Question

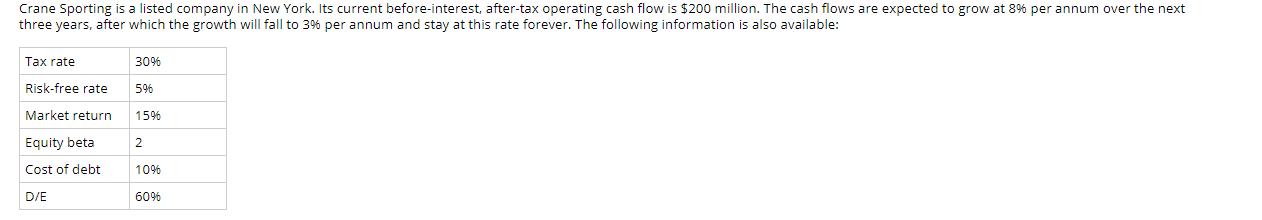

Crane Sporting is a listed company in New York. Its current before-interest, after-tax operating cash flow is $200 million. The cash flows are expected

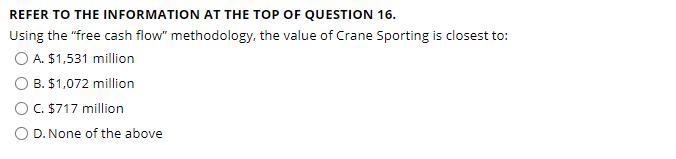

Crane Sporting is a listed company in New York. Its current before-interest, after-tax operating cash flow is $200 million. The cash flows are expected to grow at 8% per annum over the next three years, after which the growth will fall to 3% per annum and stay at this rate forever. The following information is also available: Tax rate Risk-free rate Market return Equity beta Cost of debt D/E 30% 5% 15% 2 10% 60% REFER TO THE INFORMATION AT THE TOP OF QUESTION 16. Using the "free cash flow" methodology, the value of Crane Sporting is closest to: O A. $1,531 million O B. $1,072 million C. $717 million D. None of the above

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Wd Weight of Debt x We Weight of Equity 1x Debt Equity 60 x 1x 60 16 x 06 x 0375 1x 0625 rd Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Charles E. Davis, Elizabeth Davis

2nd edition

1118548639, 9781118800713, 1118338448, 9781118548639, 1118800710, 978-1118338445

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App