Answered step by step

Verified Expert Solution

Question

1 Approved Answer

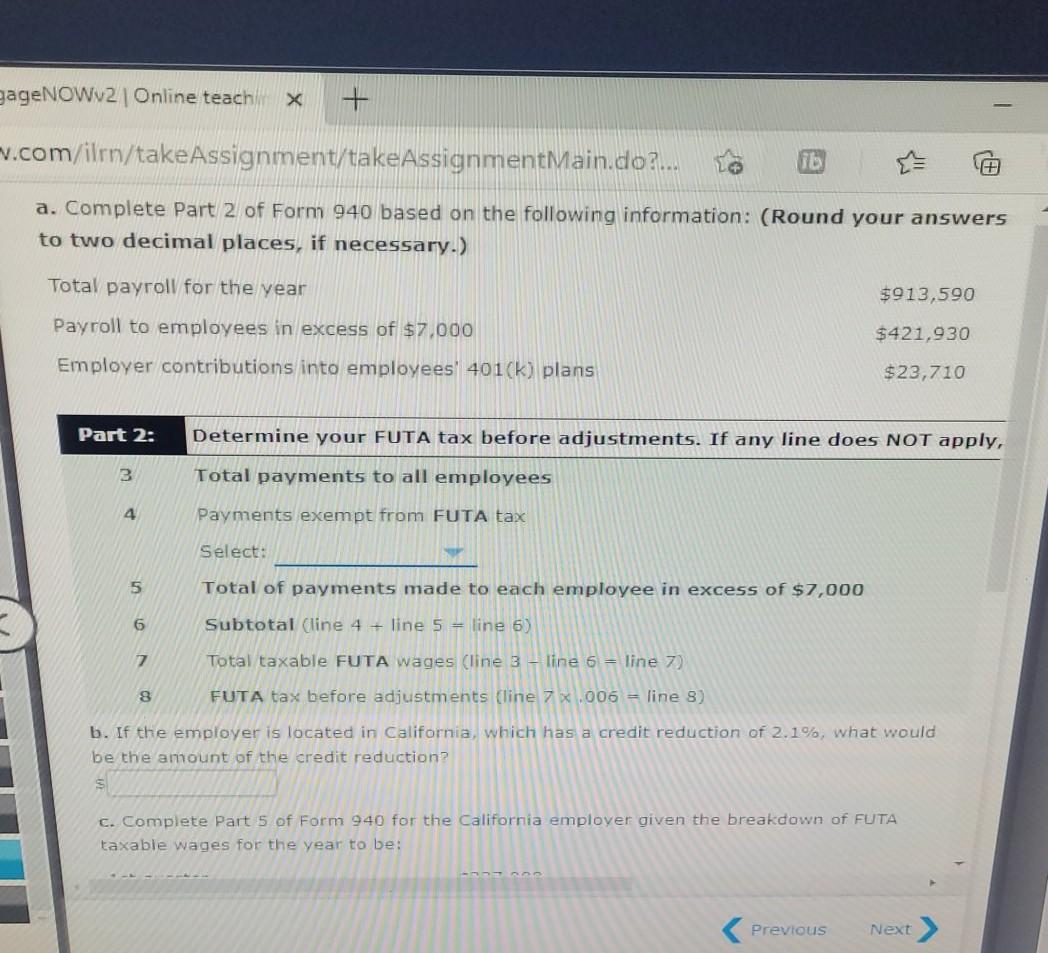

ageNOWV2 Online teach x + v.com/ilm/take Assignment/takeAssignmentMain.do?... + a. Complete Part 2 of Form 940 based on the following information: (Round your answers to two

