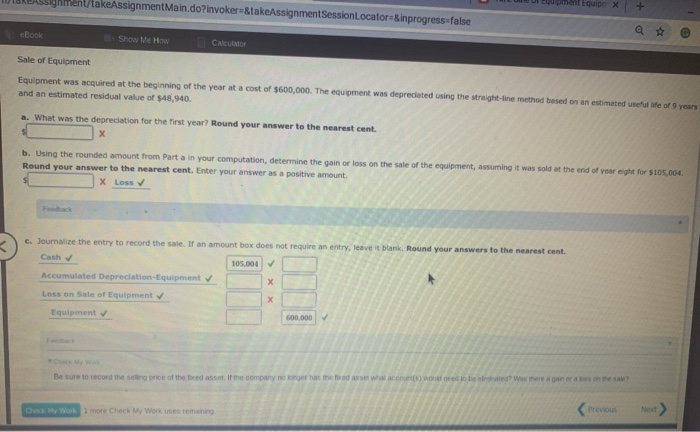

Ahment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false cuipient Equipe X + BOOK Show Me How Calculator Sale of Equipment Equipment was acquired at the beginning of the year at a cost of $600,000. The equipment was deprecated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $48,940 a. What was the depreciation for the first year? Round your answer to the nearest cent. X b. Using the rounded amount from Partain your computation, determine the pain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $105,004 Round your answer to the nearest cent. Enter your answer as a positive amount. X Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Cash 105.000 Accumulated Depreciation Equipment Loss on Sale of Equipment Equipment 600,000 Be sure to record the set price of the ed asset, if the company no longer has the foedas set WooC) wou need to be was there are also a Duck My Workmore Check My Work uses remaining Ahment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false cuipient Equipe X + BOOK Show Me How Calculator Sale of Equipment Equipment was acquired at the beginning of the year at a cost of $600,000. The equipment was deprecated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $48,940 a. What was the depreciation for the first year? Round your answer to the nearest cent. X b. Using the rounded amount from Partain your computation, determine the pain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $105,004 Round your answer to the nearest cent. Enter your answer as a positive amount. X Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Cash 105.000 Accumulated Depreciation Equipment Loss on Sale of Equipment Equipment 600,000 Be sure to record the set price of the ed asset, if the company no longer has the foedas set WooC) wou need to be was there are also a Duck My Workmore Check My Work uses remaining