Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the adjusted balance of Accounts Receivable on December 31, 2014? 2. What is the adjusted balance of Allowance for Uncollectible accounts on December

What is the adjusted balance of Accounts Receivable on December 31, 2014?

2. What is the adjusted balance of Allowance for Uncollectible accounts on December 31, 2014?

3. What is the adjusted amount of 2014 Uncollectible accounts expense?

2. What is the adjusted balance of Allowance for Uncollectible accounts on December 31, 2014?

3. What is the adjusted amount of 2014 Uncollectible accounts expense?

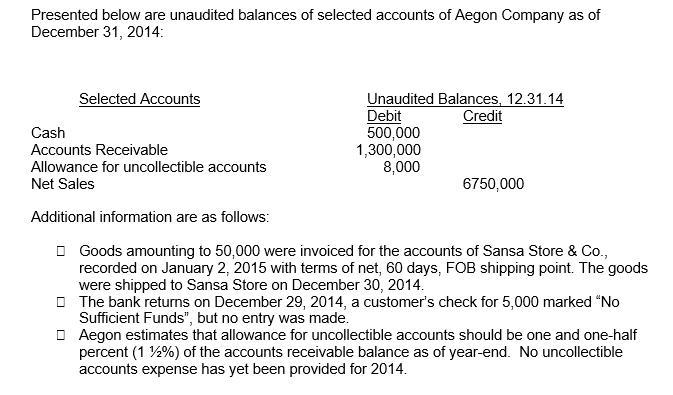

Presented below are unaudited balances of selected accounts of Aegon Company as of December 31, 2014: Selected Accounts Cash Accounts Receivable Allowance for uncollectible accounts Net Sales Unaudited Balances, 12.31.14 Debit Credit 500,000 1,300,000 8,000 6750,000 Additional information are as follows: Goods amounting to 50,000 were invoiced for the accounts of Sansa Store & Co., recorded on January 2, 2015 with terms of net, 60 days, FOB shipping point. The goods were shipped to Sansa Store on December 30, 2014. The bank returns on December 29, 2014, a customer's check for 5,000 marked "No Sufficient Funds", but no entry was made. Aegon estimates that allowance for uncollectible accounts should be one and one-half percent (1 %) of the accounts receivable balance as of year-end. No uncollectible accounts expense has yet been provided for 2014.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Adjusted Balance of Accounts Receivable on December 31 2014 Accounts Receivable balance as of Decemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started