Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a-g are a. materials purchased b. direct materials used b2. indirect materials used c. direct labor used c2. indirect labor used d. overhead applied to

a-g are a. materials purchased b. direct materials used b2. indirect materials used c. direct labor used c2. indirect labor used d. overhead applied to jobs at the rate of 80% of direct materials cost e. the completion of job 201 f. sale of job 201 on credit f2. costs of goods sold for job 201 g. actual factory overhead costs.

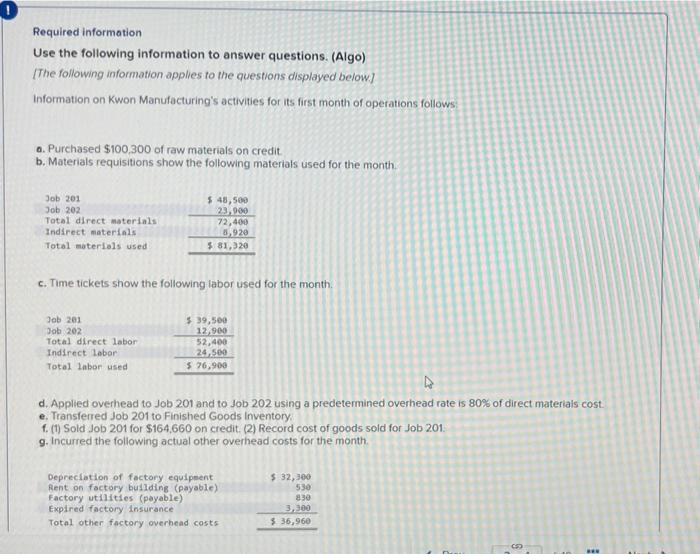

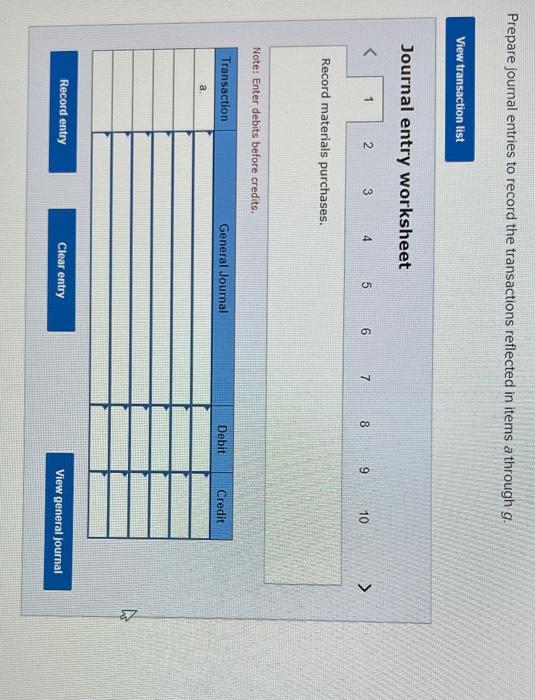

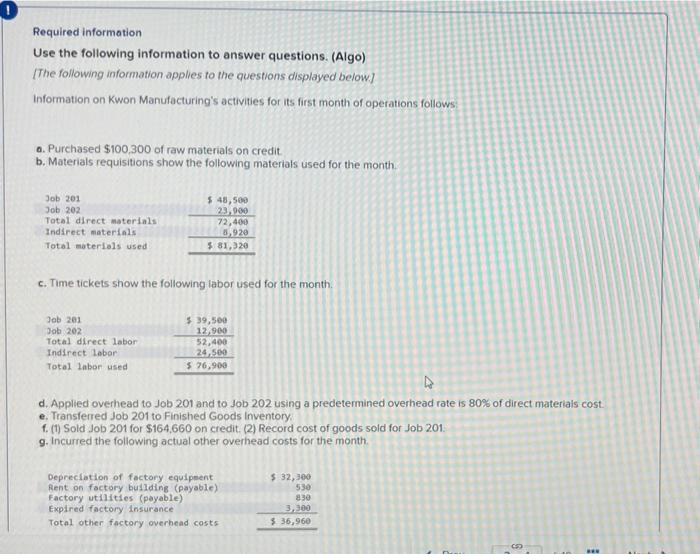

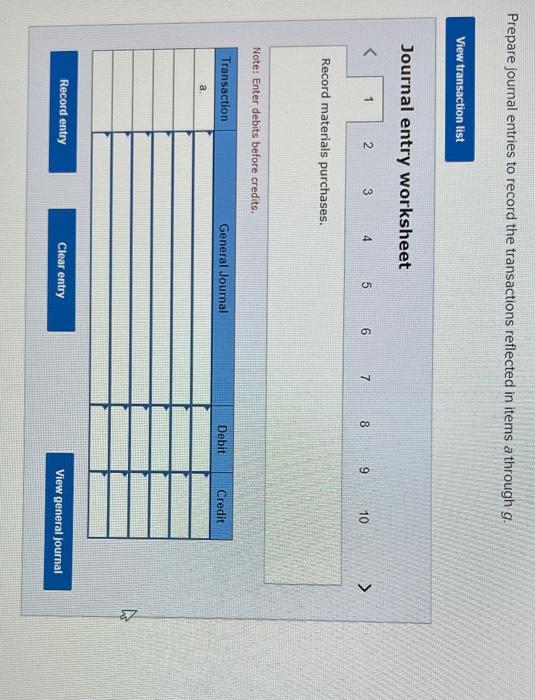

Required information Use the following information to answer questions. (Algo) The following information applies to the questions displayed below) Information on Kwon Manufacturing's activities for its first month of operations follows a. Purchased $100,300 of raw materials on credit b. Materials requisitions show the following materials used for the month Job 201 Job 202 Total direct materials Indirect materials Total materials used $ 48,500 23,900 72,400 8,920 $ 81,320 c. Time tickets show the following labor used for the month Job 201 Job 202 Total direct labor Indirect labor Total labor used $ 39,500 12.900 52,400 24,500 $ 76,900 d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory f. (1) Sold Job 201 for $164,660 on credit. (2) Record cost of goods sold for Job 201. 9. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment Rent on factory building (payable) Factory utilities (payable) Expired factory Insurance Total other factory overhead costs $ 32,300 530 830 3,300 $ 36,960 Prepare journal entries to record the transactions reflected in items a through g. View transaction list Journal entry worksheet 1 2 34 5 09 6 7 00 8 9 10 > Record materials purchases. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started