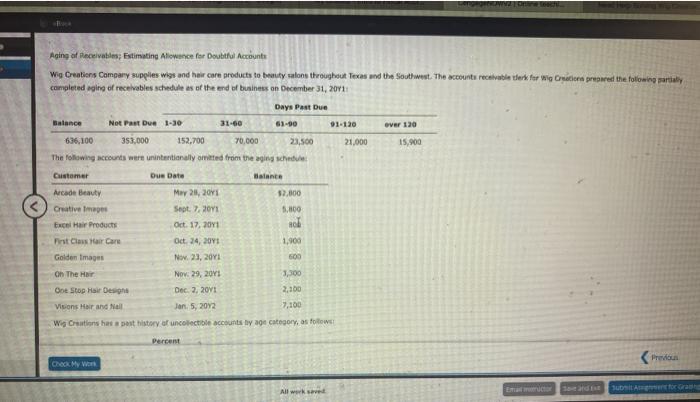

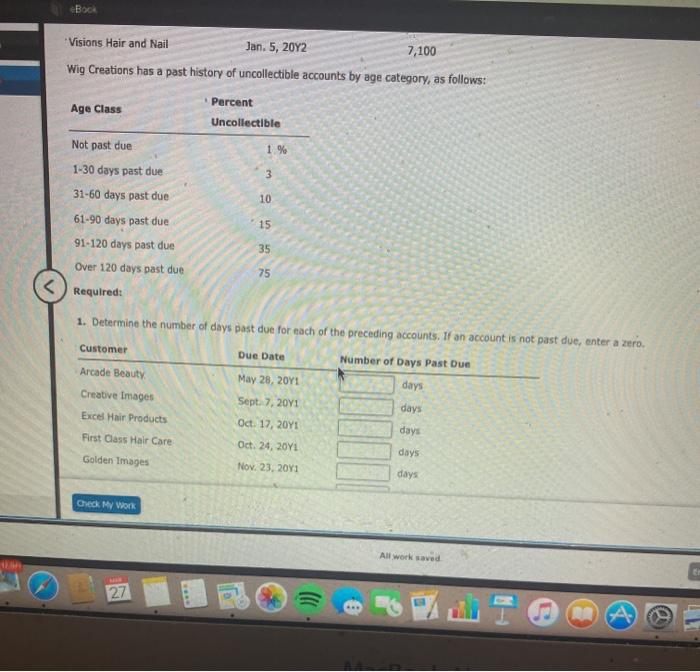

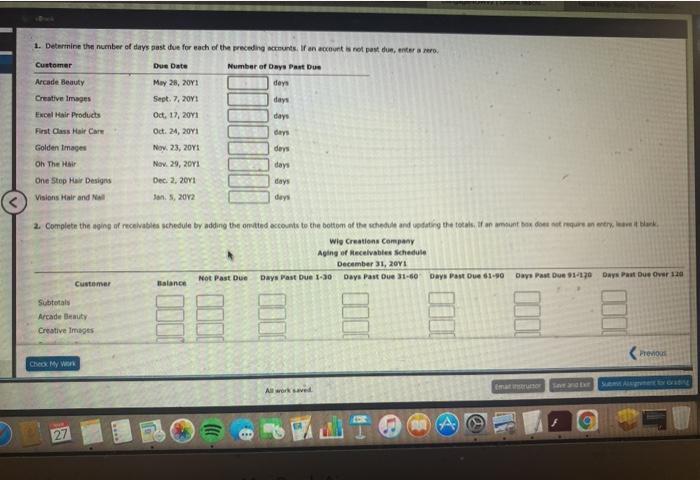

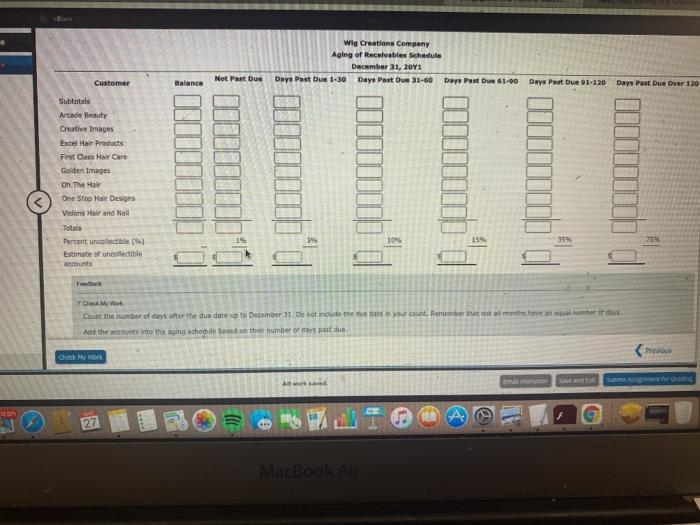

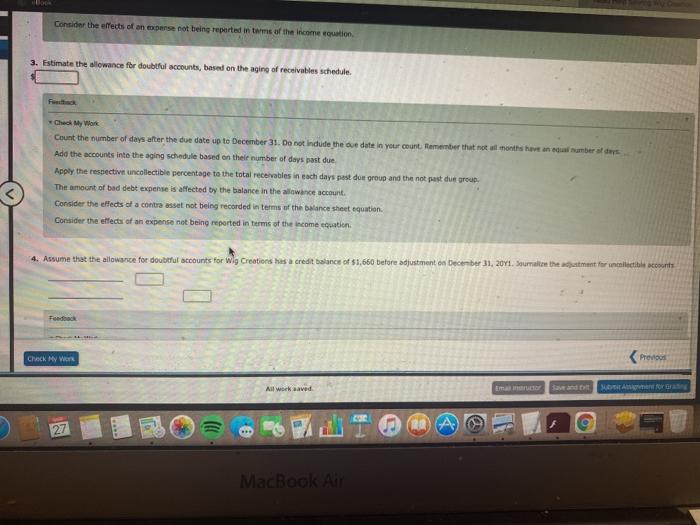

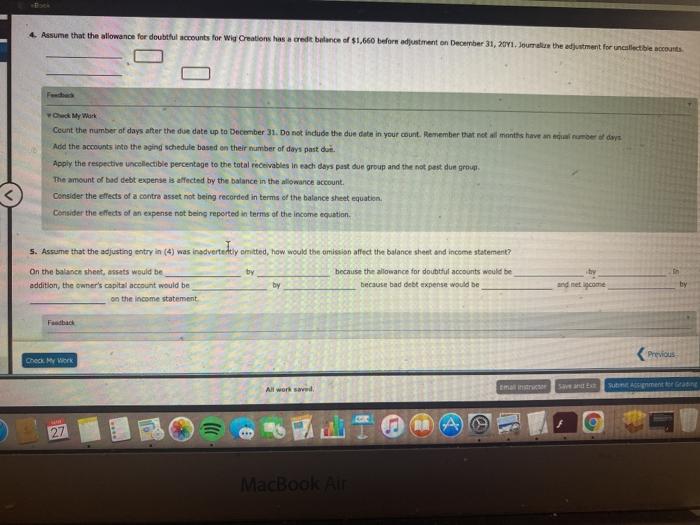

Aging of Receivables; Estimating Allowance for Doubtful Accounts Wig Creations Comary supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable er for Wig Creation prepared the following party completed soling of receivables schedule as of the end of business on December 31, 2011 Days Past Due Balance Not Pant Due 1-30 31-60 63-90 91-120 over 120 636,100 353,000 152.700 70.000 23,500 21,000 15,900 The following accounts were unintentionally omitted from the aging schedule Customer Due Date Balance Arcade Beauty May 21, 2011 12.000 Creative Images Sept.7.2011 5.800 Excel Hair Products Oct. 17, 2011 dok First Class Hair Care Oct. 24, 2011 1,900 Golden Images Nov 23, 2011 600 On The HN Now: 29, 2013 1,300 One Stop Hair Design Dec 2, 2011 2,10 Visions Hair and all Jan 5, 2012 7.100 Wis Creations het past history of uncollectible accounts by age category, as follow percent Check My Wom All work BOCA Visions Hair and Nail Jan. 5, 20Y2 7,100 Wig Creations has a past history of uncollectible accounts by age category, as follows: Age Class Percent Uncollectible Not past due 1 % 1-30 days past due 3 10 15 31-60 days past due 61-90 days past due 91-120 days past due Over 120 days past due 35 75 Required: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. Customer Due Date Number of Days Past Due Arcade Beauty May 28, 2011 days Creative Images Sept. 7, 2011 days Excel Hair Products Oct 17, 2011 days First Class Hair Care Oct. 24, 20Y1 days Golden Images Nov. 23. 