On January 1, 20X5, Piper Ltd. purchased 100% of the shares of Sutton Ltd. for $ 1,085,000.

Question:

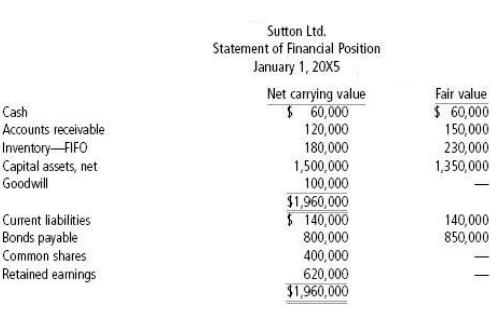

On January 1, 20X5, Piper Ltd. purchased 100% of the shares of Sutton Ltd. for $ 1,085,000. At that time Sutton Ltd. had the following SFP:

The bonds were issued at par and will mature in 10 years. Sutton Ltd. has a receivables and inventory turnover of greater than six times per year. The capital assets have an average of 10 years of remaining life and are being amortized straight- line.

In 20X5, Sutton Ltd. sold inventory to Piper Ltd. for $ 260,000; the inventory had cost $ 320,000. At the end of 20X5, 25% was still in Piper’s inventory but was all sold in 20X6.

In 20X6, Piper Ltd. sold inventory to Sutton Ltd. for $ 275,000; the inventory had cost $ 200,000. At the end of 20X6, 35% was left in Sutton’s inventory.

During 20X5, the subsidiary earned $ 875,000 and paid dividends of $ 50,000. During 20X6, the subsidiary incurred a loss of $ 180,000 and paid dividends of $ 60,000.

Piper uses the cost method for the investment in subsidiary and nets almost everything to “Other expenses.”

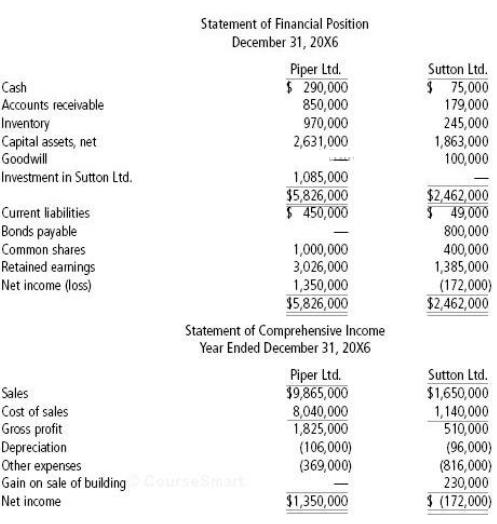

At December 31, 20X6, the following financial statements were available:

Required

a. Prepare a consolidated statement of comprehensive income for 20X6.

b. Calculate the amounts that would appear on the consolidated SFP at December 31, 20X6, for:

1. Capital assets, net

2. Bonds payable

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay