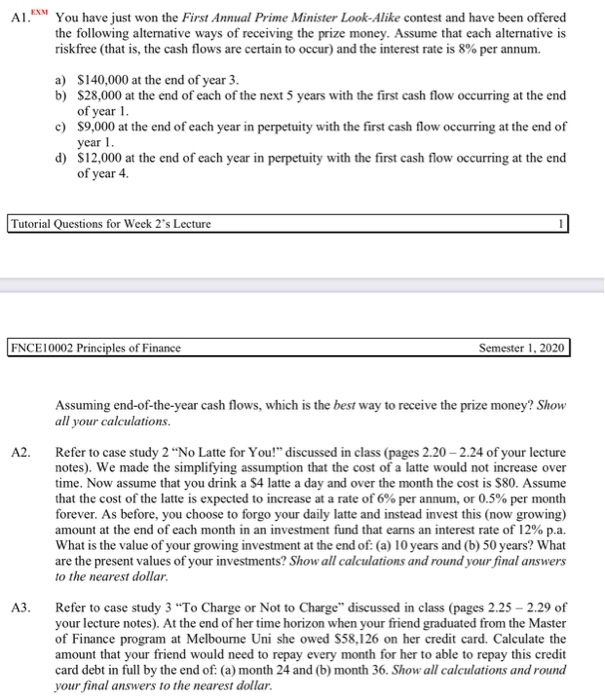

AIEN You have just won the First Annual Prime Minister Look-Alike contest and have been offered the following alternative ways of receiving the prize money. Assume that each alternative is risk free (that is, the cash flows are certain to occur) and the interest rate is 8% per annum. a) $140,000 at the end of year 3. b) $28,000 at the end of each of the next 5 years with the first cash flow occurring at the end of year 1. c) $9,000 at the end of each year in perpetuity with the first cash flow occurring at the end of year 1. d) $12,000 at the end of each year in perpetuity with the first cash flow occurring at the end of year 4. Tutorial Questions for Week 2's Lecture Lecture FNCE10002 Principles of Finance Semester 1, 2020 Assuming end-of-the-year cash flows, which is the best way to receive the prize money? Show all your calculations. A2 Refer to case study 2 "No Latte for You!" discussed in class (pages 2.20 -2.24 of your lecture notes). We made the simplifying assumption that the cost of a latte would not increase over time. Now assume that you drink a S4 latte a day and over the month the cost is $80. Assume that the cost of the latte is expected to increase at a rate of 6% per annum, or 0.5% per month forever. As before, you choose to forgo your daily latte and instead invest this (now growing) amount at the end of each month in an investment fund that earns an interest rate of 12% p.a. What is the value of your growing investment at the end of: (a) 10 years and (b) 50 years? What are the present values of your investments? Show all calculations and round your final answers to the nearest dollar. A3 Refer to case study 3 "To Charge or Not to Charge" discussed in class (pages 2.25 -2.29 of your lecture notes). At the end of her time horizon when your friend graduated from the Master of Finance program at Melbourne Uni she owed $58,126 on her credit card. Calculate the amount that your friend would need to repay every month for her to able to repay this credit card debt in full by the end of: (a) month 24 and (b) month 36. Show all calculations and round your final answers to the nearest dollar