Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AgriFoods, Incorporated prepares and delivers agricultural products to industrial-scale kitchens and food service providers. One of its key customers is Home Kitchen & Company, which

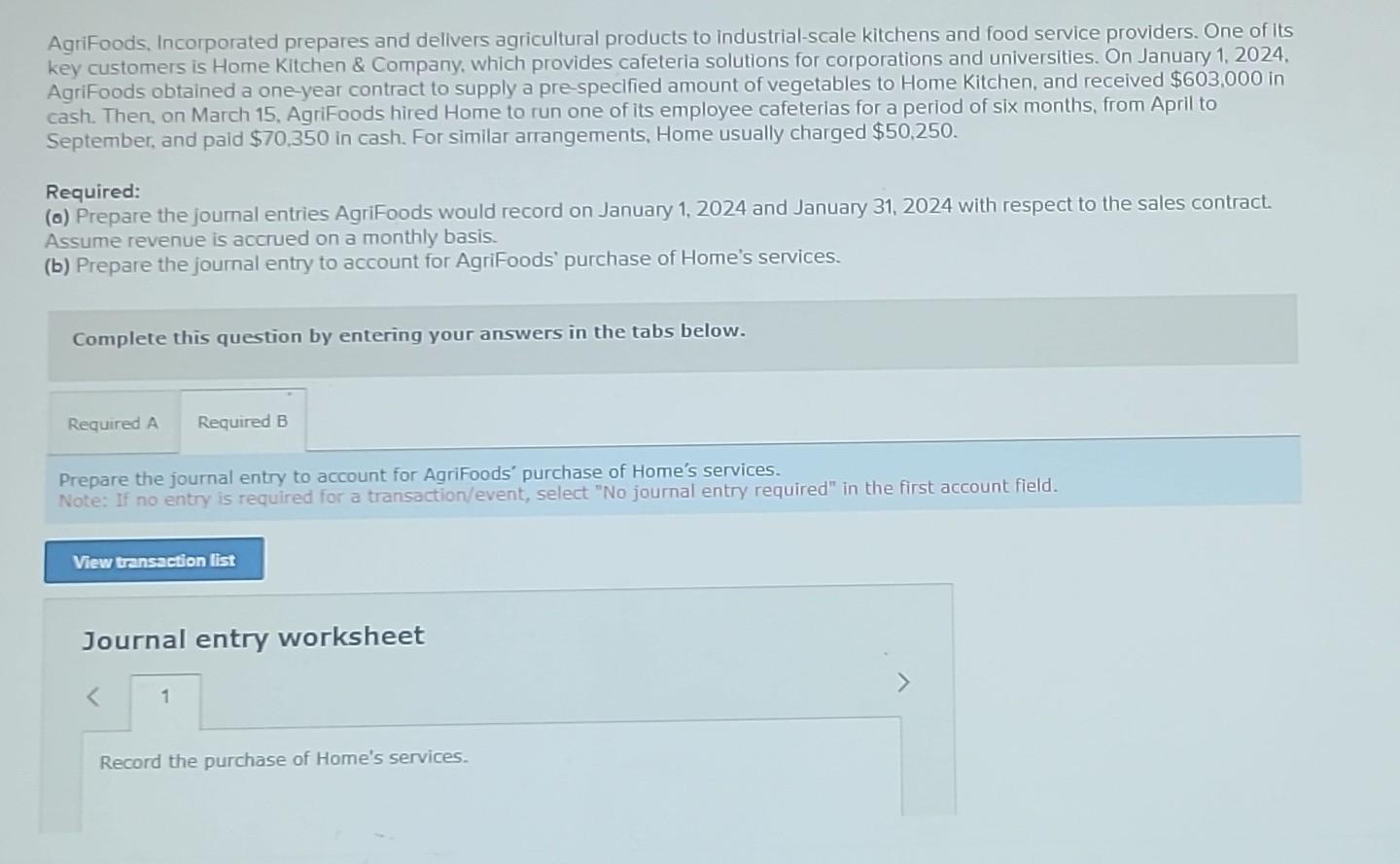

AgriFoods, Incorporated prepares and delivers agricultural products to industrial-scale kitchens and food service providers. One of its key customers is Home Kitchen \& Company, which provides cafeteria solutions for corporations and universities. On January 1, 2024. AgriFoods obtained a one-year contract to supply a pre-specified amount of vegetables to Home Kitchen, and received $603,000 in cash. Then, on March 15, AgriFoods hired Home to run one of its employee cafeterias for a period of six months, from April to September, and paid $70,350 in cash. For similar arrangements, Home usually charged $50,250. Required: (a) Prepare the journal entries AgriFoods would record on January 1, 2024 and January 31, 2024 with respect to the sales contract. Assume revenue is accrued on a monthly basis. (b) Prepare the journal entry to account for AgriFoods' purchase of Home's services. Complete this question by entering your answers in the tabs below. Prepare the journal entry to account for AgriFoods' purchase of Home's services. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. AgriFoods, Incorporated prepares and delivers agricultural products to industrial-scale kitchens and food service providers. One of its key customers is Home Kitchen \& Company, which provides cafeteria solutions for corporations and universities. On January 1, 2024. AgriFoods obtained a one-year contract to supply a pre-specified amount of vegetables to Home Kitchen, and received $603,000 in cash. Then, on March 15, AgriFoods hired Home to run one of its employee cafeterias for a period of six months, from April to September, and paid $70,350 in cash. For similar arrangements, Home usually charged $50,250. Required: (a) Prepare the journal entries AgriFoods would record on January 1, 2024 and January 31, 2024 with respect to the sales contract. Assume revenue is accrued on a monthly basis. (b) Prepare the journal entry to account for AgriFoods' purchase of Home's services. Complete this question by entering your answers in the tabs below. Prepare the journal entry to account for AgriFoods' purchase of Home's services. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started