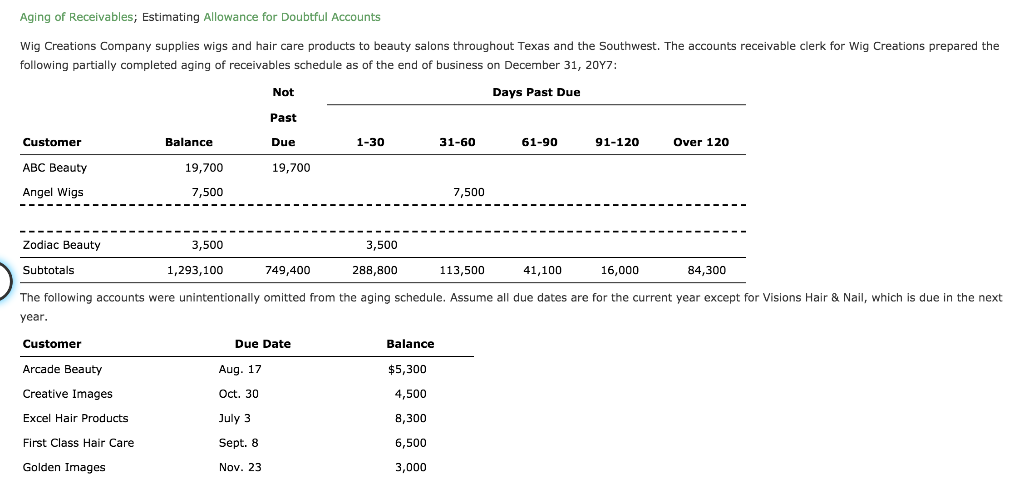

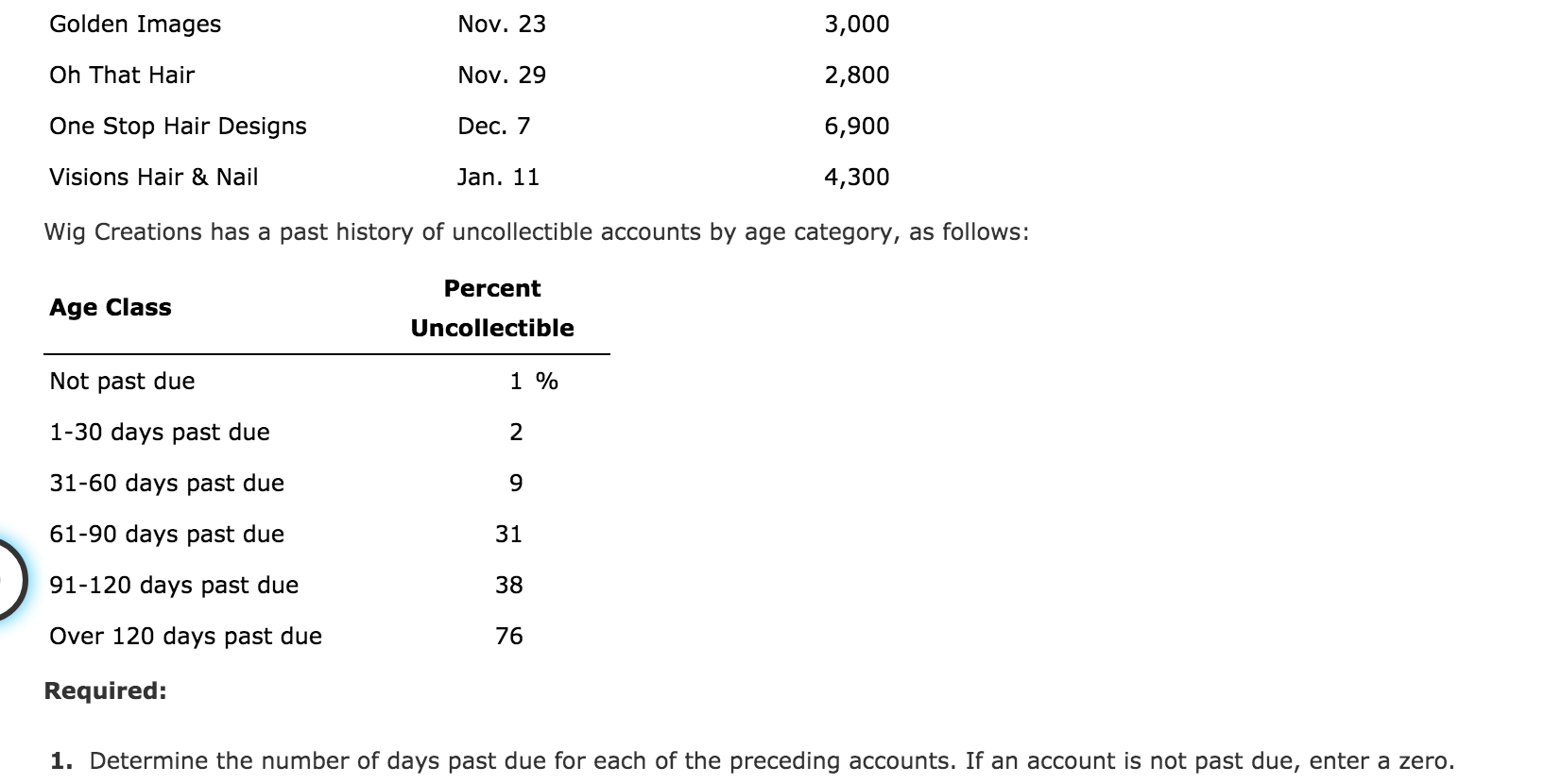

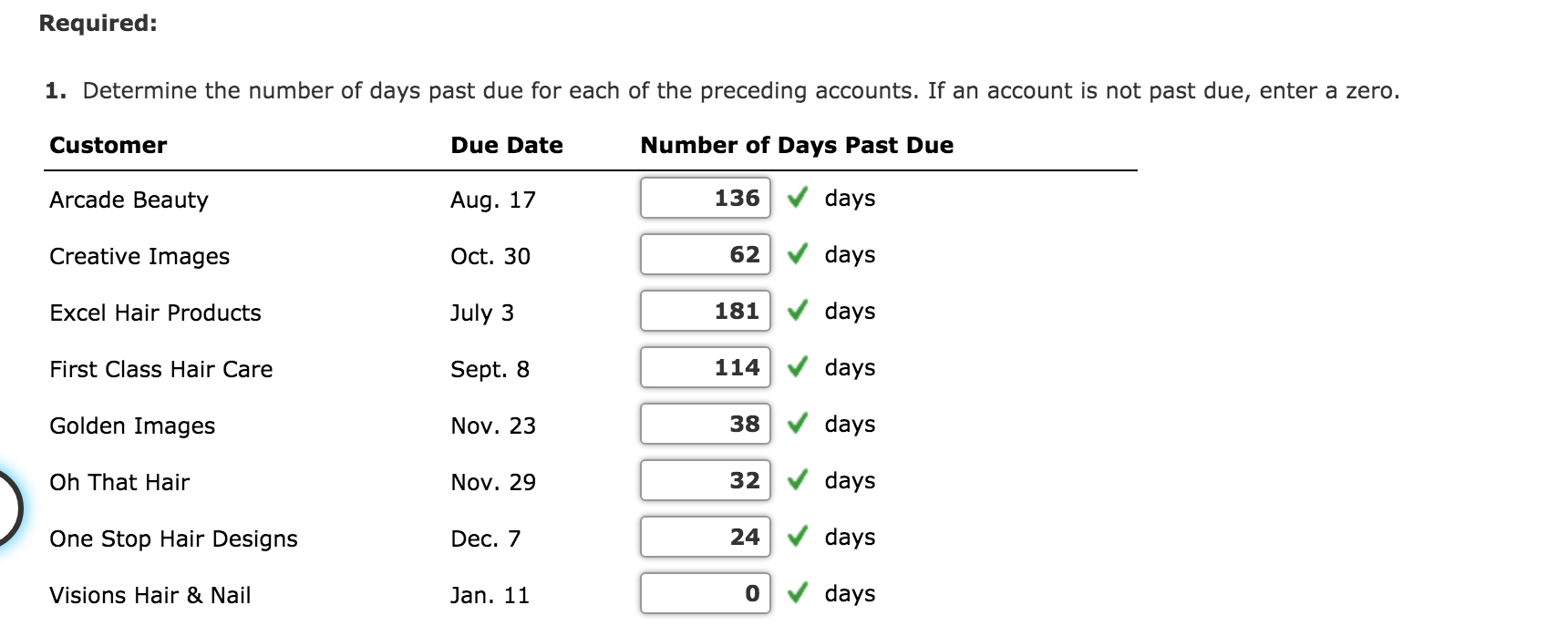

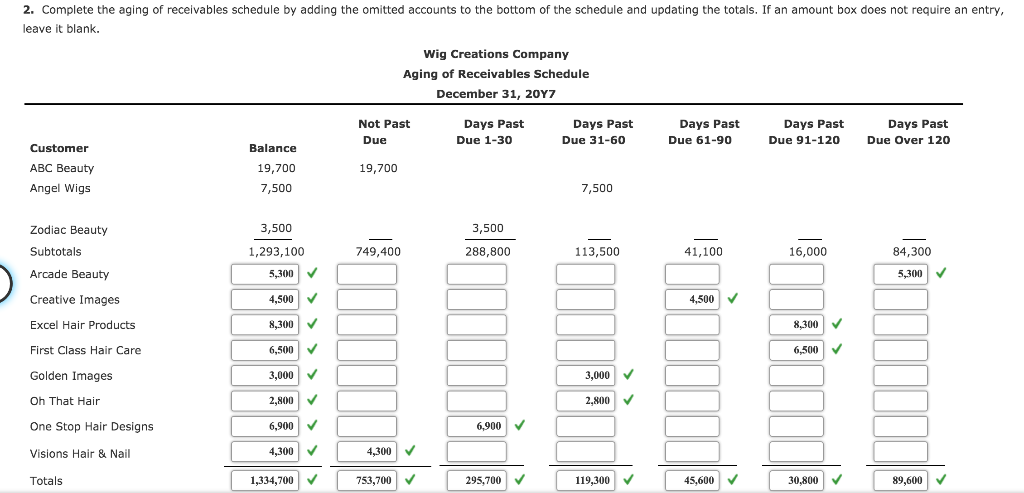

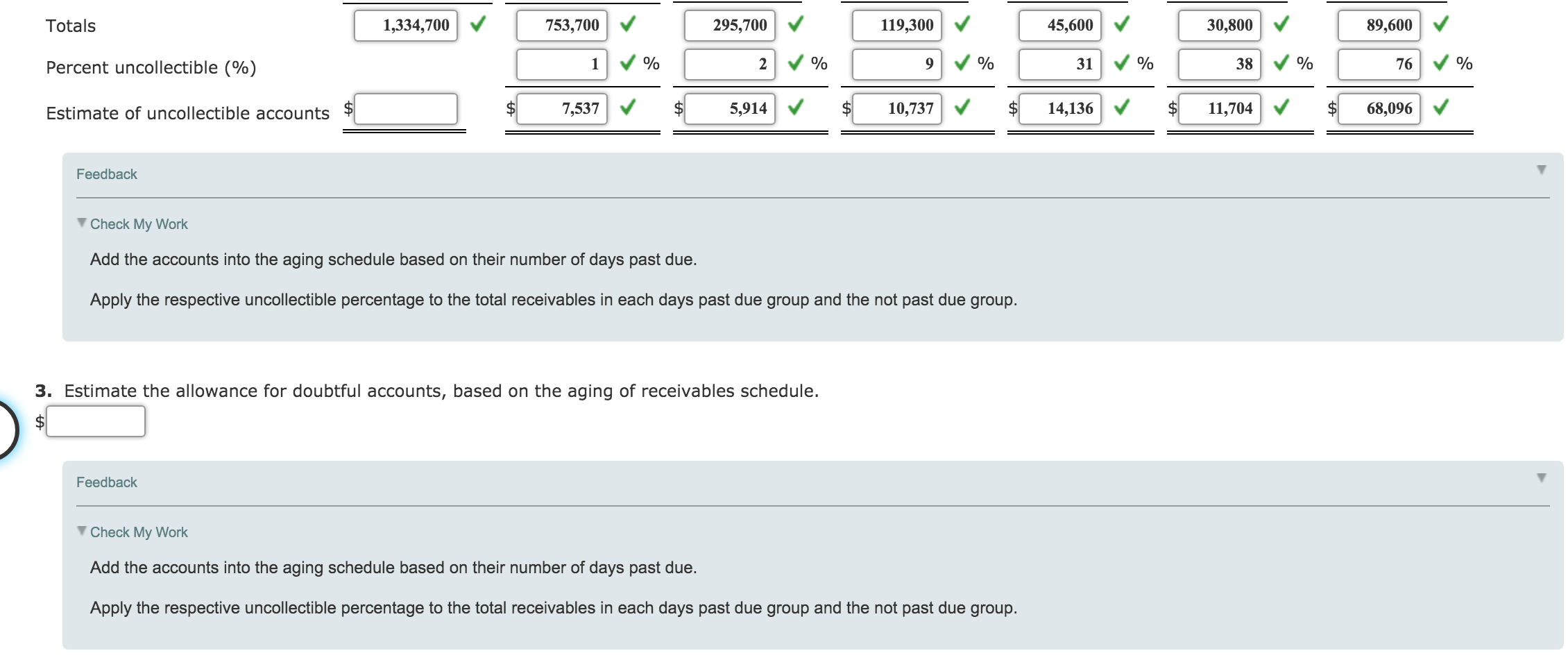

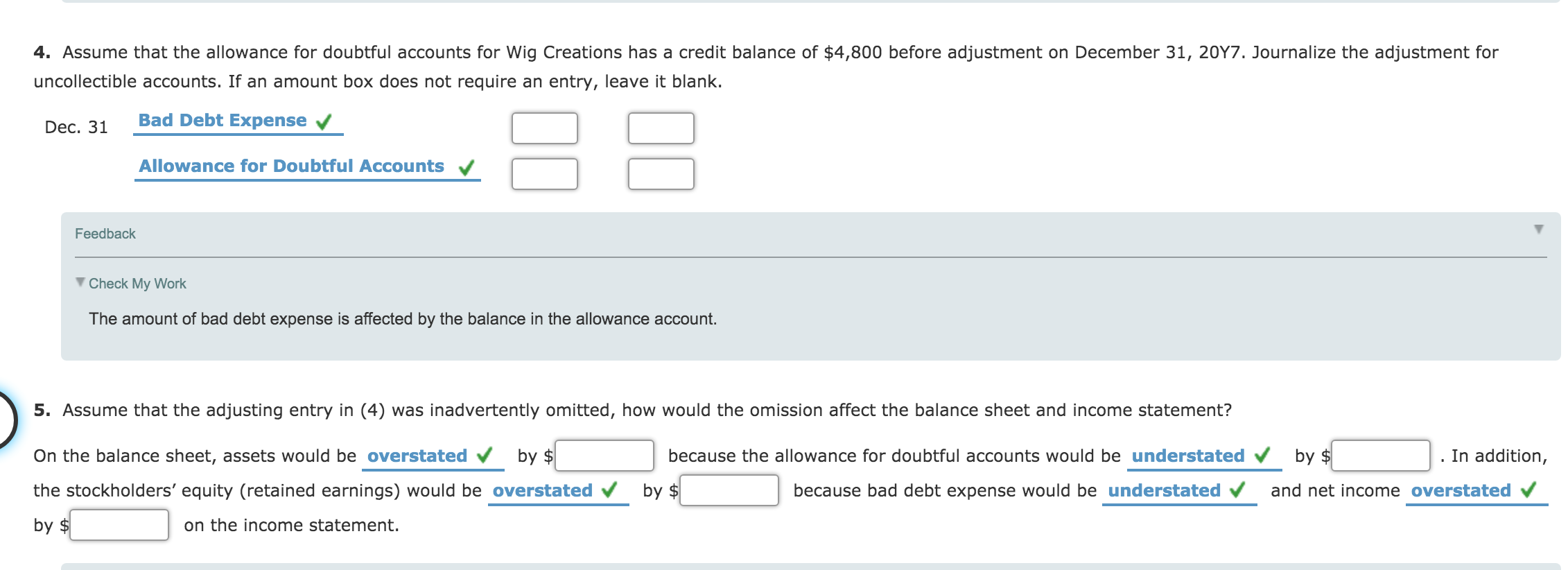

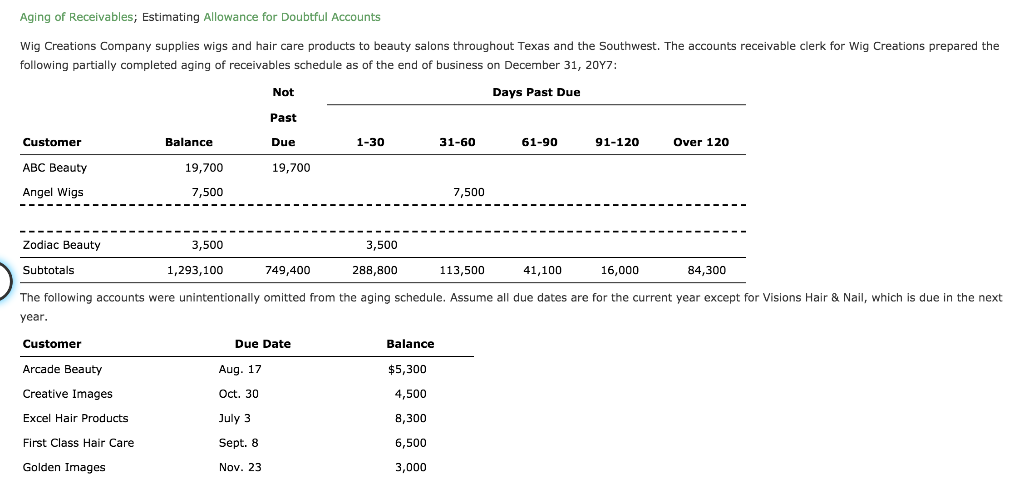

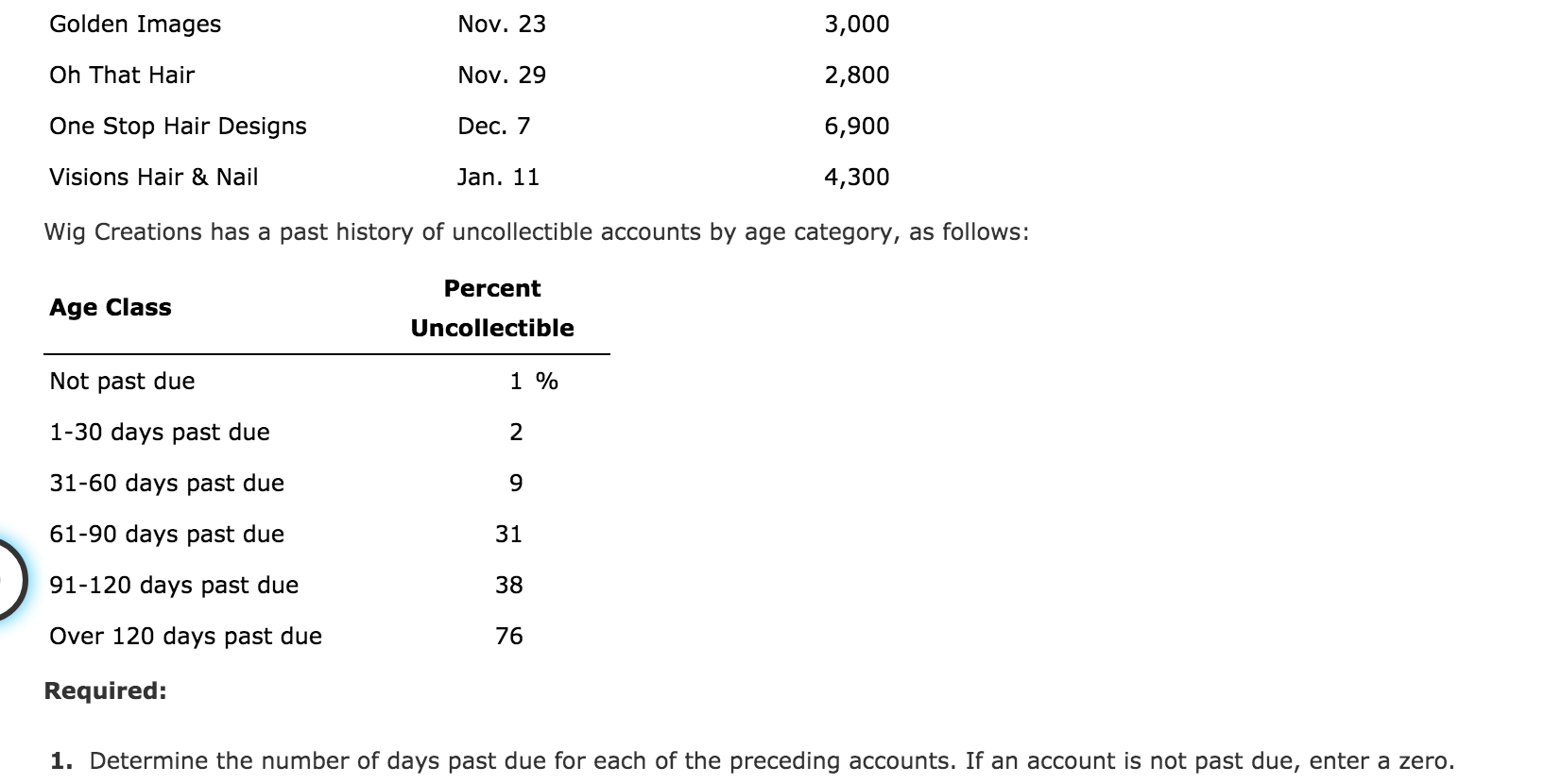

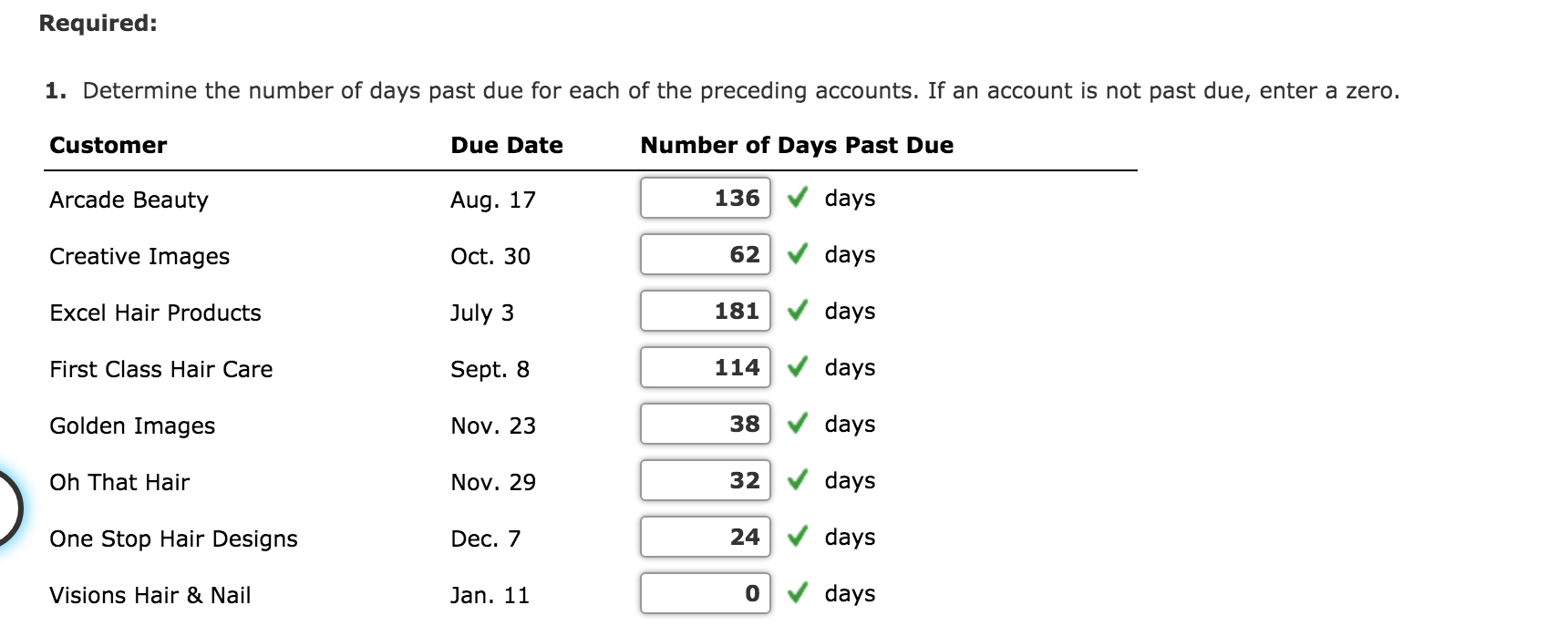

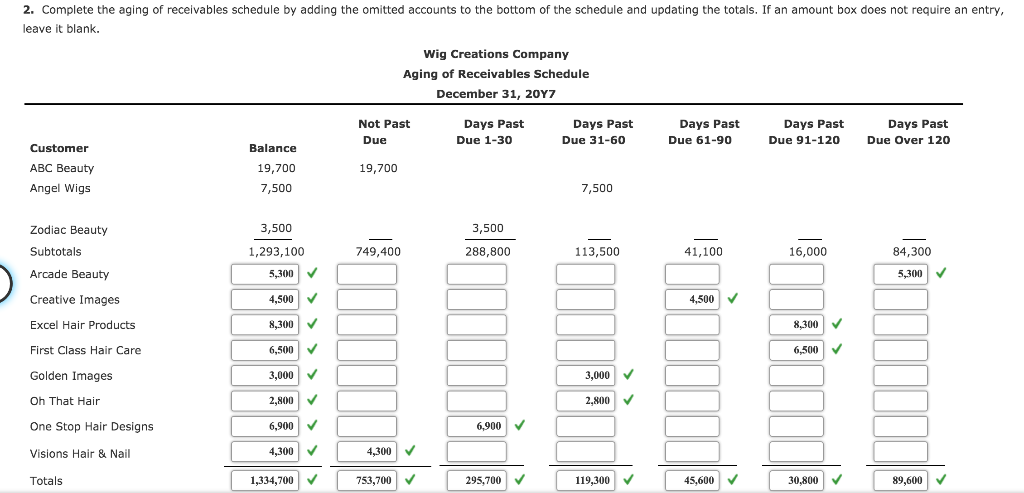

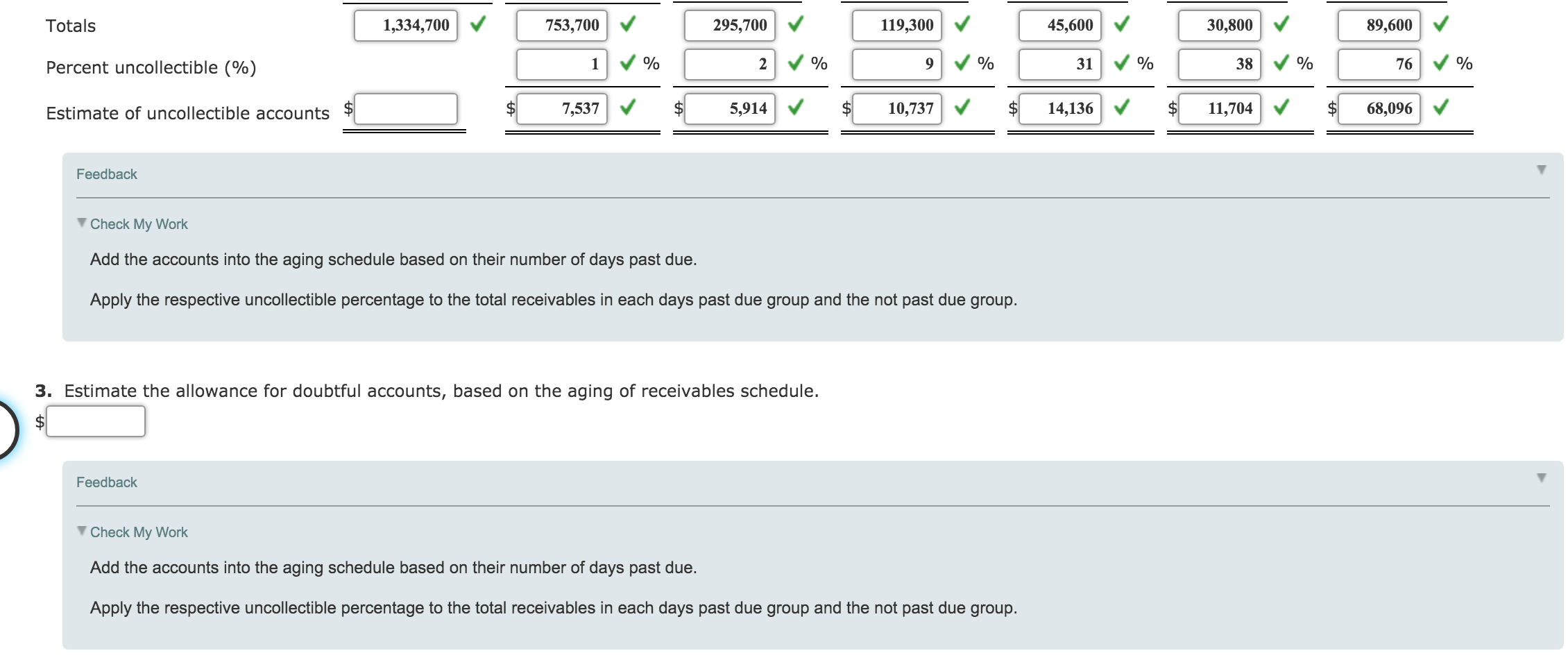

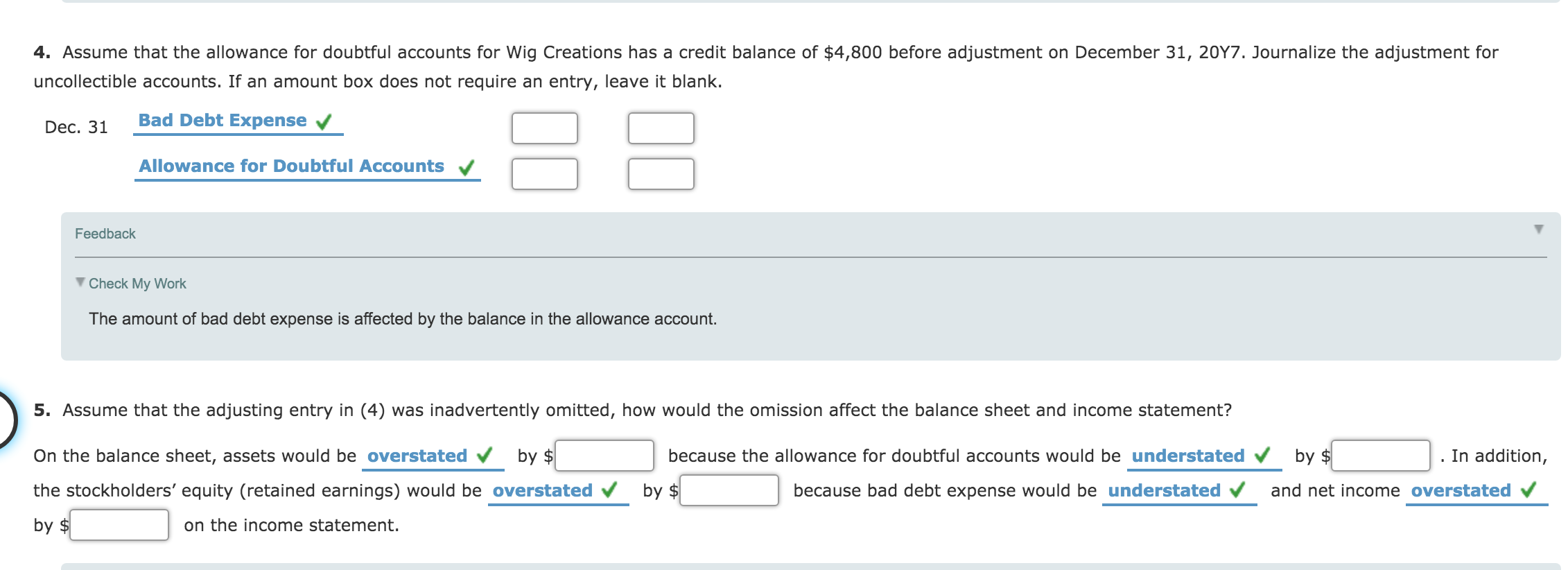

