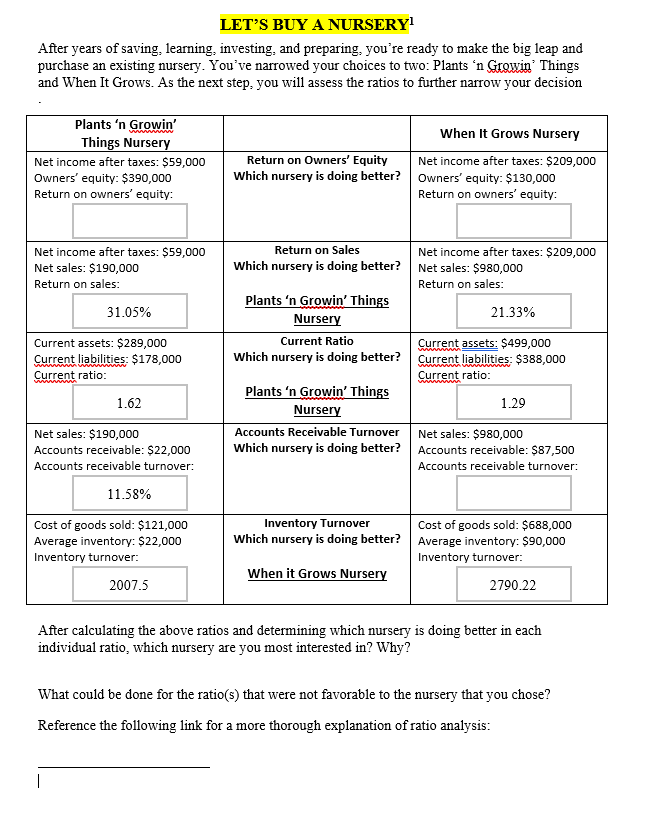

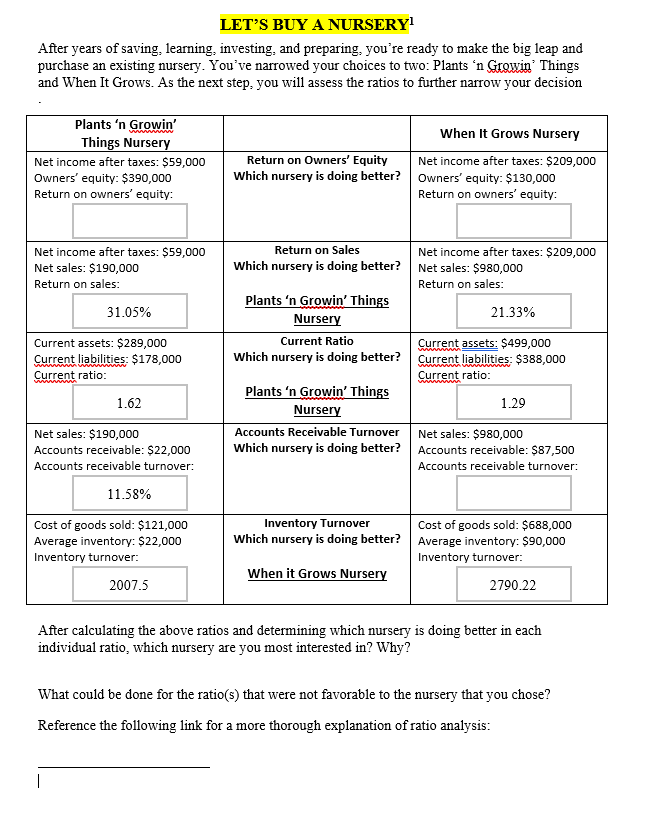

After years of saving, learning, investing, and preparing, youre ready to make the big leap and purchase an existing nursery. Youve narrowed your choices to two: Plants n Growin Things and When It Grows. As the next step, you will assess the ratios to further narrow your decision. On the balance sheet, fill in the blanks.

