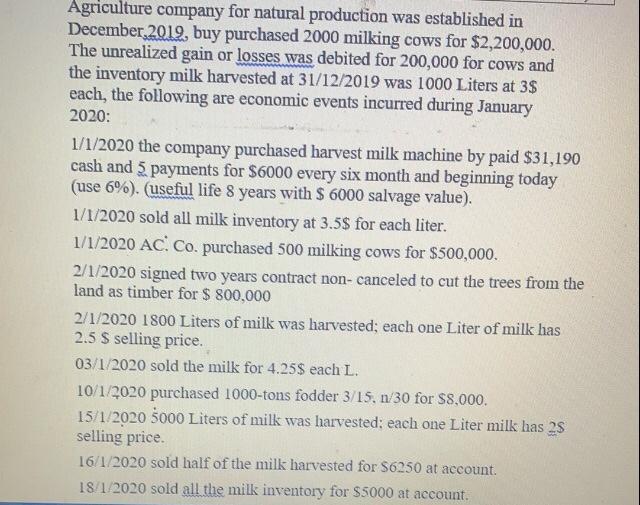

Agriculture company for natural production was established in December,2019, buy purchased 2000 milking cows for $2,200,000. The unrealized gain or losses was debited for 200,000 for cows and the inventory milk harvested at 31/12/2019 was 1000 Liters at 3$ each, the following are economic events incurred during January 2020: 1/1/2020 the company purchased harvest milk machine by paid $31,190 cash and 3 payments for $6000 every six month and beginning today (use 6%). (useful life 8 years with $ 6000 salvage value). 1/1/2020 sold all milk inventory at 3.5$ for each liter. 1/1/2020 AC Co. purchased 500 milking cows for $500,000. 2/1/2020 signed two years contract non-canceled to cut the trees from the land as timber for $ 800,000 2/1/2020 1800 Liters of milk was harvested; each one Liter of milk has 2.5 $ selling price. 03/1/2020 sold the milk for 4.25$ each L. 10/1/2020 purchased 1000-tons fodder 3/15, 1/30 for $8,000. 15/1/2020 5000 Liters of milk was harvested: each one Liter milk has 28 selling price. 16/1/2020 sold half of the milk harvested for $6250 at account. 18/1/2020 sold all the milk inventory for $5000 at account. Agriculture company for natural production was established in December,2019, buy purchased 2000 milking cows for $2,200,000. The unrealized gain or losses was debited for 200,000 for cows and the inventory milk harvested at 31/12/2019 was 1000 Liters at 3$ each, the following are economic events incurred during January 2020: 1/1/2020 the company purchased harvest milk machine by paid $31,190 cash and 3 payments for $6000 every six month and beginning today (use 6%). (useful life 8 years with $ 6000 salvage value). 1/1/2020 sold all milk inventory at 3.5$ for each liter. 1/1/2020 AC Co. purchased 500 milking cows for $500,000. 2/1/2020 signed two years contract non-canceled to cut the trees from the land as timber for $ 800,000 2/1/2020 1800 Liters of milk was harvested; each one Liter of milk has 2.5 $ selling price. 03/1/2020 sold the milk for 4.25$ each L. 10/1/2020 purchased 1000-tons fodder 3/15, 1/30 for $8,000. 15/1/2020 5000 Liters of milk was harvested: each one Liter milk has 28 selling price. 16/1/2020 sold half of the milk harvested for $6250 at account. 18/1/2020 sold all the milk inventory for $5000 at account