Aging of Receivables; Estimating Allowance for Doubtful Accounts Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 2017: Not Days Past Due Past Customer Balance Due 1-30 31-60 61-90 91-120 Over 120 ABC Beauty 19,700 19,700 Angel Wigs 7,500 7,500 Zodiac Beauty 3,500 3,500 Subtotals 1,293,100 749,400 288,800 113,500 41,100 16,000 84,300 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year. Customer Due Date Balance Arcade Beauty Aug. 17 $5,300 Creative Images Oct. 30 4,500 Excel Hair Products July 3 8,300 First Class Hair Care Sept. 8 6,500 Golden Images Nov. 23 3,000 Golden Images Nov. 23 3,000 Oh That Hair Nov. 29 2,800 One Stop Hair Designs Dec. 7 6,900 Visions Hair & Nail Jan. 11 4,300 Wig Creations has a past history of uncollectible accounts by age category, as follows: Age Class Percent Uncollectible Not past due 1 % 1-30 days past due 2 31-60 days past due 9 61-90 days past due 31 91-120 days past due 38 Over 120 days past due 76 Required: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. Required: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. Customer Due Date Number of Days Past Due Arcade Beauty Aug. 17 136 days Creative Images Oct. 30 62 days Excel Hair Products July 3 181 days First Class Hair Care Sept. 8 114 days Golden Images Nov. 23 38 days Oh That Hair Nov. 29 32 days One Stop Hair Designs Dec. 7 24 days Visions Hair & Nail Jan. 11 0 days 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. If an amount box does not require an