Question

After you read all of the comments above which is my attempt to interpret the dollar amounts associated with Indicated value with voting rights expressed

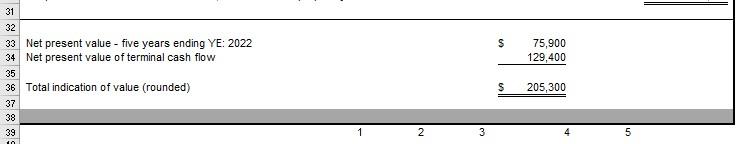

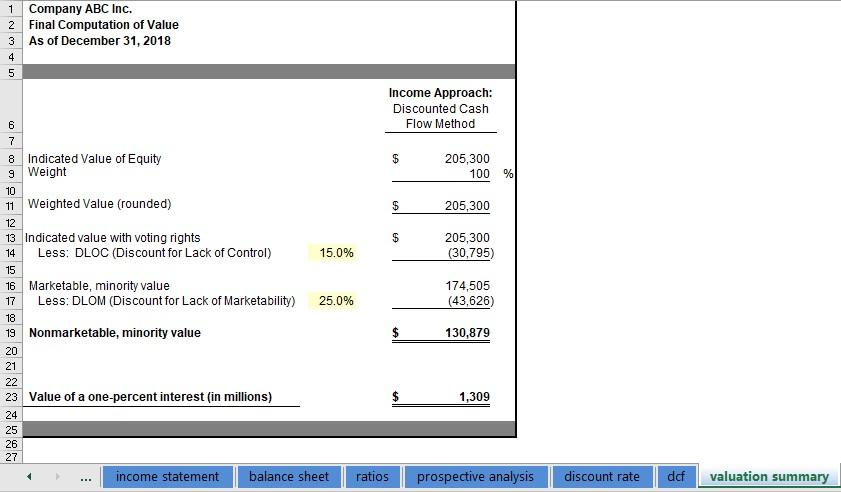

After you read all of the comments above which is my attempt to interpret the dollar amounts associated with Indicated value with voting rights expressed as a dollar amount, Discount for Lack of rights expressed as a percentage, and Discount for Lack of rights expressed as a dollar amount, Marketable, minority value, Discount for Lack of Marketability expressed as a percentage, Discount for Lack of Marketability expressed as a dollar amount, Nonmarketable, minority value expressed as a dollar amount, and Value of a one-percent interest (in millions).

Can you all help me out sharing how you all would interpret the dollar amounts associated with Indicated value with voting rights expressed as a dollar amount, Discount for Lack of rights expressed as a percentage, and Discount for Lack of rights expressed as a dollar amount, Marketable, minority value, Discount for Lack of Marketability expressed as a percentage, Discount for Lack of Marketability expressed as a dollar amount, Nonmarketable, minority value expressed as a dollar amount, and Value of a one-percent interest (in millions), which you all see in the worksheet called Valuation Summary, please?

If you all do type and enter your interpretation of the dollar amounts and their associated terms found in their respective cells on the worksheet called Valuation Summary, can you all interpret the qualitative and quantitative information in a very, very highly detailed way, please?

It is because I cannot really find any online article or articles, which would help me be able to interpret the information that is on the worksheet called Valuation Summary that is related to Capitalization rate, Net Present value of expected (future) cash flows (profits) in the future, also called Terminal cash flow, in the Terminal Years and Capitalized terminal cash flow at the end of an investment, project, the series of cash flows, Implied Enterprise Value (Total Value of a business).

What I need help is interpreting the qualitative and quantitative information found on the worksheet called Valuation Summary, which is the fourth screenshot in the middle of this listing. Thank you very much!

