Answered step by step

Verified Expert Solution

Question

1 Approved Answer

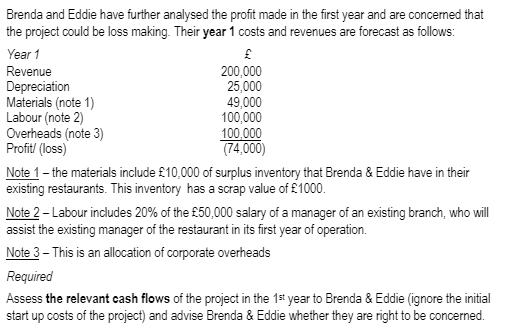

Brenda and Eddie have further analysed the profit made in the first year and are concerned that the project could be loss making. Their

Brenda and Eddie have further analysed the profit made in the first year and are concerned that the project could be loss making. Their year 1 costs and revenues are forecast as follows: Year 1 Revenue Depreciation Materials (note 1) Labour (note 2) Overheads (note 3) Profit/ (loss) 200,000 25,000 49,000 100,000 100,000 (74,000) Note 1 - the materials include 10,000 of surplus inventory that Brenda & Eddie have in their existing restaurants. This inventory has a scrap value of 1000. Note 2 - Labour includes 20% of the 50,000 salary of a manager of an existing branch, who will assist the existing manager of the restaurant in its first year of operation. Note 3 - This is an allocation of corporate overheads Required Assess the relevant cash flows of the project in the 1st year to Brenda & Eddie (ignore the initial start up costs of the project) and advise Brenda & Eddie whether they are right to be concerned.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Brenda and Eddie are right to be concerned about the profitability of their project in the first year Their revenue of 25000 is not enough to cover their costs of 74000 resulting in a loss of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started