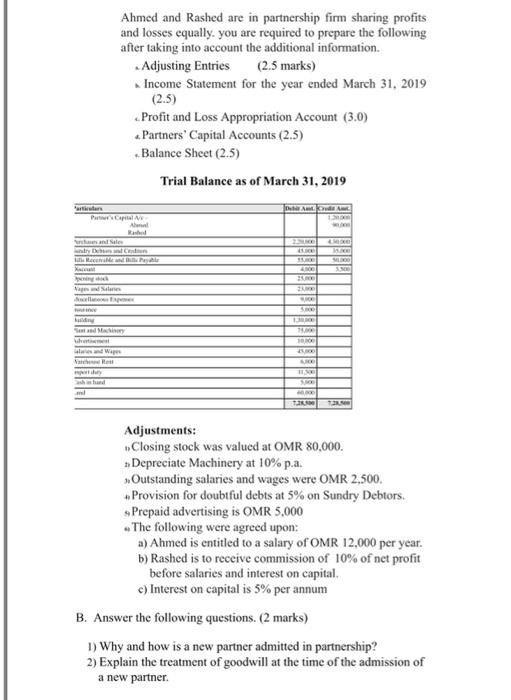

Ahmed and Rashed are in partnership firm sharing profits and losses equally, you are required to prepare the following after taking into account the additional information. Adjusting Entries (2.5 marks) Income Statement for the year ended March 31, 2019 (2.5) Profit and Loss Appropriation Account (3.0) Partners' Capital Accounts (2.5) Balance Sheet (2.5) Trial Balance as of March 31, 2019 Ad AB Rad es Sale 4 Name 15 Mainm VaR Adjustments: Closing stock was valued at OMR 80,000. Depreciate Machinery at 10% p.a. Outstanding salaries and wages were OMR 2,500. Provision for doubtful debts at 5% on Sundry Debtors. Prepaid advertising is OMR 5,000 The following were agreed upon: a) Ahmed is entitled to a salary of OMR 12,000 per year. b) Rashed is to receive commission of 10% of net profit before salaries and interest on capital c) Interest on capital is 5% per annum B. Answer the following questions. (2 marks) 1) Why and how is a new partner admitted in partnership? 2) Explain the treatment of goodwill at the time of the admission of a new partner Ahmed and Rashed are in partnership firm sharing profits and losses equally, you are required to prepare the following after taking into account the additional information. Adjusting Entries (2.5 marks) Income Statement for the year ended March 31, 2019 (2.5) Profit and Loss Appropriation Account (3.0) Partners' Capital Accounts (2.5) Balance Sheet (2.5) Trial Balance as of March 31, 2019 Ad AB Rad es Sale 4 Name 15 Mainm VaR Adjustments: Closing stock was valued at OMR 80,000. Depreciate Machinery at 10% p.a. Outstanding salaries and wages were OMR 2,500. Provision for doubtful debts at 5% on Sundry Debtors. Prepaid advertising is OMR 5,000 The following were agreed upon: a) Ahmed is entitled to a salary of OMR 12,000 per year. b) Rashed is to receive commission of 10% of net profit before salaries and interest on capital c) Interest on capital is 5% per annum B. Answer the following questions. (2 marks) 1) Why and how is a new partner admitted in partnership? 2) Explain the treatment of goodwill at the time of the admission of a new partner