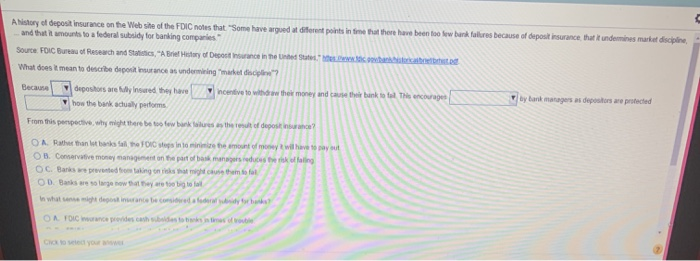

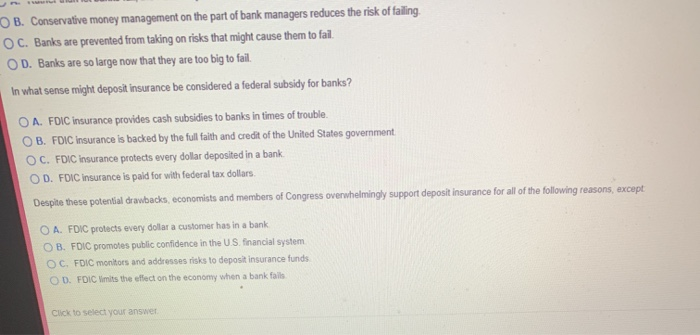

Ahistory of deposit insurance on the Web site of the FDIC notes that "Some have argued at diferent points in fime that there have been foo few bank fallures because of deposit insurance that it undemines market discipline and that it amounts to a federal subsidy for banking companies Source FOIC Bureau of Research and Statistics, "A Brief Histary of Depost Insurance in the Uned States. eichantorkathoebrht.o What does it mean to describe depost insurance as undermining "market discipline? depostors are ly Insred they hae how the bank acually performs incentive to withdraw their money and cause their bank to fal This encourages Because by bank managers as depostors are protected From this penpective, why might there be too few bank alues as the result of deposit insurance? OA Rather than lst banks fall the FOIC steps in to minimize the amount of money t wil have to pay sut OB. Conservative money management on the part of bask managers educes the risk of falling OC Banks ae prevented from taking on isks that might cause them o fat OD Basks are so large now that tey are too big to lal In what sense might depost insrance be considired a federal bidy for banks OA FOIC iurance prevides cash subeides to bnks in imas of ouble Cick to setec your answe O B. Conservative money management on the part of bank managers reduces the risk of failing OC. Banks are prevented from taking on risks that might cause them to fail OD. Banks are so large now that they are too big to fail In what sense might deposit insurance be considered a federal subsidy for banks? OA. FDIC insurance provides cash subsidies to banks in times of trouble. OB. FDIC insurance is backed by the full faith and credit of the United States government OC. FDIC insurance protects every dollar deposited in a bank OD. FDIC insurance is paid for with federal tax dollars. Despite these potential drawbacks, economists and members of Congress overwhelmingly support deposit insurance for all of the following reasons, except O A. FDIC protects every dollar a customer has in a bank O B. FDIC promotes public confidence in the US. financial system OC. FDIC monltors and addresses risks to deposit insurance funds OD. FDIC limits the effect on the economy when a bank fails Click to select your answer Ahistory of deposit insurance on the Web site of the FDIC notes that "Some have argued at diferent points in fime that there have been foo few bank fallures because of deposit insurance that it undemines market discipline and that it amounts to a federal subsidy for banking companies Source FOIC Bureau of Research and Statistics, "A Brief Histary of Depost Insurance in the Uned States. eichantorkathoebrht.o What does it mean to describe depost insurance as undermining "market discipline? depostors are ly Insred they hae how the bank acually performs incentive to withdraw their money and cause their bank to fal This encourages Because by bank managers as depostors are protected From this penpective, why might there be too few bank alues as the result of deposit insurance? OA Rather than lst banks fall the FOIC steps in to minimize the amount of money t wil have to pay sut OB. Conservative money management on the part of bask managers educes the risk of falling OC Banks ae prevented from taking on isks that might cause them o fat OD Basks are so large now that tey are too big to lal In what sense might depost insrance be considired a federal bidy for banks OA FOIC iurance prevides cash subeides to bnks in imas of ouble Cick to setec your answe O B. Conservative money management on the part of bank managers reduces the risk of failing OC. Banks are prevented from taking on risks that might cause them to fail OD. Banks are so large now that they are too big to fail In what sense might deposit insurance be considered a federal subsidy for banks? OA. FDIC insurance provides cash subsidies to banks in times of trouble. OB. FDIC insurance is backed by the full faith and credit of the United States government OC. FDIC insurance protects every dollar deposited in a bank OD. FDIC insurance is paid for with federal tax dollars. Despite these potential drawbacks, economists and members of Congress overwhelmingly support deposit insurance for all of the following reasons, except O A. FDIC protects every dollar a customer has in a bank O B. FDIC promotes public confidence in the US. financial system OC. FDIC monltors and addresses risks to deposit insurance funds OD. FDIC limits the effect on the economy when a bank fails Click to select your