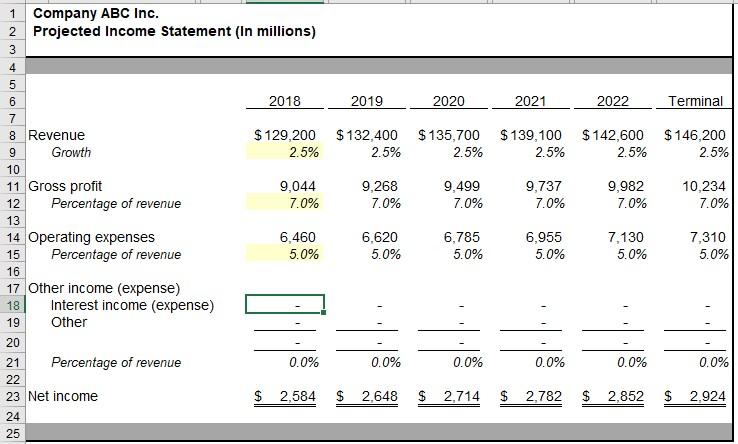

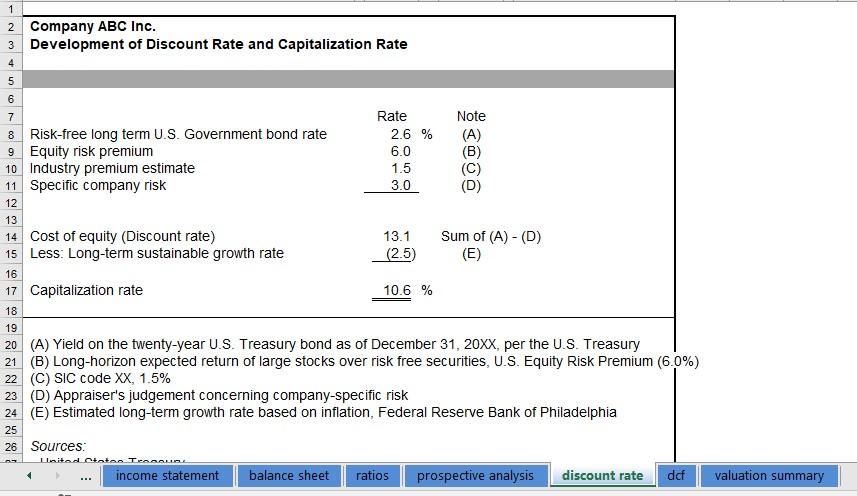

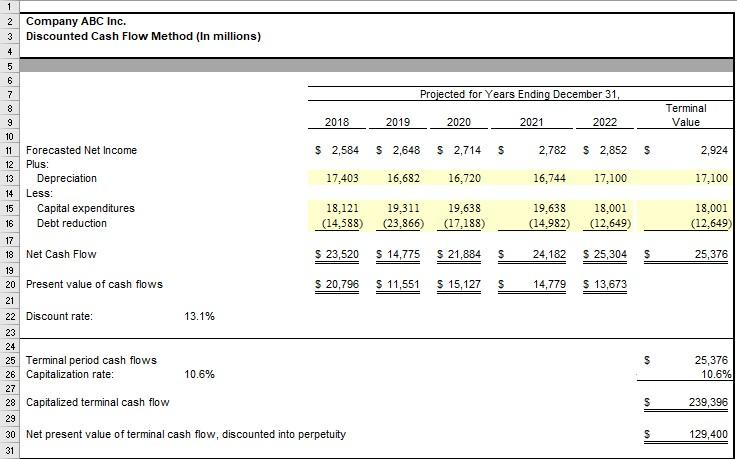

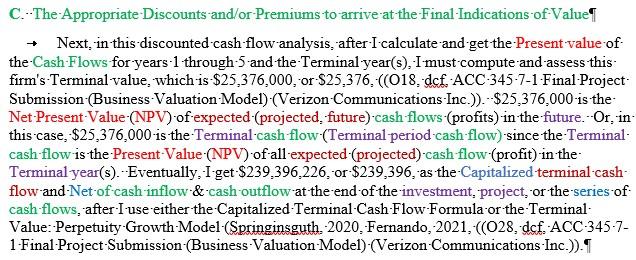

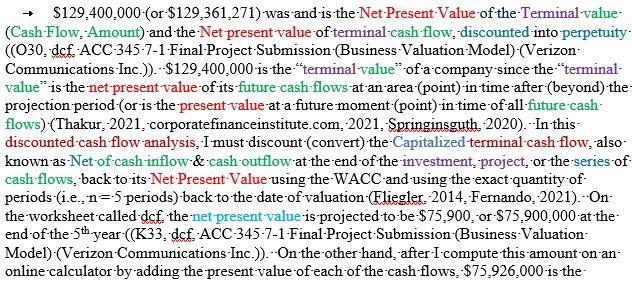

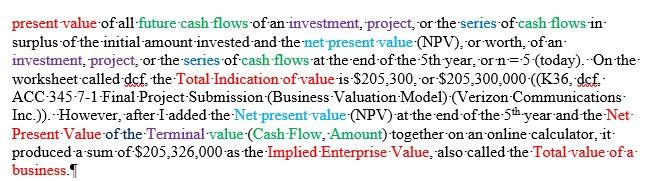

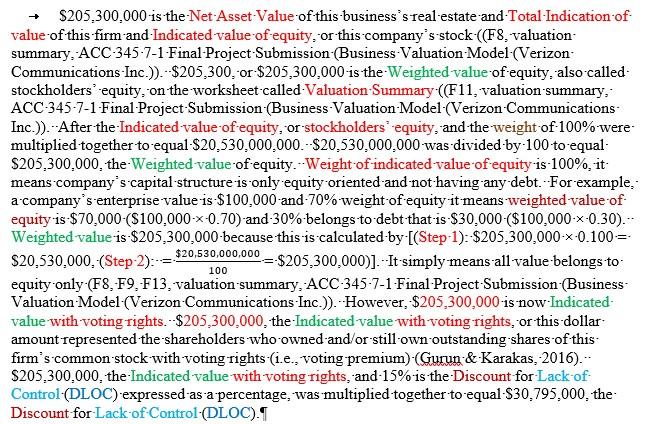

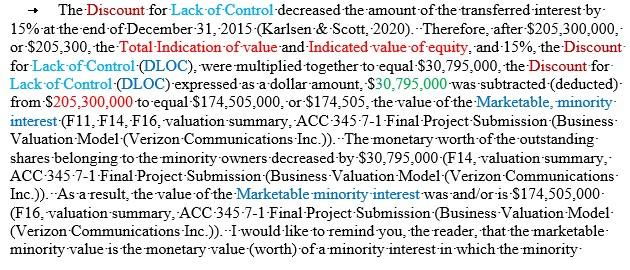

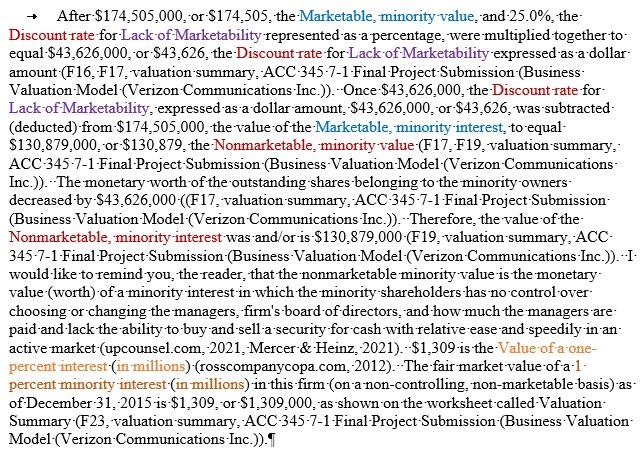

1 Company ABC Inc. 2 Projected Income Statement (In millions) 3 4 5 6 2018 2019 7 8 Revenue $ 129,200 $ 132,400 9 Growth 2.5% 2.5% 10 11 Gross profit 9,044 9,268 12 Percentage of revenue 7.0% 7.0% 2020 2021 2022 Terminal $ 135,700 2.5% $ 139,100 $ 142,600 2.5% 2.5% $ 146,200 2.5% 9,499 7.0% 9,737 7.0% 9,982 7.0% 10,234 7.0% 13 6.460 5.0% 6,620 5.0% 6,785 5.0% 6,955 5.0% 7,130 5.0% 7,310 5.0% 14 Operating expenses 15 Percentage of revenue 16 17 Other income (expense) 18 Interest income (expense) 19 Other 20 21 Percentage of revenue 22 23 Net income 24 25 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $ 2,584 $ 2,648 $ 2,714 $ 2,782 $ 2.852 $ 2.924 2 Company ABC Inc. 3 Development of Discount Rate and Capitalization Rate - | 0 | | | | | |-| 7 Note (A) & Risk-free long term U.S. Government bond rate 9 Equity risk premium 10 Industry premium estimate 11 Specific company risk Rate 2.6 % 6.0 1.5 3.0 12 13 14 Cost of equity (Discount rate) 15 Less: Long-term sustainable growth rate 13.1 (2.5) Sum of (A) - (D) (E) 16 17 Capitalization rate 10.6 % 18 19 20 (A) Yield on the twenty-year U.S. Treasury bond as of December 31, 20xx, per the U.S. Treasury 21 (6) Long-horizon expected return of large stocks over risk free securities, U.S. Equity Risk Premium (6.0%) 22 (C) SIC code XX, 1.5% 23 (D) Appraiser's judgement concerning company-specific risk 24 (E) Estimated long-term growth rate based on inflation, Federal Reserve Bank of Philadelphia 25 26 Sources: Tisited catanTraa income statement balance sheet ratios prospective analysis discount rate dcf valuation summary Projected for Years Ending December 31, Terminal Value 2018 2019 2020 2021 2022 1 2 Company ABC Inc. 3 Discounted Cash Flow Method (in millions) 4 5 6 7 8 9 10 11 Forecasted Net Income 12 Plus: 13 Depreciation 14 Less: 15 Capital expenditures 16 Debt reduction 17 18 Net Cash Flow 19 20 Present value of cash flows $ 2,584 $ 2,648 $ 2,714 $ 2,782 $ 2,852 S 2,924 17,403 16,682 16,720 16,744 17,100 17.100 18,121 (14,588) 19,311 (23,866) 19,638 (17,188) 19,638 (14,982) 18,001 (12,649) 18,001 (12,649 $ 23,520 $ 14,775 $ 21,884 S 24,182 $ 25,304 S 25,376 $ 20,796 $ 11,551 $ 15,127 $ 14,779 $ 13,673 21 $ 25,376 10.6% 22 Discount rate: 13.1% 23 24 25 Terminal period cash flows 26 Capitalization rate: 10.6% 27 28 Capitalized terminal cash flow 29 30 Net present value of terminal cash flow, discounted into perpetuity 31 S 239,396 $ 129,400 31 32 $ 33 Net present value - five years ending YE: 2022 34 Net present value of terminal cash flow 75,900 129,400 35 $ 205,300 36 Total indication of value (rounded) 37 38 39 1 2 5 10 EN + 1 Company ABC Inc. 2 Final Computation of Value 3 As of December 31, 2018 4 5 Income Approach: Discounted Cash Flow Method 6 7 8 Indicated Value of Equity 9 Weight $ 205,300 100 % 10 $ 205,300 11 Weighted Value (rounded) 12 13 Indicated value with voting rights 14 Less: DLOC (Discount for Lack of Control) $ 205,300 (30,795) 15.0% 16 Marketable, minority value 17 Less: DLOM (Discount for Lack of Marketability) 25.0% & & & = = 174,505 (43,626) $ 130,879 1,309 19 Nonmarketable, minority value 20 21 22 23 Value of a one-percent interest in millions) 24 25 26 27 income statement balance sheet ratios prospective analysis discount rate dcf valuation summary C.