Question

Ahmed Sulfi Hotels (ASH) SAOG is well established hotel network in the sultanate. With spectacular views of the majestic Hajar mountains and just steps away

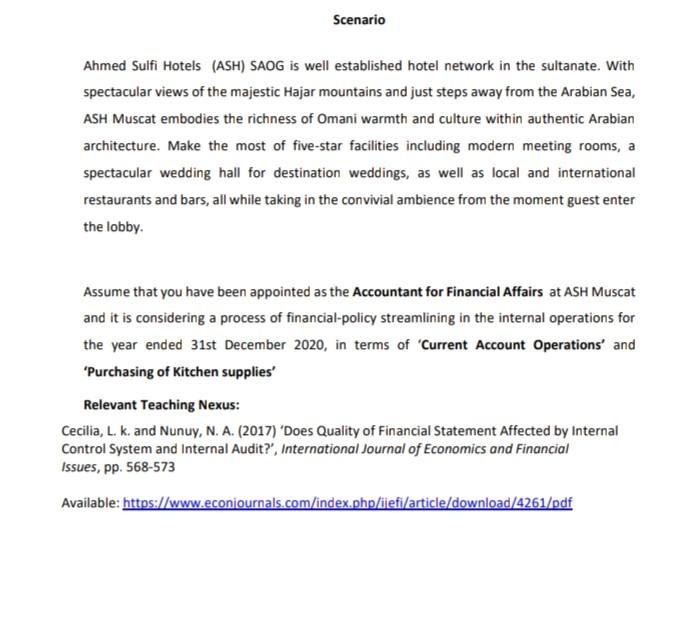

Ahmed Sulfi Hotels (ASH) SAOG is well established hotel network in the sultanate. With spectacular views of the majestic Hajar mountains and just steps away from the Arabian Sea, ASH Muscat embodies the richness of Omani warmth and culture within authentic Arabian architecture. Make the most of five-star facilities including modern meeting rooms, a spectacular wedding hall for destination weddings, as well as local and international restaurants and bars, all while taking in the convivial ambience from the moment guest enter the lobby. Assume that you have been appointed as the Accountant for Financial Affairs at ASH Muscat and it is considering a process of financial-policy streamlining in the internal operations for the year ended 31st December 2020, in terms of Current Account Operations and Purchasing of Kitchen supplies Relevant Teaching Nexus:

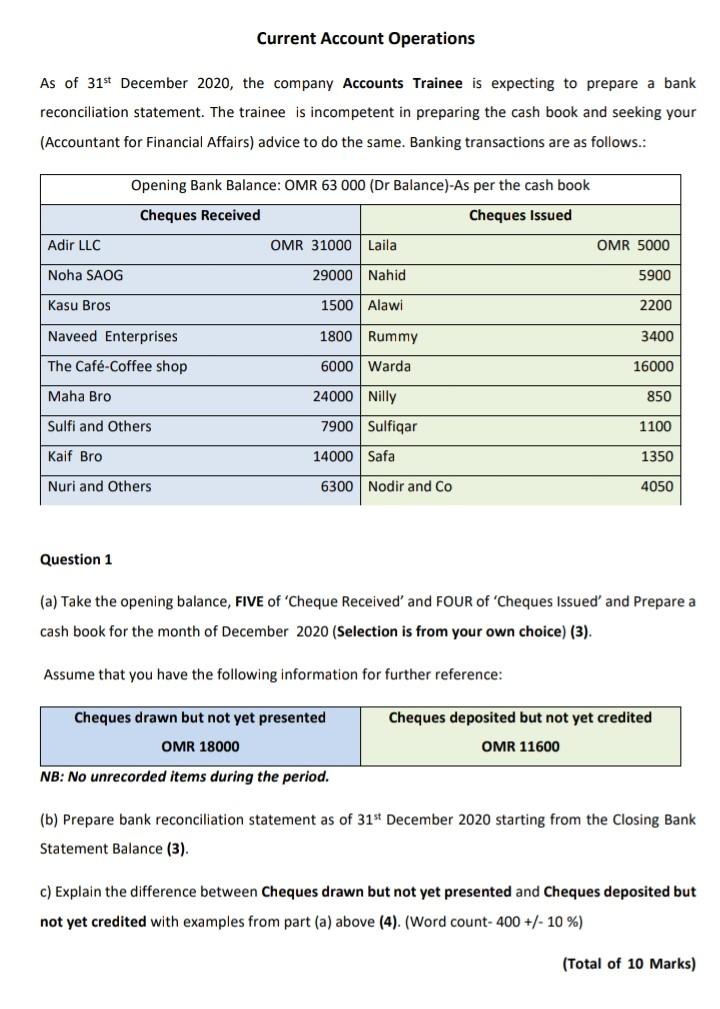

Scenario Ahmed Sulfi Hotels (ASH) SAOG is well established hotel network in the sultanate. With spectacular views of the majestic Hajar mountains and just steps away from the Arabian Sea, ASH Muscat embodies the richness of Omani warmth and culture within authentic Arabian architecture. Make the most of five-star facilities including modern meeting rooms, a spectacular wedding hall for destination weddings, as well as local and international restaurants and bars, all while taking in the convivial ambience from the moment guest enter the lobby. Assume that you have been appointed as the Accountant for Financial Affairs at ASH Muscat and it is considering a process of financial-policy streamlining in the internal operations for the year ended 31st December 2020, in terms of 'Current Account Operations and 'Purchasing of Kitchen supplies' Relevant Teaching Nexus: Cecilia, L. k. and Nunuy, N. A. (2017) 'Does Quality of Financial Statement Affected by Internal Control System and Internal Audit?', International Journal of Economics and Financial Issues, pp. 568-573 Available: https://www.econjournals.com/index.php/jefi/article/download/4261/pdf Current Account Operations As of 31st December 2020, the company Accounts Trainee is expecting to prepare a bank reconciliation statement. The trainee is incompetent in preparing the cash book and seeking your (Accountant for Financial Affairs) advice to do the same. Banking transactions are as follows.: Opening Bank Balance: OMR 63 000 (Dr Balance)-As per the cash book Cheques Received Cheques Issued OMR 31000 Laila OMR 5000 Adir LLC Noha SAOG 29000 Nahid 5900 Kasu Bros 1500 Alawi 2200 Naveed Enterprises 1800 Rummy 3400 The Caf-Coffee shop 6000 Warda 16000 Maha Bro 24000 Nilly 850 Sulfi and Others 7900 Sulfiqar 1100 Kaif Bro 14000 Safa 1350 Nuri and Others 6300 Nodir and Co 4050 Question 1 (a) Take the opening balance, FIVE of 'Cheque Received' and FOUR of 'Cheques Issued' and Prepare a cash book for the month of December 2020 (Selection is from your own choice) (3). Assume that you have the following information for further reference: Cheques drawn but not yet presented Cheques deposited but not yet credited OMR 18000 OMR 11600 NB: No unrecorded items during the period. (b) Prepare bank reconciliation statement as of 31st December 2020 starting from the Closing Bank Statement Balance (3). c) Explain the difference between Cheques drawn but not yet presented and Cheques deposited but not yet credited with examples from part (a) above (4). (Word count- 400 +/- 10%) (Total of 10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started