Question

Ahmad would like to invest in shares of Ingress Corporation. The current price of the shares is RM2.50. Last year the company paid a

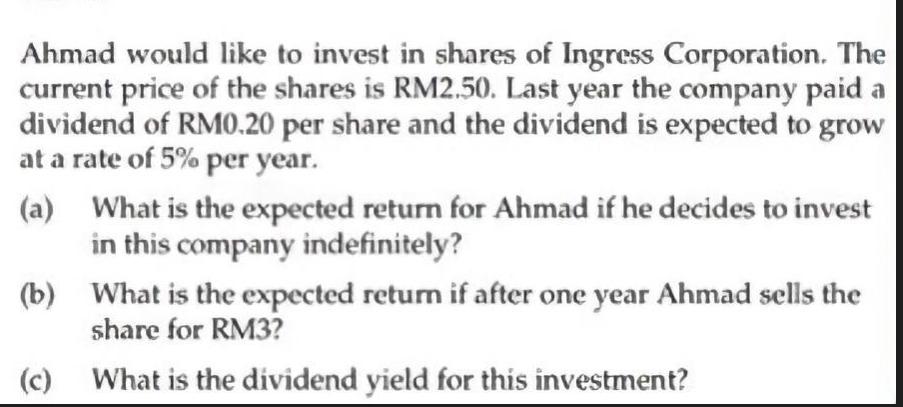

Ahmad would like to invest in shares of Ingress Corporation. The current price of the shares is RM2.50. Last year the company paid a dividend of RM0.20 per share and the dividend is expected to grow at a rate of 5% per year. (a) What is the expected return for Ahmad if he decides to invest in this company indefinitely? (b) What is the expected return if after one year Ahmad sells the share for RM3? What is the dividend yield for this investment? (c)

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Ingress Corporation Investment Analysis Assumptions Current share priceRM250 Last years dividendRM02...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finance for Non Financial Managers

Authors: Pierre Bergeron

7th edition

176530835, 978-0176530839

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App