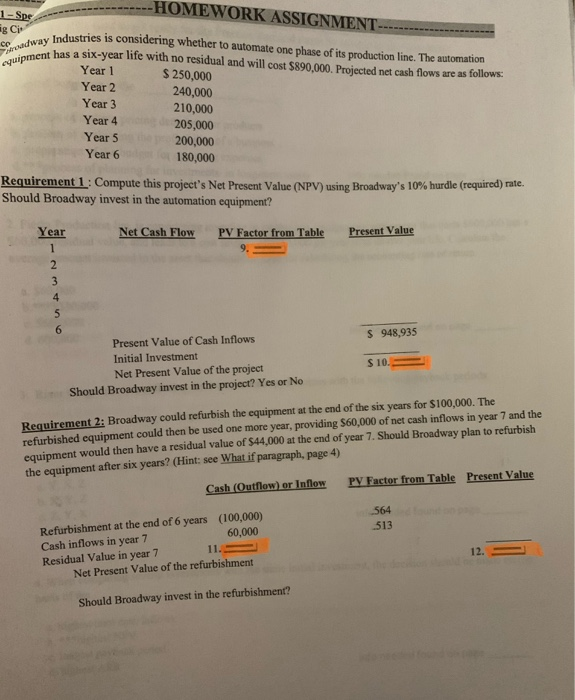

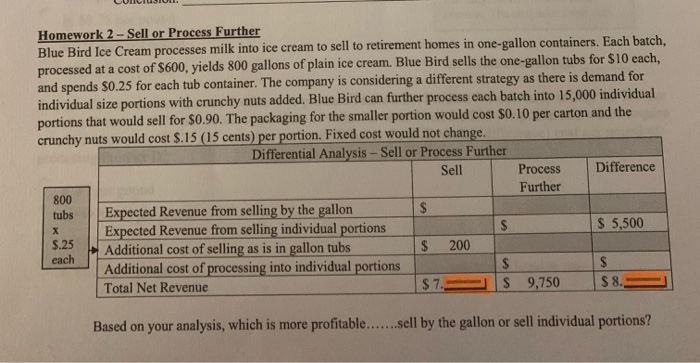

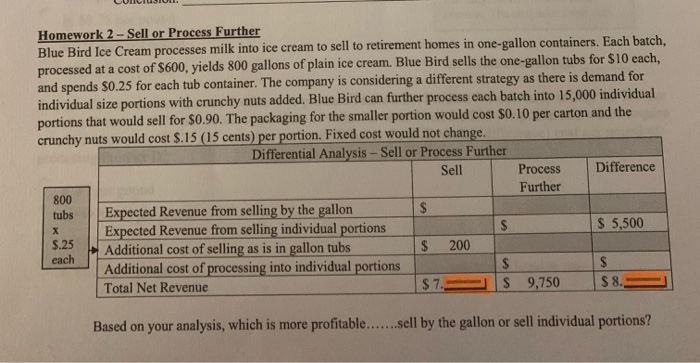

ag Ci CP equipment has a six-year life with no residual and will cost $890,000. Projected net cash flows are as follows: -HOMEWORK ASSIGNMENT- 1-Spe Year 1 $ 250,000 Year 2 240,000 Year 3 210,000 Year 4 205,000 Year 5 200,000 Year 6 180,000 Requirement 1: Compute this project's Net Present Value (NPV) using Broadway's 10% hurdle (required) rate. Should Broadway invest in the automation equipment? Year Net Cash Flow PV Factor from Table Present Value 1 2 3 4 5 6 $948,935 S 10. Present Value of Cash Inflows Initial Investment Net Present Value of the project Should Broadway invest in the project? Yes or No Requirement 2: Broadway could refurbish the equipment at the end of the six years for $100,000. The refurbished equipment could then be used one more year, providing $60,000 of net cash inflows in year 7 and the equipment would then have a residual value of $44,000 at the end of year 7. Should Broadway plan to refurbish the equipment after six years? (Hint: see What if paragraph, page 4) PY Factor from Table Present Value Cash Outflow) or Inflow 564 513 Refurbishment at the end of 6 years (100,000) Cash inflows in year 7 60,000 Residual Value in year 7 11. Net Present Value of the refurbishment 12. Should Broadway invest in the refurbishment? Homework 2 - Sell or Process Further Blue Bird Ice Cream processes milk into ice cream to sell to retirement homes in one-gallon containers. Each batch, processed at a cost of $600, yields 800 gallons of plain ice cream. Blue Bird sells the one-gallon tubs for $10 each, and spends $0.25 for each tub container. The company is considering a different strategy as there is demand for individual size portions with crunchy nuts added. Blue Bird can further process each batch into 15,000 individual portions that would sell for $0.90. The packaging for the smaller portion would cost $0.10 per carton and the crunchy nuts would cost $.15 (15 cents) per portion. Fixed cost would not change. Differential Analysis - Sell or Process Further Sell Process Difference Further 800 tubs Expected Revenue from selling by the gallon $ Expected Revenue from selling individual portions $ $ 5,500 9.25 Additional cost of selling as is in gallon tubs $ 200 each Additional cost of processing into individual portions $ $ Total Net Revenue $ 7. $ 9,750 $ 8. Based on your analysis, which is more profitable.......sell by the gallon or sell individual portions