Answered step by step

Verified Expert Solution

Question

1 Approved Answer

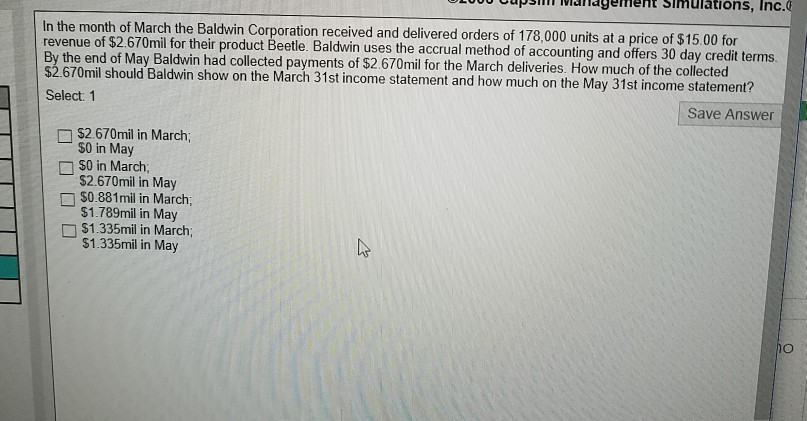

agement Simulations, Inc.0 of March the Baldwin Corporation received and delivered orders of 178,000 units at a price of $15.00 for method of accounting and

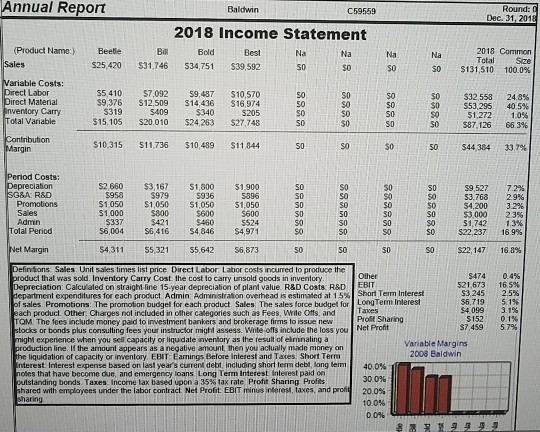

agement Simulations, Inc.0 of March the Baldwin Corporation received and delivered orders of 178,000 units at a price of $15.00 for method of accounting and offers 30 day credit terms revenue of $2.670mil for their product Beetle. Baldwin uses the accrual By the end of May Baldwin had collected payments of S2 670mil for the March deliveries. How much of the collected S2.670mil should Baldwin show on the March 31st income statement and how much on the May 31st income statemernt Select: 1 Save Answer 670mil in March; $2.670mil in March $0 in May 50 in March $2.670mil in May S0881 mil in March, $1.789mil in May $1.335mil in March $1.335mil in May Annual Report Baldwin Round:0 C59559 Dec. 31, 201 2018 Income Statement Product Name:)Beele 2018 Common TotalSize s|31,510 100.0% Bold Best Na Na S25 420 $31.746 534,751 $39,592 so Variable Costs: $5410 $7,092 9,487 S10,570 9,376$12,509 $14,436 $16,974 5205 $15,105 $20,010 $24,263 $27,748 Direct Labor Direct Material 50 $32.558 553,295 51272 587-126 24.8% 40.5% 10% 663% S0 nventory Carry Total Variable 319 5409 $340 S0 Contributon $10,315 511,736 $10,489 $11,844 SD S44384 33796 Period Costs: Depreciation SG8A: R&D S2,660 $3,167 S1,800 $1,900 5896 $1,050 $1,050 51.050 $1.050 50 S0 $9,527 53,768 S4.200 53000 51,742 $22,237 72% 29% 3.2% 23% 1.3% 169% $958 $979 S0 Promotions $0 50 $1,000 Sales Admin Total Period $800 $421 $460 5524 56,004$6,416 S4,846 $4,971 S0 50 et Margin $4,31155,321 55,642 6,873 50 50 so S22, 147 16.8% efiniions Sales Unit sales times list price Direct Labor Labor costs incurred to produce the S474 $21673 3,245 S6.719 S4099 5152 $7.459 0.4% 165% 2.5% 5,1% 31% 01% 5.7% product that was sold. Inventory Carry Cost the cost to carry unsold goods in inventory Depreciation: Calculaled on straight-line 15 year depreciation of plant value. R&D Costs: R&D department expenditures for each product Admin Admnstrat n overhead is estimated at 1 5% shari Term Interest of sales. Promotions: The promotion budget for each product Sales The sales force budget for Longerm inlerest EBIT each product Other, Charges not included in other categories such as Fees, Wite Otfs, and TOM. The fees include moncy paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instrucfor might assess. Wite offs include the loss you Ne might experience when you sell capacity or liquidate inveniory as the result of eliminaling a production line. If the amount appears as a negative amount then you aclualy made money on he liquidation of capacity or inventory. EBAT Earnings Before Interest and Tates Short Term nterest Interest expense based on last year's current debt including short term debt lang term 40 0% notes that have become due, and emergency loans Long Term Interest Inlerest paid on outstanding bonds. Taxes income tax based upon a 35% lax rate Profit Sharing Profits shared with employees under the labor contract Net Profit EBIT minus interest taxes, and profit 20.0% Prost Sharing Variable Margins 2006 Baldwin Ilin 30 096 100% 00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started