--The-Appropriate Discounts and/or Premiums to arrive at the Final Indications of Value + Next, in this discounted cash flow-analysis, after I calculate and get the Present value of the-Cash-Flows for years 1 through-5 and the Terminal year(s), I must compute and assess this firm's Terminal value, which is $25,376,000, or $25,376, (018. dcf-ACC-345-7-1-Final-Project- Submission (Business Valuation Model) (Verizon Communications Inc.)). --$25,376,000 is the Net Present-Value-(NPV) of expected (projected. future) cash flows (profits) in the future. --Or, in this case, $25,376,000 is the-Terminal cash flow (Terminal period cash flow)-since the Terminal cash-flow is the Present Value-(NPV) of all-expected-(projected)-cash-flow (profit) in the Terminal year(s). Eventually, I get-$239.396,226, or $239,396, as the-Capitalized terminal cash- flow-and-Net of cash-inflow & cash outflow at the end of the investment, project, or the series of cash-flows, after I use either the Capitalized-Terminal Cash-Flow Formula-or the Terminal- Value: Perpetuity Growth-Model (Springinsguth.-2020. Fernando, 2021, ((028. def. ACC-345-7- 1-Final-Project-Submission (Business Valuation-Model) (Verizon Communications Inc.)). $129,400.000 (or $129,361,271) was and is the Net Present-Value of the Terminal value (Cash-Flow, Amount) and the Net present-value of terminal-cash-flow, discounted into perpetuity- (030. dcf-ACC-345-7-1 Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.))--$129,400,000 is the terminal value of a company since the "terminal value is the net present value of its future cash flows at an area (point) in time after (beyond) the projection period (or is the present value at a future moment (point in time of all-future cash flows) (Thakur. 2021, corporatefinanceinstitute.com, -2021, Springinsguth -2020). --In this discounted cash flow analysis, I must discount-(convert) the Capitalized terminal cash flow, also known as Net-of-cash-inflow-&-cash-outflow at the end of the investment, project, or the series of cash flows, back to its Net Present Value using the WACC and using the exact quantity of periods (i.e., n=-5 periods) back to the date of valuation (Fliegler. 2014. Fernando, 2021). --On the worksheet called dcf. the net present value is projected to be $75,900,-or-S75,900.000 at the end of the 5th year ((K33, dcf-ACC-345-7-1 Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.)). On the other hand, after I compute this amount-on-an- online calculator by adding the present value of each of the cash flows. $75,926,000 is the present value of all-future-cash flows of an investment, project, or the series of cash-flows in surplus of the initial amount invested and the net present value (NPV), or worth, of an investment, project, or the series of cash flows at the end of the 5th year, or n=-5-(today). On the worksheet called-def. the Total-Indication of value is $205,300, or $205,300,000-((K36. def.: ACC-345-7-1-Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.)). However, after I added the Net present value (NPV) at the end of the 5th year and the Net- Present-Value of the Terminal value (Cash-Flow, Amount) together on an online calculator, it- produced-a-sum of $205,326,000 as the-Implied-Enterprise.Value, also called the Total value of a business. + $205,300,000 is the-Net-Asset-Value of this business's real-estate and Total-Indication of value of this firm-and-Indicated value of equity, or this company's stock:((F8, valuation summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). - $205,300, or $205,300,000 is the Weighted value of equity, also called stockholders' equity, on the worksheet called Valuation Summary :((F11, valuation-summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). --After the Indicated value of equity, or stockholders' equity, and the weight of 100% were multiplied together to equal $20,530,000,000.