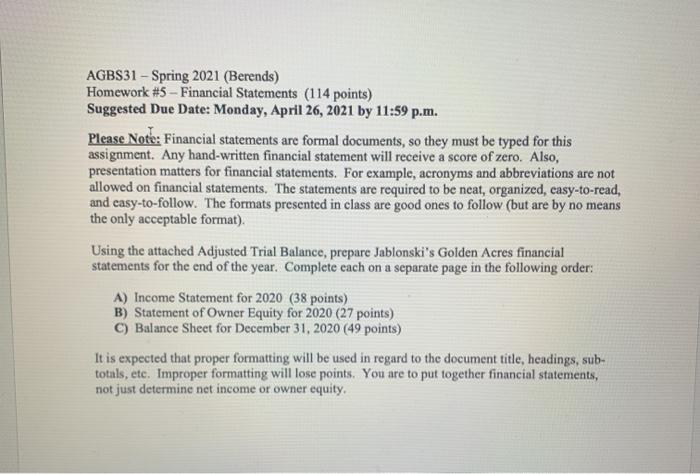

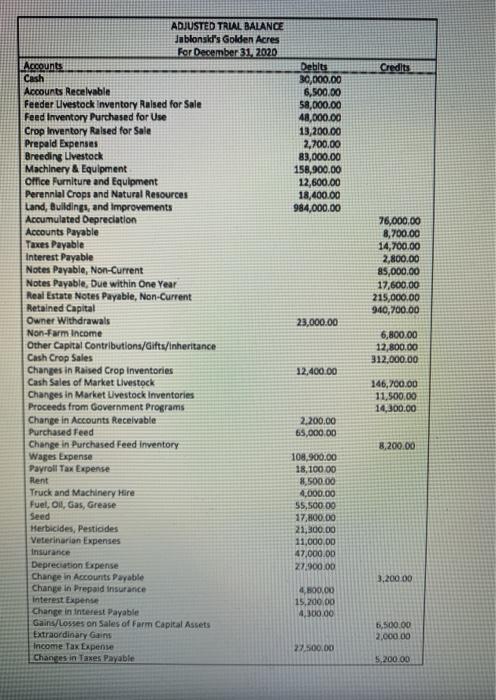

AGBS31 - Spring 2021 (Berends) Homework #5 - Financial Statements (114 points) Suggested Due Date: Monday, April 26, 2021 by 11:59 p.m. Please Note: Financial statements are formal documents, so they must be typed for this assignment. Any hand-written financial statement will receive a score of zero. Also, presentation matters for financial statements. For example, acronyms and abbreviations are not allowed on financial statements. The statements are required to be ncat, organized, casy-to-read, and easy-to-follow. The formats presented in class are good ones to follow (but are by no means the only acceptable format). Using the attached Adjusted Trial Balance, prepare Jablonski's Golden Acres financial statements for the end of the year. Complete each on a separate page in the following order: A) Income Statement for 2020 (38 points) B) Statement of Owner Equity for 2020 (27 points) C) Balance Sheet for December 31, 2020 (49 points) It is expected that proper formatting will be used in regard to the document title, headings, sub- totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity. Credits Debits 30,000.00 6,500.00 58,000.00 48,000.00 13,200.00 2,700.00 83,000.00 158,900.00 12,600,00 18,400.00 984,000.00 76,000,00 8,700.00 14,700.00 2,800.00 85,000.00 17,600.00 215,000.00 940,700.00 23,000.00 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2020 Accounts Cash Accounts Recevable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Bulidings, and improvements Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Raised Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased teed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Rent Truck and Machinery Hire Fuel Oil, Gas, Grease Seed Herbicides, Pestiodes Veterinarion Expenses Insurance Depreciation Expense Change in Accounts Payable Change in Prepaid Insurance interest Expense Change in interest Payable Gains/losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 6,800.00 12,800.00 312,000.00 12,400.00 146,700.00 11,500.00 14,300.00 2.200.00 65,000.00 8,200.00 108,900.00 18,100.00 8,500.00 4.000.00 55,500.00 17,800.00 21,300.00 11,000.00 47.000.00 27.900.00 3.200.00 800.00 15,200.00 4,300.00 5,500.00 2.000.00 27.500,00 5,200.00 AGBS31 - Spring 2021 (Berends) Homework #5 - Financial Statements (114 points) Suggested Due Date: Monday, April 26, 2021 by 11:59 p.m. Please Note: Financial statements are formal documents, so they must be typed for this assignment. Any hand-written financial statement will receive a score of zero. Also, presentation matters for financial statements. For example, acronyms and abbreviations are not allowed on financial statements. The statements are required to be ncat, organized, casy-to-read, and easy-to-follow. The formats presented in class are good ones to follow (but are by no means the only acceptable format). Using the attached Adjusted Trial Balance, prepare Jablonski's Golden Acres financial statements for the end of the year. Complete each on a separate page in the following order: A) Income Statement for 2020 (38 points) B) Statement of Owner Equity for 2020 (27 points) C) Balance Sheet for December 31, 2020 (49 points) It is expected that proper formatting will be used in regard to the document title, headings, sub- totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity. Credits Debits 30,000.00 6,500.00 58,000.00 48,000.00 13,200.00 2,700.00 83,000.00 158,900.00 12,600,00 18,400.00 984,000.00 76,000,00 8,700.00 14,700.00 2,800.00 85,000.00 17,600.00 215,000.00 940,700.00 23,000.00 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2020 Accounts Cash Accounts Recevable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Bulidings, and improvements Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Raised Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased teed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Rent Truck and Machinery Hire Fuel Oil, Gas, Grease Seed Herbicides, Pestiodes Veterinarion Expenses Insurance Depreciation Expense Change in Accounts Payable Change in Prepaid Insurance interest Expense Change in interest Payable Gains/losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 6,800.00 12,800.00 312,000.00 12,400.00 146,700.00 11,500.00 14,300.00 2.200.00 65,000.00 8,200.00 108,900.00 18,100.00 8,500.00 4.000.00 55,500.00 17,800.00 21,300.00 11,000.00 47.000.00 27.900.00 3.200.00 800.00 15,200.00 4,300.00 5,500.00 2.000.00 27.500,00 5,200.00