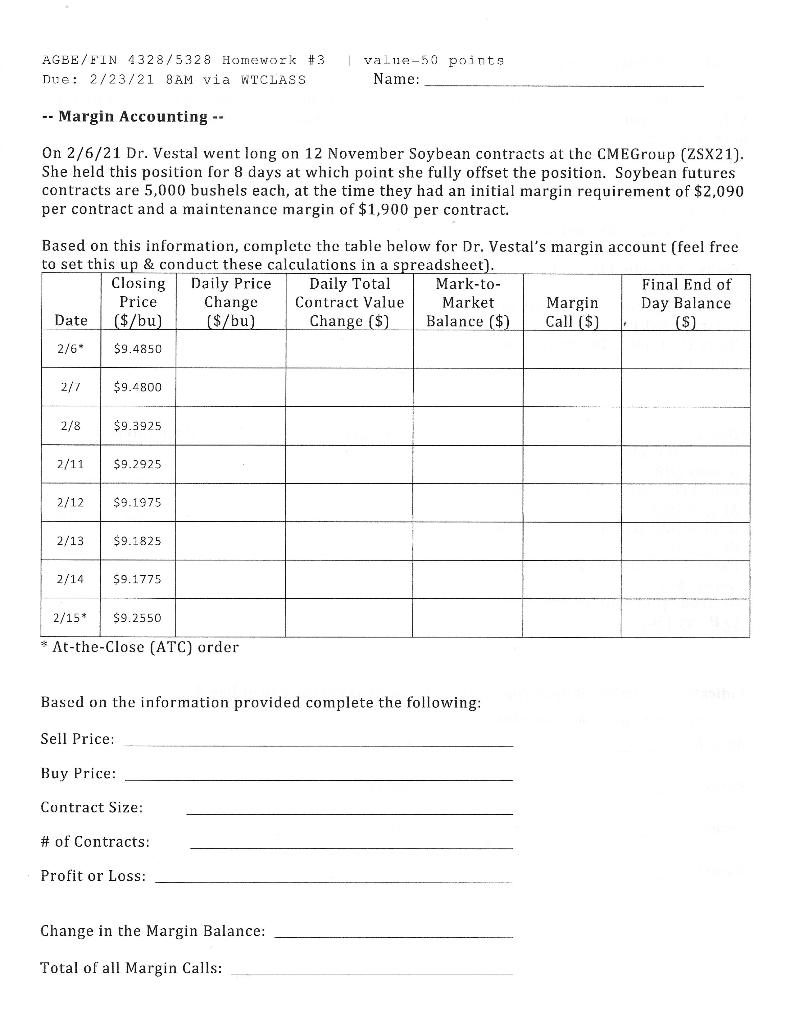

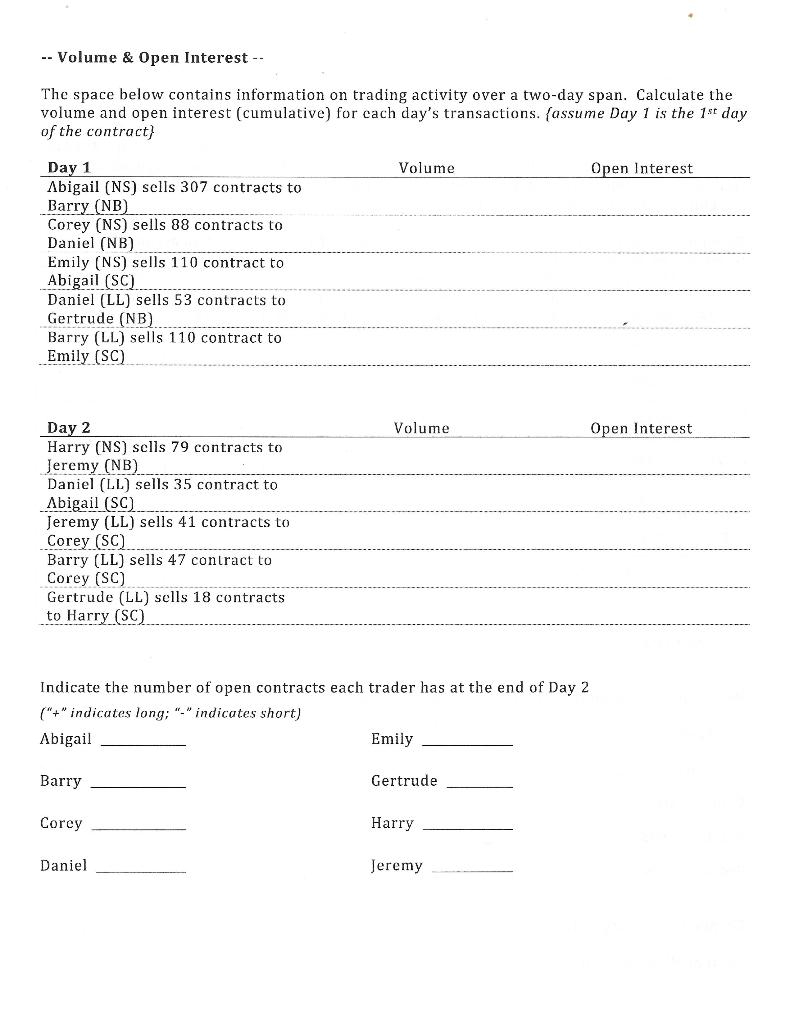

AGBE/FIN 4328/5328 Homework #3 Due: 2/23/21 8AM via WTCLASS value-50 points Name: -- Margin Accounting -- On 2/6/21 Dr. Vestal went long on 12 November Soybean contracts at the CMEGroup (ZSX21). She held this position for 8 days at which point she fully offset the position. Soybean futures contracts are 5,000 bushels each, at the time they had an initial margin requirement of $2,090 per contract and a maintenance margin of $1,900 per contract. Based on this information, complete the table below for Dr. Vestal's margin account (feel free to set this up & conduct these calculations in a spreadsheet). Closing Daily Price Daily Total Mark-to- Final End of Price Change Contract Value Market Margin Day Balance Date ($/bu) ($/bu) Change ($) Balance ($) Call ($) ($) 2/6 $9.4850 2/4 $9.4800 2/8 $9.3925 2/11 $9.2925 2/12 $9.1975 2/13 $9.1825 2/14 $9.1775 2/15* $9.2550 * At-the-Close (ATC) order Based on the information provided complete the following: Sell Price: Buy Price: Contract Size: # of Contracts: Profit or Loss: Change in the Margin Balance: Total of all Margin Calls: -- Volume & Open Interest -- The space below contains information on trading activity over a two-day span. Calculate the volume and open interest (cumulative) for each day's transactions. {assume Day 1 is the 1st day of the contract} Volume Open Interest Day 1 Abigail (NS) sells 307 contracts to Barry (NB) Corey (NS) sells 88 contracts to Daniel (NB) Emily (NS) sells 110 contract to Abigail (SC) Daniel (LL) sells 53 contracts to Gertrude (NB) Barry (LL) sells 110 contract to Emily (SC) Volume Open Interest Day 2 Harry (NS) sells 79 contracts to Jeremy (NB) Daniel (LL) sells 35 contract to Abigail (SC) Jeremy (LL) sells 41 contracts to Corey (SC) Barry (LL) sells 47 contract to Corey (SC) Gertrude (LL) sells 18 contracts to Harry (SC) Indicate the number of open contracts each trader has at the end of Day 2 ("+" indicates long; "-" indicates short) Abigail Emily