--$20,530,000,000 was divided by 100 to equal $205,300.000, the Weighted value of equity.--Weight of indicated value of equity is 100%, it means company's capital-structure is only equity-oriented and not having any debt. --For example, a company's enterprise value is $100,000-and-70% weight of equity it means weighted value of equity is $70,000 ($100.000-x-0.70) and-30%-belongs to debt that is $30,000 ($100.000-x-0.30)... Weighted value is $205,300,000 because this is calculated by [(Step-1): $205,300,000-x-0.100= $20,530,000, (Step-2): -= 20,530,000,000 = $205,300,000)). --It-simply means all value belongs to equity only (F8, F9, F13, valuation summary, ACC-345-7-1 Final-Project Submission (Business- Valuation Model (Verizon Communications Inc.)). However, $205,300,000 is now-Indicated- value with voting rights. -- $205,300,000, the Indicated value with voting rights, or this dollar amount represented the shareholders who owned and/or-still-own-outstanding shares of this firm's common stock with voting rights (1.e., voting premium) (Gurun & -Karakas, 2016). $205,300,000, the Indicated value with voting rights, and -15% is the Discount for Lack of Control (DLOC) -expressed as a percentage, was multiplied together to equal $30,795,000, the Discount for Lack of Control (DLOC). 100 The Discount for Lack-of-Control decreased the amount of the transferred-interest by 15% at the end of December 31, 2015 (Karlsen & Scott, 2020). --Therefore, after $205,300,000, or $205,300, the Total-Indication of value-and-Indicated value of equity, and -15%, the Discount for Lack of Control (DLOC), were multiplied together to equal-$30,795,000, the-Discount for Lack of Control (DLOC) expressed as a dollar amount. $30,795,000 was subtracted (deducted) from $205,300,000 to equal $174,505,000.-or $174,505, the value of the Marketable, minority interest (F11, F14, F16, valuation-summary, -ACC-345-7-1-Final-Project-Submission (Business- Valuation Model (Verizon-Communications Inc.)). --The monetary worth of the outstanding shares belonging to the minority owners decreased by $30,795,000-(F14, valuation-summary, ACC-345-7-1-Final Project Submission (Business Valuation Model (Verizon-Communications- Inc.)). --As a result, the value of the Marketable minority interest was and/or is $174,505.000- (F16, valuation-summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). --I-would like to remind you the reader, that the marketable: minority value is the monetary value (worth) of a minority interest in which the minority shareholders have the ability to buy and sell-a-security for cash quickly and with comparative ease-in-an active market and has no control over choosing or changing the managers, firm's board of directors, and how much the managers are paid (upcounsel.com.-2021, Mercer & Heinz, 2021). + After $174,505,000, or $174,505, the Marketable, minority value and -25.0%, the- Discount rate for Lack of Marketability represented as a percentage, were multiplied together to- equal-$43,626,000, -or-S43,626, the Discount rate for Lack of Marketability expressed as a dollar amount (F16, F17. valuation summary, ACC-345-7-1-Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)).