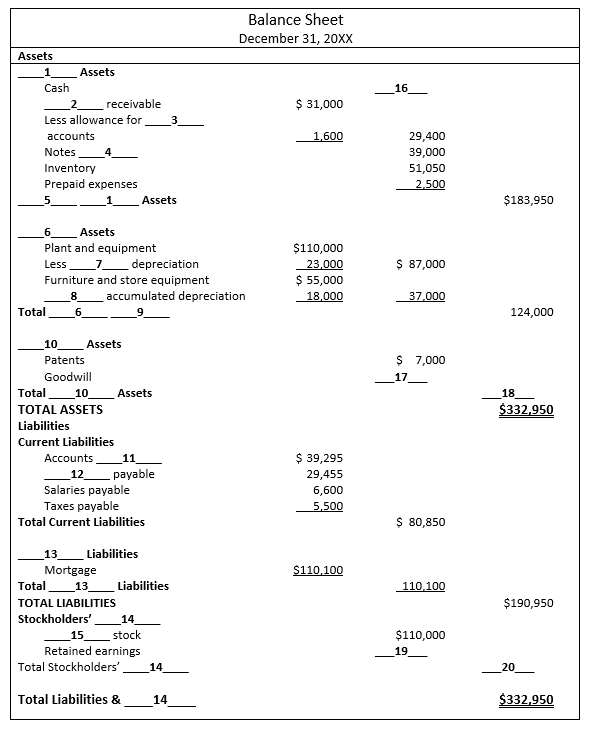

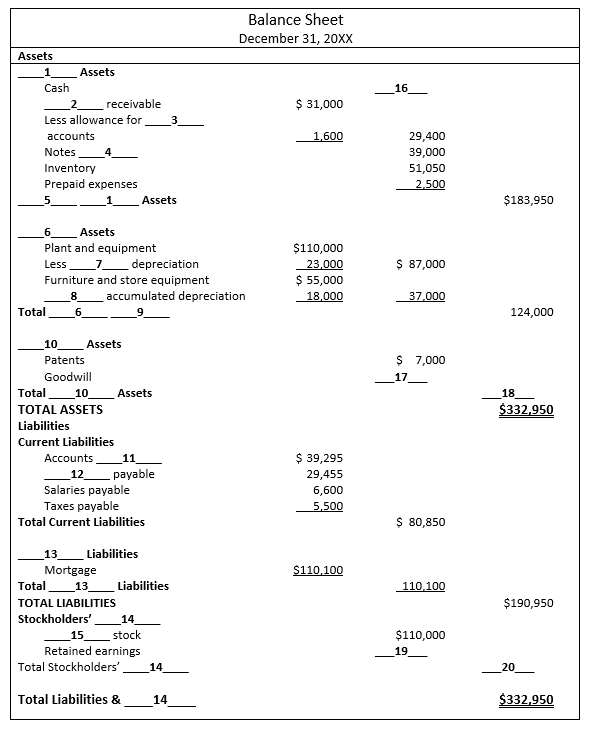

LET'S BUY A NURSERY After years of saving, learning, investing, and preparing, you're ready to make the big leap and purchase an existing nursery. You've narrowed your choices to two: Plants n Growin' Things and When It Grows. As the next step, you will assess the ratios to further narrow your decision Plants 'n Growin' Things Nursery Net income after taxes: $59,000 Owners' equity: $390,000 Return on owners' equity: When It Grows Nursery Return on Owners' Equity Net income after taxes: $209,000 Which nursery is doing better? Owners' equity: $130,000 Return on owners' equity: Net income after taxes: $59,000 Net sales: $190,000 Return on sales: 31.05% Current assets: $289,000 Current liabilities: $178,000 Current ratio: Return on Sales Net income after taxes: $209,000 Which nursery is doing better? Net sales: $980,000 Return on sales: Plants 'n Growin' Things Nursery 21.33% Current Ratio Current assets: $499,000 Which nursery is doing better? Current liabilities: $388,000 Current ratio: Plants 'n Growin' Things 1.29 Nursery Accounts Receivable Turnover Net sales: $980,000 Which nursery is doing better? Accounts receivable: $87,500 Accounts receivable turnover: 1.62 Net sales: $190,000 Accounts receivable: $22,000 Accounts receivable turnover: 11.58% Cost of goods sold: $121,000 Average inventory: $22,000 Inventory turnover: 2007.5 Inventory Turnover Cost of goods sold: $688,000 Which nursery is doing better? Average inventory: $90,000 Inventory turnover: When it Grows Nursery 2790.22 After calculating the above ratios and determining which nursery is doing better in each individual ratio, which nursery are you most interested in? Why? What could be done for the ratio(s) that were not favorable to the nursery that you chose? Reference the following link for a more thorough explanation of ratio analysis: 1 Balance Sheet December 31, 20XX 16 $ 31,000 Assets 1 Assets Cash 2 receivable Less allowance for 3 accounts Notes Inventory Prepaid expenses 5 1 Assets 1,600 29,400 39,000 51,050 2,500 $183,950 $ 87,000 Assets Plant and equipment Less _1_depreciation Furniture and store equipment 8 accumulated depreciation Total 6 $110,000 23,000 $ 55,000 18,000 37.000 124,000 $ 7,000 17 18 $332,950 10 Assets Patents Goodwill Total 10 Assets TOTAL ASSETS Liabilities Current Liabilities Accounts 11 _12 payable Salaries payable Taxes payable Total Current Liabilities $ 39,295 29,455 6,600 5,500 $ 80,850 $110,100 110,100 13 Liabilities Mortgage Total 13 Liabilities TOTAL LIABILITIES Stockholders' 14 15 stock Retained earnings Total Stockholders' 14 $190,950 $110,000 19 20 Total Liabilities & 14 $332,950