entry, leave it blank. Wig Creations Company Aging of Receivables Schedule December 31, 2017 Not Past Due Days Past Due 1-30 Days Past Due 31-60 Days Past Due 61-90 Days Past Due 91-120 Days Past Due Over 120 Customer ABC Beauty Angel Wigs Balance 19,700 7,500 19,700 7,500 3,500 Zodiac Beauty Subtotals 3,500 288,800 749,400 113,500 41,100 16,000 84,300 1,293,100 5,300 Arcade Beauty 5,300 Creative Images 4,500 4,500 Excel Hair Products 8,300 8,300 First Class Hair Care 6,500 6,500 Golden Images 3,000 3,000 Oh That Hair 2,800 2,800 One Stop Hair Designs 6,900 6,900 Visions Hair & Nail 4,300 4,300 Totals 1,334,700 753,700 295,700 119,300 45,600 30,800 89,600 Totals 1,334,700 753,700 295,700 119,300 45,600 30,800 89,600 Percent uncollectible (%) 1 % 2 % 9 % 31 % 38 % 76 % Estimate of uncollectible accounts $ 7,537 $ 5,914 $ 10,737 14,136 11,704 68,096 Feedback Check My Work Add the accounts into the aging schedule based on their number of days past due. Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past due group. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. $ Feedback Check My Work Add the accounts into the aging schedule based on their number of days past due. Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past due group. 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $4,800 before adjustment on December 31, 2017. Journalize the adjustment for uncollectible accounts. If an amount box does not require an entry, leave it blank. Dec. 31 Bad Debt Expense Allowance for Doubtful Accounts Feedback Check My Work The amount of bad debt expense is affected by the balance in the allowance account. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? because the allowance for doubtful accounts would be understated On the balance sheet, assets would be overstated by $ the stockholders' equity (retained earnings) would be overstated by $ In addition, and net income overstated by $ because bad debt expense would be understated by $ on the income statement