- Once-$43,626,000, the-Discount rate for Lack-of-Marketability, expressed as a dollar amount. -$43,626,000,-or-$43,626, was subtracted (deducted) from $174,505.000, the value of the Marketable, minority interest, to equal $130,879,000,-or-$130,879, theNonmarketable, minority value (F17, F19, valuation-summary, ACC-345-7-1 -Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)). --The monetary worth of the outstanding shares belonging to the minority owners decreased by S43,626,000-((F17, valuation-summary, ACC-345-7-1-Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)). --Therefore, the value of the Nonmarketable, minority interest was and/or is $130,879,000 (F19, valuation-summary, ACC 345-7-1-Final Project Submission (Business Valuation-Model (Verizon Communications Inc.)). -I- would like to remind you, the reader, that the nonmarketable minority value is the monetary value (worth) of a minority interest in which the minority shareholders has no control over choosing or changing the managers, firm's board of directors, and how much the managers are paid-and-lack the ability to buy and sell-a-security for cash with relative ease and speedily in an active market (upcounsel.com, 2021, Mercer & Heinz, 2021).--$1,309 is the Value of a one- percent interest (in millions) (rosscompanycopa.com, 2012). --The fair market value of a 1. percent minority interest (in millions) in this firm (on a non-controlling, non-marketable-basis) -as- of December 31, 2015 is $1,309, or $1,309,000, as shown on the worksheet called Valuation Summary (F23, valuation-summary, ACC-345-7-1 Final-Project-Submission (Business Valuation- Model (Verizon Communications Inc.)). 1 Company ABC Inc. 2 Projected Income Statement (In millions) 3 4 5 6 2018 2019 7 8 Revenue $ 129,200 $ 132,400 9 Growth 2.5% 2.5% 10 11 Gross profit 9,044 9,268 12 Percentage of revenue 7.0% 7.0% 2020 2021 2022 Terminal $ 135,700 2.5% $ 139,100 $ 142,600 2.5% 2.5% $ 146,200 2.5% 9,499 7.0% 9,737 7.0% 9,982 7.0% 10,234 7.0% 13 6.460 5.0% 6,620 5.0% 6,785 5.0% 6,955 5.0% 7,130 5.0% 7,310 5.0% 14 Operating expenses 15 Percentage of revenue 16 17 Other income (expense) 18 Interest income (expense) 19 Other 20 21 Percentage of revenue 22 23 Net income 24 25 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $ 2,584 $ 2,648 $ 2,714 $ 2,782 $ 2.852 $ 2.924 2 Company ABC Inc. 3 Development of Discount Rate and Capitalization Rate - | 0 | | | | | |-| 7 Note (A) & Risk-free long term U.S. Government bond rate 9 Equity risk premium 10 Industry premium estimate 11 Specific company risk Rate 2.6 % 6.0 1.5 3.0 12 13 14 Cost of equity (Discount rate) 15 Less: Long-term sustainable growth rate 13.1 (2.5) Sum of (A) - (D) (E) 16 17 Capitalization rate 10.6 % 18 19 20 (A) Yield on the twenty-year U.S. Treasury bond as of December 31, 20xx, per the U.S. Treasury 21 (6) Long-horizon expected return of large stocks over risk free securities, U.S. Equity Risk Premium (6.0%) 22 (C) SIC code XX, 1.5% 23 (D) Appraiser's judgement concerning company-specific risk 24 (E) Estimated long-term growth rate based on inflation, Federal Reserve Bank of Philadelphia 25 26 Sources: Tisited catanTraa income statement balance sheet ratios prospective analysis discount rate dcf valuation summary Projected for Years Ending December 31, Terminal Value 2018 