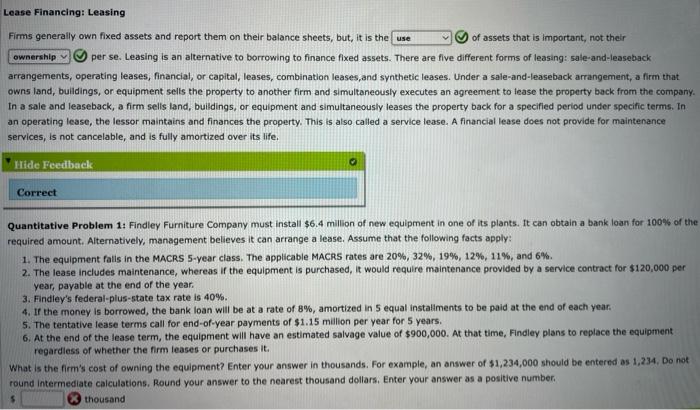

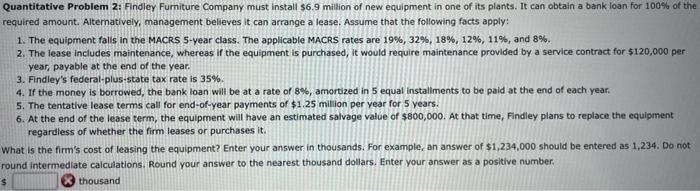

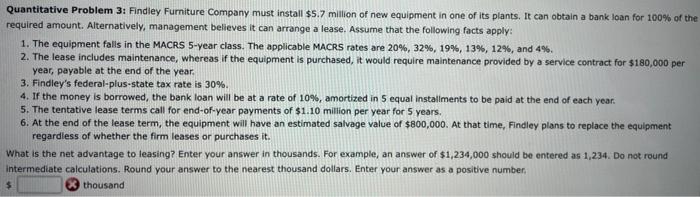

Lease Financing: Leasing Firms generally own fixed assets and report them on their balance sheets, but it is the use of assets that is important, not their ownership per se. Leasing is an alternative to borrowing to finance fixed assets. There are five different forms of leasing: sale-and-leaseback arrangements, operating leases, financial, or capital, leases, combination leases and synthetic leases. Under a sale-and-leaseback arrangement, a firm that owns land, buildings, or equipment sells the property to another firm and simultaneously executes an agreement to lease the property back from the company. In a sale and leaseback, a firm sells land, buildings, or equipment and simultaneously leases the property back for a specified period under specific terms. In an operating lease, the lessor maintains and finances the property. This is also called a service lease. A financial lease does not provide for maintenance services, is not cancelable, and is fully amortized over its life, Hide Feedback Correct Quantitative Problem 1: Findley Furniture Company must install $6.4 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 20%, 32%, 19%, 12%, 11%, and 6% 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $120,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 40%. 4. If the money is borrowed, the bank loan will be at a rate of 8%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.15 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $900,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the firm's cost of owning the equipment? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234, Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number thousand Quantitative Problem 2: Findley Furniture Company must install $6.9 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 19%, 32%, 18%, 12%, 11%, and 8%. 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $120,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 35%. 4. If the money is borrowed, the bank loan will be at a rate of 8%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.25 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $800,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the firm's cost of leasing the equipment? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234. Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number. thousand Quantitative Problem 3: Findley Furniture Company must install $5.7 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 20%, 32%, 19%, 13%, 12%, and 4% 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $180,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 30%. 4. If the money is borrowed, the bank loan will be at a rate of 10%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.10 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $800,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the net advantage to leasing? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234. Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number, thousand Lease Financing: Leasing Firms generally own fixed assets and report them on their balance sheets, but it is the use of assets that is important, not their ownership per se. Leasing is an alternative to borrowing to finance fixed assets. There are five different forms of leasing: sale-and-leaseback arrangements, operating leases, financial, or capital, leases, combination leases and synthetic leases. Under a sale-and-leaseback arrangement, a firm that owns land, buildings, or equipment sells the property to another firm and simultaneously executes an agreement to lease the property back from the company. In a sale and leaseback, a firm sells land, buildings, or equipment and simultaneously leases the property back for a specified period under specific terms. In an operating lease, the lessor maintains and finances the property. This is also called a service lease. A financial lease does not provide for maintenance services, is not cancelable, and is fully amortized over its life, Hide Feedback Correct Quantitative Problem 1: Findley Furniture Company must install $6.4 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 20%, 32%, 19%, 12%, 11%, and 6% 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $120,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 40%. 4. If the money is borrowed, the bank loan will be at a rate of 8%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.15 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $900,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the firm's cost of owning the equipment? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234, Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number thousand Quantitative Problem 2: Findley Furniture Company must install $6.9 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 19%, 32%, 18%, 12%, 11%, and 8%. 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $120,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 35%. 4. If the money is borrowed, the bank loan will be at a rate of 8%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.25 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $800,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the firm's cost of leasing the equipment? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234. Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number. thousand Quantitative Problem 3: Findley Furniture Company must install $5.7 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a lease. Assume that the following facts apply: 1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 20%, 32%, 19%, 13%, 12%, and 4% 2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $180,000 per year, payable at the end of the year. 3. Findley's federal-plus-state tax rate is 30%. 4. If the money is borrowed, the bank loan will be at a rate of 10%, amortized in 5 equal installments to be paid at the end of each year. 5. The tentative lease terms call for end-of-year payments of $1.10 million per year for 5 years. 6. At the end of the lease term, the equipment will have an estimated salvage value of $800,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it. What is the net advantage to leasing? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234. Do not round Intermediate calculations. Round your answer to the nearest thousand dollars. Enter your answer as a positive number, thousand