Barry Gertrude Corey Harry Daniel Jeremy AGBE/FIN 4328/5328 Homework #3 Due: 2/23/21 8AM via WTCLASS value-50 points Name: -- Margin Accounting -- On 2/6/21 Dr. Vestal went long on 12 November Soybean contracts at the CMEGroup (ZSX21). She held this position for 8 days at which point she fully offset the position. Soybean futures contracts are 5,000 bushels each, at the time they had an initial margin requirement of $2,090 per contract and a maintenance margin of $1,900 per contract. Based on this information, complete the table below for Dr. Vestal's margin account (feel free to set this up & conduct these calculations in a spreadsheet). Closing Daily Price Daily Total Mark-to- Final End of Price Change Contract Value Market Margin Day Balance Date ($/bu) ($/bu) Change ($) Balance ($) Call ($) ($) 2/6 $9.4850 2/4 $9.4800 2/8 $9.3925 2/11 $9.2925 2/12 $9.1975 2/13 $9.1825 2/14 $9.1775 2/15* $9.2550 * At-the-Close (ATC) order Based on the information provided complete the following: Sell Price: Buy Price: Contract Size: # of Contracts: Profit or Loss: Change in the Margin Balance: Total of all Margin Calls: -- Volume & Open Interest -- The space below contains information on trading activity over a two-day span. Calculate the volume and open interest (cumulative) for each day's transactions. {assume Day 1 is the 1st day of the contract} Volume Open Interest Day 1 Abigail (NS) sells 307 contracts to Barry (NB) Corey (NS) sells 88 contracts to Daniel (NB) Emily (NS) sells 110 contract to Abigail (SC) Daniel (LL) sells 53 contracts to Gertrude (NB) Barry (LL) sells 110 contract to Emily (SC) Volume Open Interest Day 2 Harry (NS) sells 79 contracts to Jeremy (NB) Daniel (LL) sells 35 contract to Abigail (SC) Jeremy (LL) sells 41 contracts to Corey (SC) Barry (LL) sells 47 contract to Corey (SC) Gertrude (LL) sells 18 contracts to Harry (SC) Indicate the number of open contracts each trader has at the end of Day 2 ("+" indicates long; "-" indicates short) Abigail Emily Barry Gertrude Corey Harry Daniel Jeremy