2019 2020 2021 2022 1 2 Company ABC Inc. 3 Discounted Cash Flow Method (in millions) 4 5 6 7 8 9 10 11 Forecasted Net Income 12 Plus: 13 Depreciation 14 Less: 15 Capital expenditures 16 Debt reduction 17 18 Net Cash Flow 19 20 Present value of cash flows $ 2,584 $ 2,648 $ 2,714 $ 2,782 $ 2,852 S 2,924 17,403 16,682 16,720 16,744 17,100 17.100 18,121 (14,588) 19,311 (23,866) 19,638 (17,188) 19,638 (14,982) 18,001 (12,649) 18,001 (12,649 $ 23,520 $ 14,775 $ 21,884 S 24,182 $ 25,304 S 25,376 $ 20,796 $ 11,551 $ 15,127 $ 14,779 $ 13,673 21 $ 25,376 10.6% 22 Discount rate: 13.1% 23 24 25 Terminal period cash flows 26 Capitalization rate: 10.6% 27 28 Capitalized terminal cash flow 29 30 Net present value of terminal cash flow, discounted into perpetuity 31 S 239,396 $ 129,400 31 32 $ 33 Net present value - five years ending YE: 2022 34 Net present value of terminal cash flow 75,900 129,400 35 $ 205,300 36 Total indication of value (rounded) 37 38 39 1 2 5 10 EN + 1 Company ABC Inc. 2 Final Computation of Value 3 As of December 31, 2018 4 5 Income Approach: Discounted Cash Flow Method 6 7 8 Indicated Value of Equity 9 Weight $ 205,300 100 % 10 $ 205,300 11 Weighted Value (rounded) 12 13 Indicated value with voting rights 14 Less: DLOC (Discount for Lack of Control) $ 205,300 (30,795) 15.0% 16 Marketable, minority value 17 Less: DLOM (Discount for Lack of Marketability) 25.0% & & & = = 174,505 (43,626) $ 130,879 1,309 19 Nonmarketable, minority value 20 21 22 23 Value of a one-percent interest in millions) 24 25 26 27 income statement balance sheet ratios prospective analysis discount rate dcf valuation summary C.--The-Appropriate Discounts and/or Premiums to arrive at the Final Indications of Value + Next, in this discounted cash flow-analysis, after I calculate and get the Present value of the-Cash-Flows for years 1 through-5 and the Terminal year(s), I must compute and assess this firm's Terminal value, which is $25,376,000, or $25,376, (018. dcf-ACC-345-7-1-Final-Project- Submission (Business Valuation Model) (Verizon Communications Inc.)). --$25,376,000 is the Net Present-Value-(NPV) of expected (projected. future) cash flows (profits) in the future. --Or, in this case, $25,376,000 is the-Terminal cash flow (Terminal period cash flow)-since the Terminal cash-flow is the Present Value-(NPV) of all-expected-(projected)-cash-flow (profit) in the Terminal year(s). Eventually, I get-$239.396,226, or $239,396, as the-Capitalized terminal cash- flow-and-Net of cash-inflow & cash outflow at the end of the investment, project, or the series of cash-flows, after I use either the Capitalized-Terminal Cash-Flow Formula-or the Terminal- Value: Perpetuity Growth-Model (Springinsguth.-2020. Fernando, 2021, ((028. def. ACC-345-7- 1-Final-Project-Submission (Business Valuation-Model) (Verizon Communications Inc.)). $129,400.000 (or $129,361,271) was and is the Net Present-Value of the Terminal value (Cash-Flow, Amount) and the Net present-value of terminal-cash-flow, discounted into perpetuity- (030. dcf-ACC-345-7-1 Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.))--$129,400,000 is the terminal value of a company since the "terminal value is the net present value of its future cash flows at an area (point) in time after (beyond) the projection period (or is the present value at a future moment (point in time of all-future cash flows) (Thakur. 