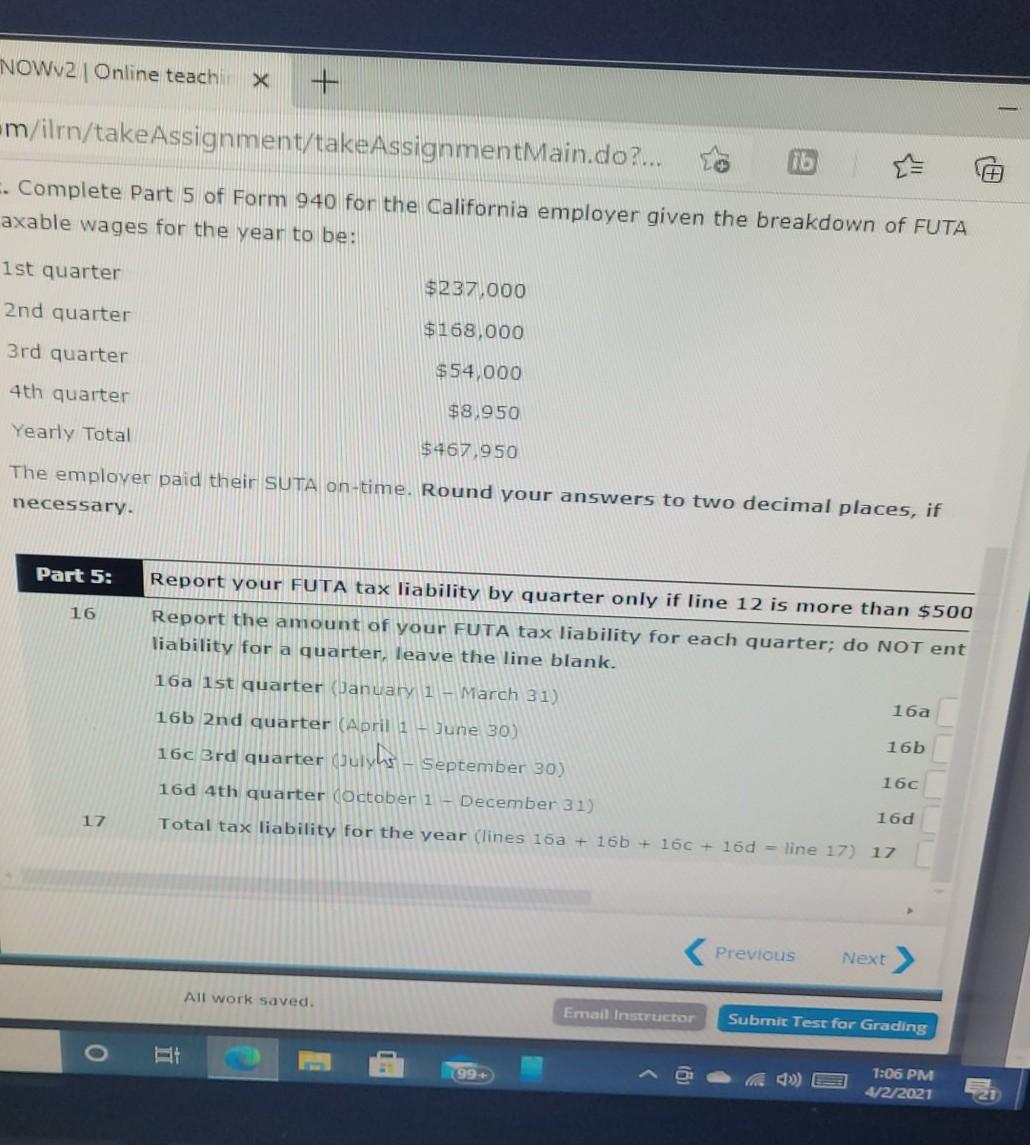

ageNOWV2 Online teach x + v.com/ilm/take Assignment/takeAssignmentMain.do?... + a. Complete Part 2 of Form 940 based on the following information: (Round your answers to two decimal places, if necessary.) Total payroll for the year $913,590 Payroll to employees in excess of $7,000 $421,930 Employer contributions into employees' 401(k) plans $23,710 Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, 3 Total payments to all employees 4 Payments exempt from FUTA tax Select: 5 Total of payments made to each employee in excess of $7,000 6 Subtotal (line 4 + line 5 = line 6) 7 Total taxable FUTA wages (line 3 - line 6 = line 7) 8 FUTA tax before adjustments line 7x.006 = line 8) b. If the employer is located in California, which has a credit reduction of 2.1%, what would be the amount of the credit reduction? 5 C. Complete Part 5 of Form 940 for the California emplover given the breakdown of FUTA taxable wages for the year to be: Previous Next NOWV2 Online teachinx m/ilrn/takeAssignment/takeAssignmentMain.do?.... 16 . Complete Part 5 of Form 940 for the California employer given the breakdown of FUTA axable wages for the year to be: 1 st quarter $237,000 2nd quarter $168,000 3rd quarter $54,000 4th quarter $9.950 Yearly Total $467,950 The emplover paid their SUTA on-time. Round your answers to two decimal places, if necessary. Part 5: 16 Report your FUTA tax liability by quarter only if line 12 is more than $500 Report the amount of your FUTA tax liability for each quarter; do NOT ent liability for a quarter, leave the line blank. 16a 1st quarter (January 1 - March 31) 16a 16b 2nd quarter (April 1 - June 30) 16b 16C 3rd quarter (Julys - September 30) 1 16d 4th quarter (October 1 - December 31) 160 Total tax liability for the year (lines 16a + 16b + 160 + 160 = line 17) 17 17 Previous Next All work saved. Email Instructor Submit Test for Grading 199+ 1:06 PM 4/2/2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started