2011 days Check My Work All work saved 27 1. Determine the number of days past due for each of the preceding nuts. Wan control post duranterarro Due Date Number of Days Past Due days day Customer Arcade Beauty Creative Images Excel Hair Products First Class Hair Care Golden Images Oh The Hair One Stop Hair Designs Visions Hair and NA May 28, 2011 Sept.7.2011 Oct, 17, 2011 Oct. 24, 2011 Nov. 23, 2018 Nov 29, 2011 Dec 2, 2011 days days dans days days Jan 5, 2012 days 2. Complete the wping of receivabits schedule by adding the amotted accounts to the bottom at the scheme and votating the totale. If an amount tox dont set riqure un estry, wit black Wie Creations Company Aging of Receivables Schedule December 31, 2011 Days Past Due 1-30 Days Part Oue 31-60 Days Past Du 61-90 Not Past Due Days Past Du 91-170 DSP Due Over 120 Customer Balance Subtotal Arcade Beauty Creative Images le Prevo Choo My Won Ak saved ))) ( 27 Wig Creations Company Aging of Receivables Schedule December 31, 2016 Days Past Due 1-30 Days Past Oue 31-60 Days Past Du 61-90 Not Past Due Customer Balance Days Past Due 01-120 Days Past Dus Over 120 Subtotals Arcade Beauty Creative Images Excel Hair Products First Class Hair Care Golden Images Oh The Hair One Stop Hair Designs Visions Hair and Nail Total Percent uncollectible (5) Estimate of uncollectible accounts 39 104 15 35 75% Check My Work Count the number of days after the due date up to December 11 De not incude the due date in your count. Remember that months ameri Add the content the aging scheduled on the number of past due Previous All with seved 27 ))) lacton i Consider the effects of an experse not being reported in terms of the income 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. Check My Wor Count the number of days after the due date up to December 31. Do not Indude the due date in your