2021, corporatefinanceinstitute.com, -2021, Springinsguth -2020). --In this discounted cash flow analysis, I must discount-(convert) the Capitalized terminal cash flow, also known as Net-of-cash-inflow-&-cash-outflow at the end of the investment, project, or the series of cash flows, back to its Net Present Value using the WACC and using the exact quantity of periods (i.e., n=-5 periods) back to the date of valuation (Fliegler. 2014. Fernando, 2021). --On the worksheet called dcf. the net present value is projected to be $75,900,-or-S75,900.000 at the end of the 5th year ((K33, dcf-ACC-345-7-1 Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.)). On the other hand, after I compute this amount-on-an- online calculator by adding the present value of each of the cash flows. $75,926,000 is the present value of all-future-cash flows of an investment, project, or the series of cash-flows in surplus of the initial amount invested and the net present value (NPV), or worth, of an investment, project, or the series of cash flows at the end of the 5th year, or n=-5-(today). On the worksheet called-def. the Total-Indication of value is $205,300, or $205,300,000-((K36. def.: ACC-345-7-1-Final-Project Submission (Business Valuation Model) (Verizon Communications Inc.)). However, after I added the Net present value (NPV) at the end of the 5th year and the Net- Present-Value of the Terminal value (Cash-Flow, Amount) together on an online calculator, it- produced-a-sum of $205,326,000 as the-Implied-Enterprise.Value, also called the Total value of a business. + $205,300,000 is the-Net-Asset-Value of this business's real-estate and Total-Indication of value of this firm-and-Indicated value of equity, or this company's stock:((F8, valuation summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). - $205,300, or $205,300,000 is the Weighted value of equity, also called stockholders' equity, on the worksheet called Valuation Summary :((F11, valuation-summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). --After the Indicated value of equity, or stockholders' equity, and the weight of 100% were multiplied together to equal $20,530,000,000.--$20,530,000,000 was divided by 100 to equal $205,300.000, the Weighted value of equity.--Weight of indicated value of equity is 100%, it means company's capital-structure is only equity-oriented and not having any debt. --For example, a company's enterprise value is $100,000-and-70% weight of equity it means weighted value of equity is $70,000 ($100.000-x-0.70) and-30%-belongs to debt that is $30,000 ($100.000-x-0.30)... Weighted value is $205,300,000 because this is calculated by [(Step-1): $205,300,000-x-0.100= $20,530,000, (Step-2): -= 20,530,000,000 = $205,300,000)). --It-simply means all value belongs to equity only (F8, F9, F13, valuation summary, ACC-345-7-1 Final-Project Submission (Business- Valuation Model (Verizon Communications Inc.)). However, $205,300,000 is now-Indicated- value with voting rights. -- $205,300,000, the Indicated value with voting rights, or this dollar amount represented the shareholders who owned and/or-still-own-outstanding shares of this firm's common stock with voting rights (1.e., voting premium) (Gurun & -Karakas, 2016). $205,300,000, the Indicated value with voting rights, and -15% is the Discount for Lack of Control (DLOC) -expressed as a percentage, was multiplied together to equal $30,795,000, the Discount for Lack of Control (DLOC). 