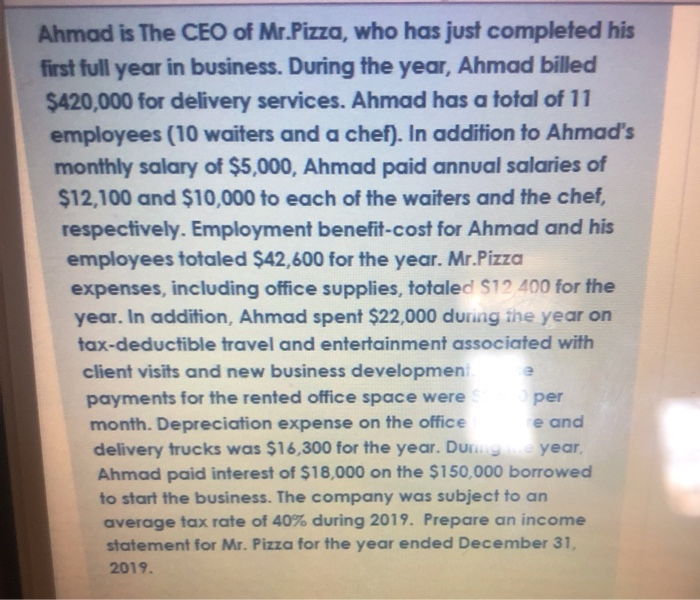

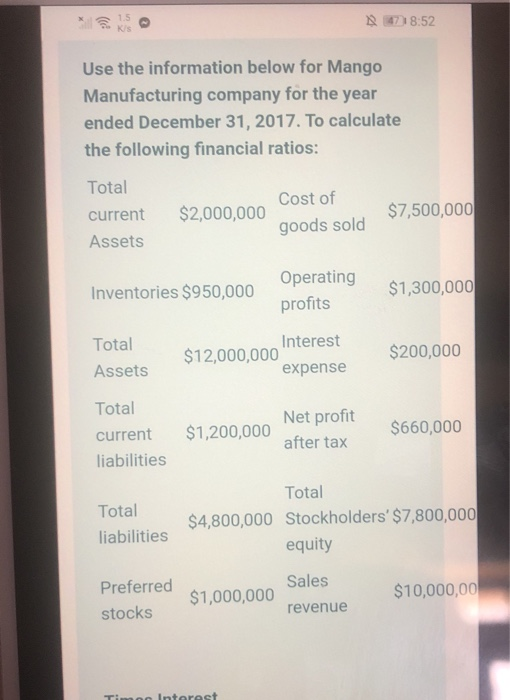

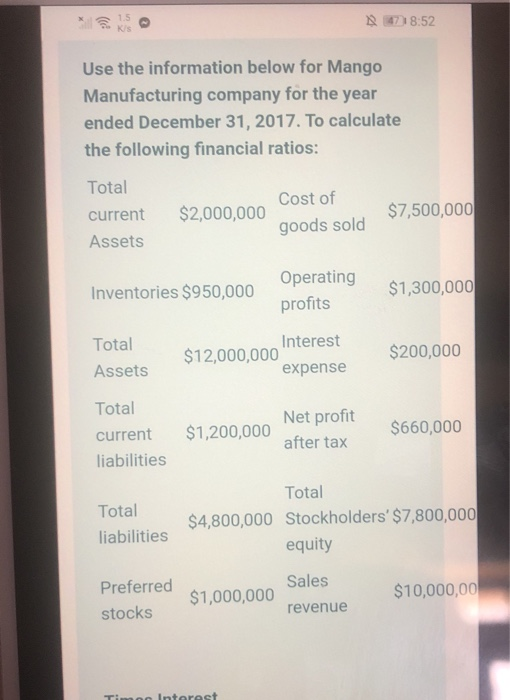

Ahmad is The CEO of Mr.Pizza, who has just completed his first full year in business. During the year, Ahmad billed $420,000 for delivery services. Ahmad has a total of 11 employees (10 waiters and a chef). In addition to Ahmad's monthly salary of $5,000, Ahmad paid annual salaries of $12,100 and $10,000 to each of the waiters and the chef, respectively. Employment benefit-cost for Ahmad and his employees totaled $42,600 for the year. Mr.Pizza expenses, including office supplies, totaled 512 400 for the year. In addition, Ahmad spent $22,000 during the year on tax-deductible travel and entertainment associated with client visits and new business development payments for the rented office space were per month. Depreciation expense on the office e and delivery trucks was $16,300 for the year. During year, Ahmad paid interest of $18,000 on the $150,000 borrowed to start the business. The company was subject to an average tax rate of 40% during 2019. Prepare an income statement for Mr. Pizza for the year ended December 31, 2019. 1.5 K's 47 8:52 Use the information below for Mango Manufacturing company for the year ended December 31, 2017. To calculate the following financial ratios: Total current Assets $2,000,000 Cost of goods sold $7,500,000 Inventories $950,000 Operating profits $1,300,000 Total Assets Interest $12,000,000 expense $200,000 Total current liabilities $1,200,000 Net profit after tax $660,000 Total liabilities Total $4,800,000 Stockholders' $7,800,000 equity Sales Preferred stocks $1,000,000 $10,000,00 revenue Interest Ahmad is The CEO of Mr.Pizza, who has just completed his first full year in business. During the year, Ahmad billed $420,000 for delivery services. Ahmad has a total of 11 employees (10 waiters and a chef). In addition to Ahmad's monthly salary of $5,000, Ahmad paid annual salaries of $12,100 and $10,000 to each of the waiters and the chef, respectively. Employment benefit-cost for Ahmad and his employees totaled $42,600 for the year. Mr.Pizza expenses, including office supplies, totaled 512 400 for the year. In addition, Ahmad spent $22,000 during the year on tax-deductible travel and entertainment associated with client visits and new business development payments for the rented office space were per month. Depreciation expense on the office e and delivery trucks was $16,300 for the year. During year, Ahmad paid interest of $18,000 on the $150,000 borrowed to start the business. The company was subject to an average tax rate of 40% during 2019. Prepare an income statement for Mr. Pizza for the year ended December 31, 2019. 1.5 K's 47 8:52 Use the information below for Mango Manufacturing company for the year ended December 31, 2017. To calculate the following financial ratios: Total current Assets $2,000,000 Cost of goods sold $7,500,000 Inventories $950,000 Operating profits $1,300,000 Total Assets Interest $12,000,000 expense $200,000 Total current liabilities $1,200,000 Net profit after tax $660,000 Total liabilities Total $4,800,000 Stockholders' $7,800,000 equity Sales Preferred stocks $1,000,000 $10,000,00 revenue Interest