Answered step by step

Verified Expert Solution

Question

1 Approved Answer

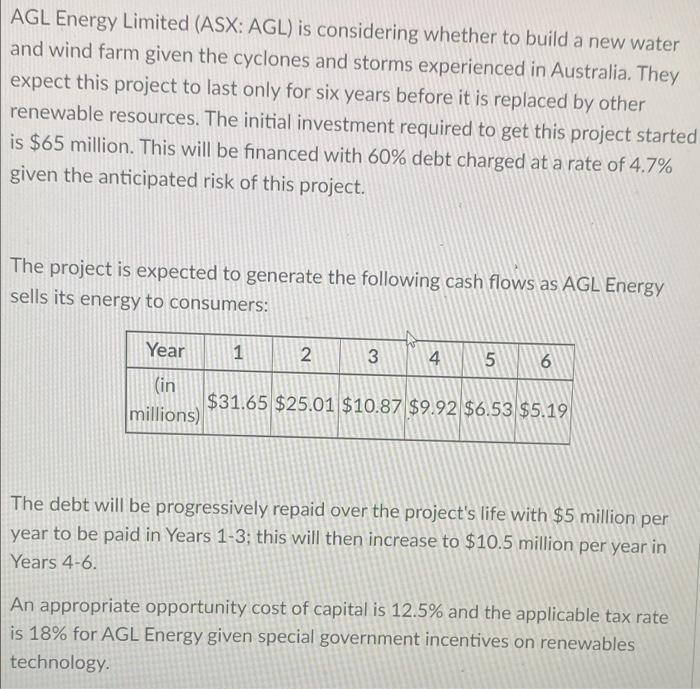

AGL Energy Limited (ASX: AGL) is considering whether to build a new water and wind farm given the cyclones and storms experienced in Australia.

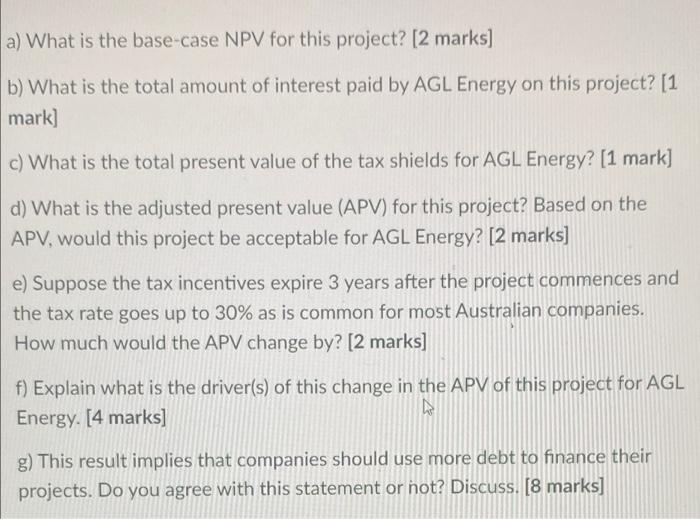

AGL Energy Limited (ASX: AGL) is considering whether to build a new water and wind farm given the cyclones and storms experienced in Australia. They expect this project to last only for six years before it is replaced by other renewable resources. The initial investment required to get this project started is $65 million. This will be financed with 60% debt charged at a rate of 4.7% given the anticipated risk of this project. The project is expected to generate the following cash flows as AGL Energy sells its energy to consumers: Year 1 2 3 4 5 6 (in millions) $31.65 $25.01 $10.87 $9.92 $6.53 $5.19 The debt will be progressively repaid over the project's life with $5 million per year to be paid in Years 1-3; this will then increase to $10.5 million per year in Years 4-6. An appropriate opportunity cost of capital is 12.5% and the applicable tax rate is 18% for AGL Energy given special government incentives on renewables technology. a) What is the base-case NPV for this project? [2 marks] b) What is the total amount of interest paid by AGL Energy on this project? [1 mark] c) What is the total present value of the tax shields for AGL Energy? [1 mark] d) What is the adjusted present value (APV) for this project? Based on the APV, would this project be acceptable for AGL Energy? [2 marks] e) Suppose the tax incentives expire 3 years after the project commences and the tax rate goes up to 30% as is common for most Australian companies. How much would the APV change by? [2 marks] f) Explain what is the driver(s) of this change in the APV of this project for AGL Energy. [4 marks] g) This result implies that companies should use more debt to finance their projects. Do you agree with this statement or not? Discuss. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the basecase NPV for the project we need to discount the cash flows and the tax shields at the opportunity cost of capital taking into ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started