Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ahjussi company has is a manufacturer and a retailer of household furniture. Your audit of the company's financial statements for the year ended December

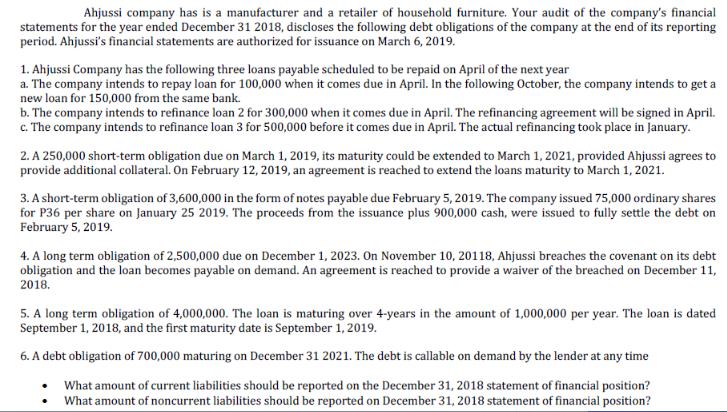

Ahjussi company has is a manufacturer and a retailer of household furniture. Your audit of the company's financial statements for the year ended December 31 2018, discloses the following debt obligations of the company at the end of its reporting period. Ahjussi's financial statements are authorized for issuance on March 6, 2019. 1. Ahjussi Company has the following three loans payable scheduled to be repaid on April of the next year a. The company intends to repay loan for 100,000 when it comes due in April. In the following October, the company intends to get a new loan for 150,000 from the same bank. b. The company intends to refinance loan 2 for 300,000 when it comes due in April. The refinancing agreement will be signed in April. c. The company intends to refinance loan 3 for 500,000 before it comes due in April. The actual refinancing took place in January. 2. A 250,000 short-term obligation due on March 1, 2019, its maturity could be extended to March 1, 2021, provided Ahjussi agrees to provide additional collateral. On February 12, 2019, an agreement is reached to extend the loans maturity to March 1, 2021. 3. A short-term obligation of 3,600,000 in the form of notes payable due February 5, 2019. The company issued 75,000 ordinary shares for P36 per share on January 25 2019. The proceeds from the issuance plus 900,000 cash, were issued to fully settle the debt on February 5, 2019. 4. A long term obligation of 2,500,000 due on December 1, 2023. On November 10, 20118, Ahjussi breaches the covenant on its debt obligation and the loan becomes payable on demand. An agreement is reached to provide a waiver of the breached on December 11, 2018. 5. A long term obligation of 4,000,000. The loan is maturing over 4-years in the amount of 1,000,000 per year. The loan is dated September 1, 2018, and the first maturity date is September 1, 2019. 6. A debt obligation of 700,000 maturing on December 31 2021. The debt is callable on demand by the lender at any time What amount of current liabilities should be reported on the December 31, 2018 statement of financial position? What amount of noncurrent liabilities should be reported on December 31, 2018 statement of financial position?

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of current liabilities on the December 31 2018 statement of financial positi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started