100 The Discount for Lack-of-Control decreased the amount of the transferred-interest by 15% at the end of December 31, 2015 (Karlsen & Scott, 2020). --Therefore, after $205,300,000, or $205,300, the Total-Indication of value-and-Indicated value of equity, and -15%, the Discount for Lack of Control (DLOC), were multiplied together to equal-$30,795,000, the-Discount for Lack of Control (DLOC) expressed as a dollar amount. $30,795,000 was subtracted (deducted) from $205,300,000 to equal $174,505,000.-or $174,505, the value of the Marketable, minority interest (F11, F14, F16, valuation-summary, -ACC-345-7-1-Final-Project-Submission (Business- Valuation Model (Verizon-Communications Inc.)). --The monetary worth of the outstanding shares belonging to the minority owners decreased by $30,795,000-(F14, valuation-summary, ACC-345-7-1-Final Project Submission (Business Valuation Model (Verizon-Communications- Inc.)). --As a result, the value of the Marketable minority interest was and/or is $174,505.000- (F16, valuation-summary, ACC-345-7-1-Final-Project-Submission (Business Valuation Model (Verizon Communications Inc.)). --I-would like to remind you the reader, that the marketable: minority value is the monetary value (worth) of a minority interest in which the minority shareholders have the ability to buy and sell-a-security for cash quickly and with comparative ease-in-an active market and has no control over choosing or changing the managers, firm's board of directors, and how much the managers are paid (upcounsel.com.-2021, Mercer & Heinz, 2021). + After $174,505,000, or $174,505, the Marketable, minority value and -25.0%, the- Discount rate for Lack of Marketability represented as a percentage, were multiplied together to- equal-$43,626,000, -or-S43,626, the Discount rate for Lack of Marketability expressed as a dollar amount (F16, F17. valuation summary, ACC-345-7-1-Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)).- Once-$43,626,000, the-Discount rate for Lack-of-Marketability, expressed as a dollar amount. -$43,626,000,-or-$43,626, was subtracted (deducted) from $174,505.000, the value of the Marketable, minority interest, to equal $130,879,000,-or-$130,879, theNonmarketable, minority value (F17, F19, valuation-summary, ACC-345-7-1 -Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)). --The monetary worth of the outstanding shares belonging to the minority owners decreased by S43,626,000-((F17, valuation-summary, ACC-345-7-1-Final-Project Submission (Business Valuation-Model (Verizon Communications Inc.)). --Therefore, the value of the Nonmarketable, minority interest was and/or is $130,879,000 (F19, valuation-summary, ACC 345-7-1-Final Project Submission (Business Valuation-Model (Verizon Communications Inc.)). -I- would like to remind you, the reader, that the nonmarketable minority value is the monetary value (worth) of a minority interest in which the minority shareholders has no control over choosing or changing the managers, firm's board of directors, and how much the managers are paid-and-lack the ability to buy and sell-a-security for cash with relative ease and speedily in an active market (upcounsel.com, 2021, Mercer & Heinz, 2021).--$1,309 is the Value of a one- percent interest (in millions) (rosscompanycopa.com, 2012). --The fair market value of a 1. percent minority interest (in millions) in this firm (on a non-controlling, non-marketable-basis) -as- of December 31, 2015 is $1,309, or $1,309,000, as shown on the worksheet called Valuation Summary (F23, valuation-summary, ACC-345-7-1 Final-Project-Submission (Business Valuation- Model (Verizon Communications Inc.))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started