Question

After you have recorded all of Beas transactions in a worksheet, you realise that the worksheet may not be the best way to present the

After you have recorded all of Bea’s transactions in a worksheet, you realise that the worksheet may not be the best way to present the information. Bea has indicated that the Bank wants to see an Income Statement and Balance sheet. You help Bea by preparing an Income Statement and a Balance Sheet from your worksheet data instead, to concisely summarise the financial performance and the financial position of PhoneBea Solutions. You arrange to meet with Bea for a coffee, with your pre-prepared statements and ready to answer questions with your knowledge of accounting so far.

REQUIREMENTS

Using the correct list of accounts and balances posted on FLO from Part 1:

a) Prepare an Income Statement (Statement of Financial Performance) for the month ending 30 April 2021. 20 marks

b) Prepare a classified Balance Sheet (Statement of Financial Position) in the vertical format using the proprietary approach, as at 30 April 2021. 35 marks

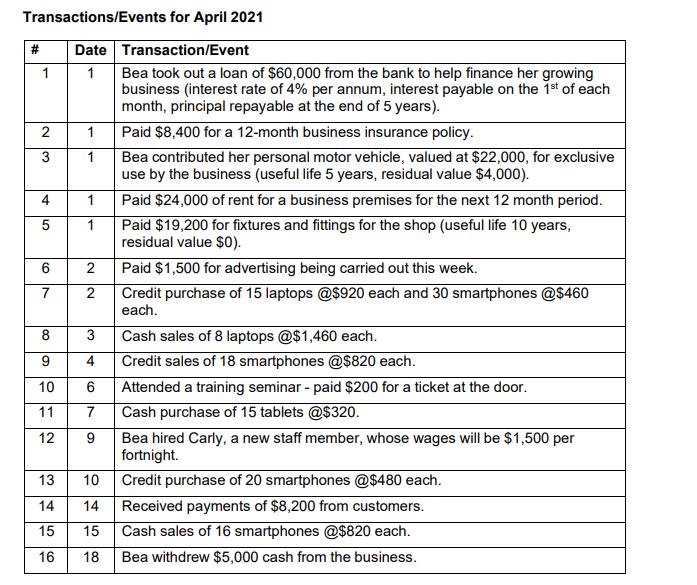

Transactions/Events for April 2021 #3 Date Transaction/Event 1 1 Bea took out a loan of $60,000 from the bank to help finance her growing business (interest rate of 4% per annum, interest payable on the 1st of each month, principal repayable at the end of 5 years). 2 1 Paid $8,400 for a 12-month business insurance policy. Bea contributed her personal motor vehicle, valued at $22,000, for exclusive use by the business (useful life 5 years, residual value $4,000). 3 1 1 Paid $24,000 of rent for a business premises for the next 12 month period. Paid $19,200 for fixtures and fittings for the shop (useful life 10 years, residual value $0). 1 2 Paid $1,500 for advertising being carried out this week. 7 2 Credit purchase of 15 laptops @$920 each and 30 smartphones @$460 each. 8 Cash sales of 8 laptops @$1,460 each. 9 4 Credit sales of 18 smartphones @$820 each. 10 6 Attended a training seminar - paid $200 for a ticket at the door. 11 7 Cash purchase of 15 tablets @$320. 12 9 Bea hired Carly, a new staff member, whose wages will be $1,500 per fortnight. 13 10 Credit purchase of 20 smartphones @$480 each. 14 14 Received payments of $8,200 from customers. 15 15 Cash sales of 16 smartphones @$820 each. 16 18 Bea withdrew $5,000 cash from the business. 3. 4.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started