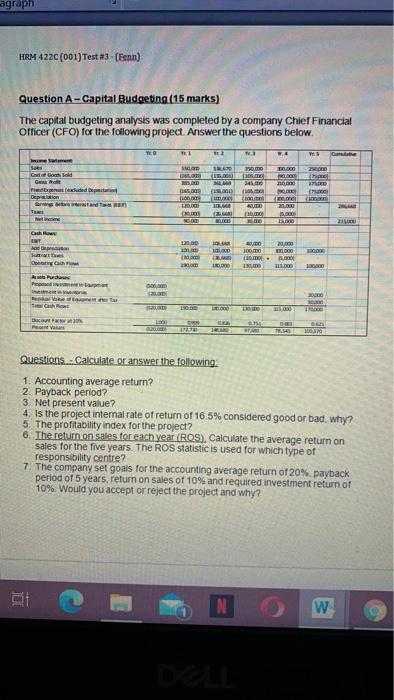

agraph HRM 4220 (001) Test #3 - Cenn) Question A - Capital Budgeting (15 marks) The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. YO 1 W. TES Game San TO Saks Get mod Ger | Feeded Depr Barina LAS DE 11:00 HD ( 200 0.000 name NO DELO 21.GO . () (1 CS 15. DO 12. DO DO welcome 90D BE Cach 20,000 EVO TO 10 10.00 Och 10.000 1. 100 Pudu Pro Dom 10 B PV Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS), Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20% payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why? N w agraph HRM 4220 (001) Test #3 - Cenn) Question A - Capital Budgeting (15 marks) The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. YO 1 W. TES Game San TO Saks Get mod Ger | Feeded Depr Barina LAS DE 11:00 HD ( 200 0.000 name NO DELO 21.GO . () (1 CS 15. DO 12. DO DO welcome 90D BE Cach 20,000 EVO TO 10 10.00 Och 10.000 1. 100 Pudu Pro Dom 10 B PV Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS), Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20% payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why? N w