Answered step by step

Verified Expert Solution

Question

1 Approved Answer

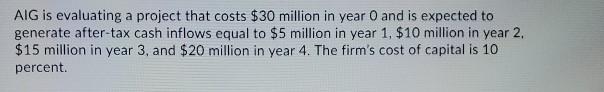

AIG is evaluating a project that costs $30 million in year and is expected to generate after-tax cash inflows equal to $5 million in year

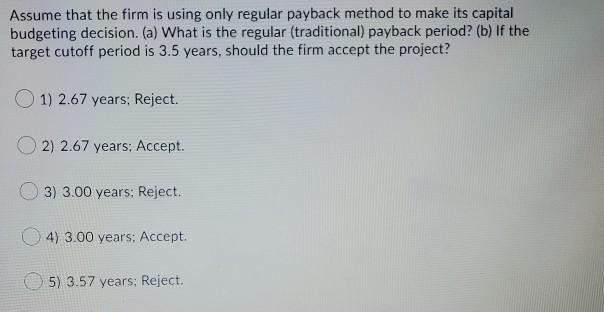

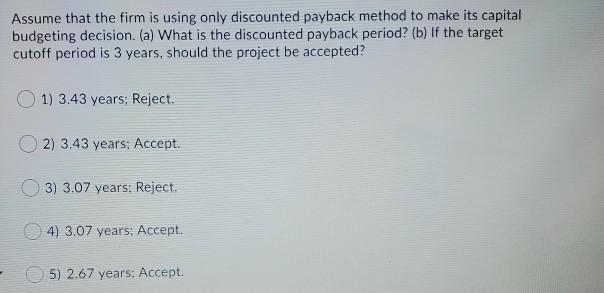

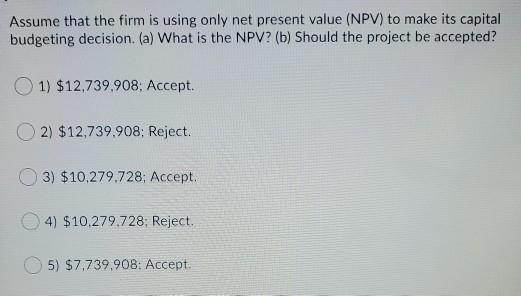

AIG is evaluating a project that costs $30 million in year and is expected to generate after-tax cash inflows equal to $5 million in year 1, $10 million in year 2 $15 million in year 3, and $20 million in year 4. The firm's cost of capital is 10 percent. Assume that the firm is using only regular payback method to make its capital budgeting decision. (a) What is the regular (traditional) payback period? (b) If the target cutoff period is 3.5 years, should the firm accept the project? 1) 2.67 years; Reject. 2) 2.67 years: Accept. 3) 3.00 years; Reject. 4) 3.00 years: Accept. 5) 3.57 years: Reject. Assume that the firm is using only discounted payback method to make its capital budgeting decision. (a) What is the discounted payback period? (b) If the target cutoff period is 3 years, should the project be accepted? 1) 3.43 years; Reject. 2) 3.43 years; Accept. 3) 3.07 years: Reject. 4) 3.07 years: Accept. 5) 2.67 years: Accept Assume that the firm is using only net present value (NPV) to make its capital budgeting decision. (a) What is the NPV? (b) Should the project be accepted? 1) $12,739,908; Accept. 2) $12,739,908; Reject. 3) $10,279.728; Accept. 4) $10.279.728: Reject. 5) $7.739,908: Accept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started