolumn{4}{|c|}{ Schedule of Safe Payments to Partners } \\ \hline & Terry & Phyllis & Connie \\ \hline Capital balances, September 1, 20X9 & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Loans to (from) partner } \\ \hline Total & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Write-off of goodwill } \\ \hline \multicolumn{4}{|l|}{ Write-off of receivables } \\ \hline \multicolumn{4}{|l|}{ Loss on sale of inventory } \\ \hline Capital balances, September 30, 209 & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Possible loss for remaining receivables and inventory } \\ \hline \multicolumn{4}{|l|}{ Possible liquidation costs } \\ \hline Balances & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Distribute any potential deficits } \\ \hline Safe payments to partners, September 30,209 & $ & $ & $ \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ KITCHENS JUST FOR YOU } \\ \hline \multicolumn{4}{|c|}{ Schedule of Safe Payments to Partners } \\ \hline & Terry & Phyllis & Connie \\ \hline Capital balances, September 1, 20X9 & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Loans to (from) partner } \\ \hline Total & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Write-off of goodwill } \\ \hline \multicolumn{4}{|l|}{ Write-off of receivables } \\ \hline \multicolumn{4}{|l|}{ Loss on sale of inventory } \\ \hline Capital balances, September 30, 209 & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Possible loss for remaining receivables and inventory } \\ \hline \multicolumn{4}{|l|}{ Possible liquidation costs } \\ \hline Balances & $ & $ & $ \\ \hline \multicolumn{4}{|l|}{ Distribute any potential deficits } \\ \hline Safe payments to partners, September 30,209 & $ & $ & $ \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started