count. Remember that not a month and sumber days Add the accounts into the aging schedule based on their number of days past due Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past due group The amount of bad debt expenses affected by the balance in the allowance account Consider the effects of a contra as not being recorded in terms of the balance sheet equation. Consider the effects of an expense not being reported in terms of the income equation 4. Assume that the allowance for doubtful accounts for Wig Creation has a credit bance of $1,660 before adjustment on December 31, 2011. Jumatthewment formlectible accounts Food Check My W Predo All work saved Em G Arora 27 (RA MacBook Air Assume that the allowance for doubtful accounts for We Creations has a credit balance of $1,660 before adjustment on December 31, 2011. Journals the stjustment for uncollectible accounts Count the number of days after the due date up to December 31. Do not indude the due date in your count. Remember that not wil months have an armoed days Add the accounts into the aging schedule based on their number of days past dui. Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past du group, The amount of bad debt expense is affected by the balance in the allowance account Consider the effects of a contra asset not being recorded in terms of the balance sheet equation Consider the effects of an expense not being reported in terms of the income equation. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? inadvertedery On the balance shent, assets would be by because the allowance for doubtful accounts would be addition, the owner's capital account would be by because bad debt expense would be on the income statement toy and met come Feedback Check My Work All works Fuentran BA 27 MacBook Air